The 10 Biggest Misconceptions About Money

For centuries, money has been the subject of numerous misconceptions and myths, causing many people to adopt unhealthy attitudes toward wealth and financial management. This is true even in the Muslim world, where individuals from diverse backgrounds, social classes, and professions hold various perspectives about money, often shaped by their personal experiences.

Despite individual orientations, there is an Islamic stance on money and how it should be earned and disposed of. In the middle of these stand some general misconceptions regarding money.

#1. Money is the root of all evil

The saying "Money is the root of all evil" has been passed down from generation to generation.

People believe that once you have money, it pushes you to do the unimaginable. Individuals with this orientation do not take advantage of opportunities to make money; they see those who key into such opportunities as greedy. Their belief makes them want to get rid of money quickly (perhaps by spending and donating), thinking the pieces of paper in their hands are evil.

Additionally, Muslims with this mindset see fellow Muslims who are wealthy as people who live just for the worldly life and not the hereafter. They believe money will distance them from worshipping Allah.

Reality: Money is not necessarily the root of all evil. The statement itself is a misconstrued biblical verse (1 Timothy 6:10). It says, 'The love of money is the root of all evil.' instead of money is the root of all evil. When we look at the correct verse, it's pretty explanatory. Money in itself cannot distance you from worshipping Allah or make you sin. It is just a piece of paper. Your relationship with money and how you treat it makes a difference. Indeed, loving money is the root of all evil.

Many wealthy people are committed to helping others, contributing to a cause, and lifting people out of poverty. You will likely find that some of these wealthy Muslims spend in the way of Allah, build mosques, sponsor people to go for Hajj and Umrah, give Zakat and sadaqah, and strengthen family ties with their wealth. All these acts bring them closer to Allah, not farther away from Him.

The Prophet (PBUH) would supplicate to Allah against poverty, knowing that poverty, if worsened, can make one disbelieve. The Qur'an explicitly states wealth is part of worldly adornments (Surah Al-Kahf, verse 46). Money is not the major issue here, but the excessive love of money and its harmful use is.

#2. You have plenty of time to save

Another prevalent misconception among some young, hardworking individuals is that having savings is unnecessary, particularly if they don't plan to retire soon. Consequently, they don't prioritize saving.

Reality: The best advice anyone could give is to start saving immediately. Whether you're saving for retirement or just saving away money for an upcoming project or vacation, do not delay saving. The earlier you start, the better off you'll be financially.

Keep in mind that time is not infinite, so it's essential not to wait until you have a substantial income to begin saving. As your earnings increase, so does the temptation for a more lavish lifestyle. Every bit you save, no matter how small, makes a difference in your financial well-being.

Here's a quote from Morgan Housel, which I believe could be your guiding compass in your saving journey: "The first idea— simple, but easy to overlook— is that building wealth has little to do with your income or investment returns and lots to do with your savings rate."

#3. More money = more happiness

People often ascribe happiness to having more money. Some are content with having enough money to pay their bills, whereas some believe that the more money you have, the happier you will be. They think that having a lavish lifestyle, driving a fancy car, and living in a mansion automatically means you are satisfied.

Reality: Everyone wants money, but excessive love for money will make you unhappy. Seeing more money as a means to happiness will only create an endless cycle of needs that cannot be fulfilled. Ultimately, you'll be plunged into an abyss of sadness and emptiness.

Anas bin Malik narrated that Allah's Messenger (PBUH) said, "If a son of Adam had a valley full of gold, he would like to have two valleys, for nothing fills his mouth except dust. And Allah forgives him who repents to Him." — Sahih al-Bukhari, 6439.

This world is a test, and a life of contentment in Allah's decree is advised for anyone who wishes to see happiness in its purest form.

#4. You need a lot of money before you can start investing

Part of the misconception surrounding money is that people think anyone needing more should not consider investing.

Reality: Not having enough money should never prevent you from investing. Investing is mainly for the long term, and the truth is that you don’t need a lot to start. You can invest in fractional shares, which allow you to buy portions of a share, building up your position over time.

A good idea is to set aside a specific amount of your earnings for investment (even if it’s just a dollar) and slowly build up the habit of investing. Remember, no investment is too small.

#5. You can't retire until your 60s

Some people believe that you can only retire once you are 65, and only then can you really start to take things slow and enjoy your life.

Reality: By default, retirement comes knocking on your door at 65, though this varies by region. For example, in the UK and the US, the retirement age is between 62-67, but nothing says you cannot retire earlier. What you put in to secure an early retirement for yourself matters.

Having the proper plan and system can allow you to retire as early as in your 30s. Take a look at the article below, which dives into the FIRE (Financially Independent, Retire Early) method, and how you can implement this as a Muslim.

#6. You don't have what it takes to be wealthy

Another misconception is that some people think they cannot be wealthy because they lack the required skills. However, when you ask them what skills they lack, they make excuses, and you’ll find that instead of lacking skills, they don’t have the drive to utilize them. This is an unhealthy mindset.

Reality: Anyone wanting to become wealthy should be prepared to put in the work, as there are no shortcuts. Ask yourself:

- What’s the worst thing that can happen if I decide to take on the risk of working hard, day and night?

- What's the best thing that can happen if my hard work pays off?

- Why am I trying so hard to fit in like others when I can decide to stand out?

- What are my natural skills, and how can I harness the power of those skills?

Poor people often exhibit a negative mindset and write themselves off, while rich people usually possess a can-do attitude and have an abundance mindset over a scarcity mindset.

#7. Money = security

People often misconstrue having money as being secure. They believe once you are rich, you are above all trials and tribulations. Could this be true?

Reality: Having money does not translate to being secure. You may still be bedridden with illness. You will never have enough money to control everything. Many rich people die of terminal diseases; nothing is so secure. We, as Muslims, know that Allah is above all, and He tests whom he wishes.

Yes, wealth gives you comfort that everyday folks cannot attain, but it does not make you untouchable.

#8. The more money you have, the fewer your worries become

Many people believe that having more money translates to having fewer worries. For instance, they think money solves all problems and can be thrown at any challenge. This misconception is indeed a grave one.

Reality: Reality begs to differ. More money often means more worries. For a Muslim, there is the greatest worry of all: the worry of accountability. The fact that one will account for every single dollar spent in this world on the day of judgment is worth worrying about.

It was reported from Ibn Mas’ood (may Allah be pleased with him) that the Prophet (PBUH) said: “The son of Adam will not be dismissed from before his Lord on the Day of Resurrection until he has been questioned about five things: his life and how he spent it, his youth and how he used it, his wealth and how he earned it and how he disposed of it, and how he acted upon what he acquired of knowledge.” (Narrated by al-Tirmidhi, 2422; classed as Hasan by al-Albaani in Saheeh al-Tirmidhi, 1969)

#9. Debt is normal

Some people live with the misconception that having credit card debt and taking on loans are the norm and are nothing to worry about.

Reality: This misconception is probably the worst because it can cripple you financially. Creating a habit of buying things you can’t afford is a sure way to financial ruin. According to Experian, more than $1 trillion was added to the overall debt carried by consumers in 2022—an extraordinary increase not seen in over a decade.

Resist the urge to normalize large debts because it will prevent you from building wealth and force you to channel the bulk of your resources toward debt settlement. Also, it’s crucial to spend within your means.

#10. You deserve to buy nice things because you work hard

After working hard, it’s common for people to reward themselves by buying "nice things." In this context, nice things refer to expensive items for someone interested in wealth building. But because they want to feel good about themselves and care more about what other people think, the actual item’s price is insignificant.

Reality: Some people who buy themselves "nice things" from their hard-earned money live paycheck to paycheck.

Billionaires like Mark Zuckerberg, Carlos Slim, and Warren Buffett, among others, are known to live a frugal lifestyle. While it is good to reward yourself with gifts, learning to delay gratification can provide the ultimate reward long-term.

Conclusion

Money is an essential aspect of our lives, and understanding its true nature can significantly impact our financial decisions and overall well-being. Always remember that the proper acquisition, management, and use of money in line with Islamic teachings can bring numerous blessings and opportunities. At the same time, excessive love for money and material possessions can be detrimental to one's spiritual and emotional well-being. As Muslims, it's essential to strike the right balance between our worldly pursuits and our spiritual goals.

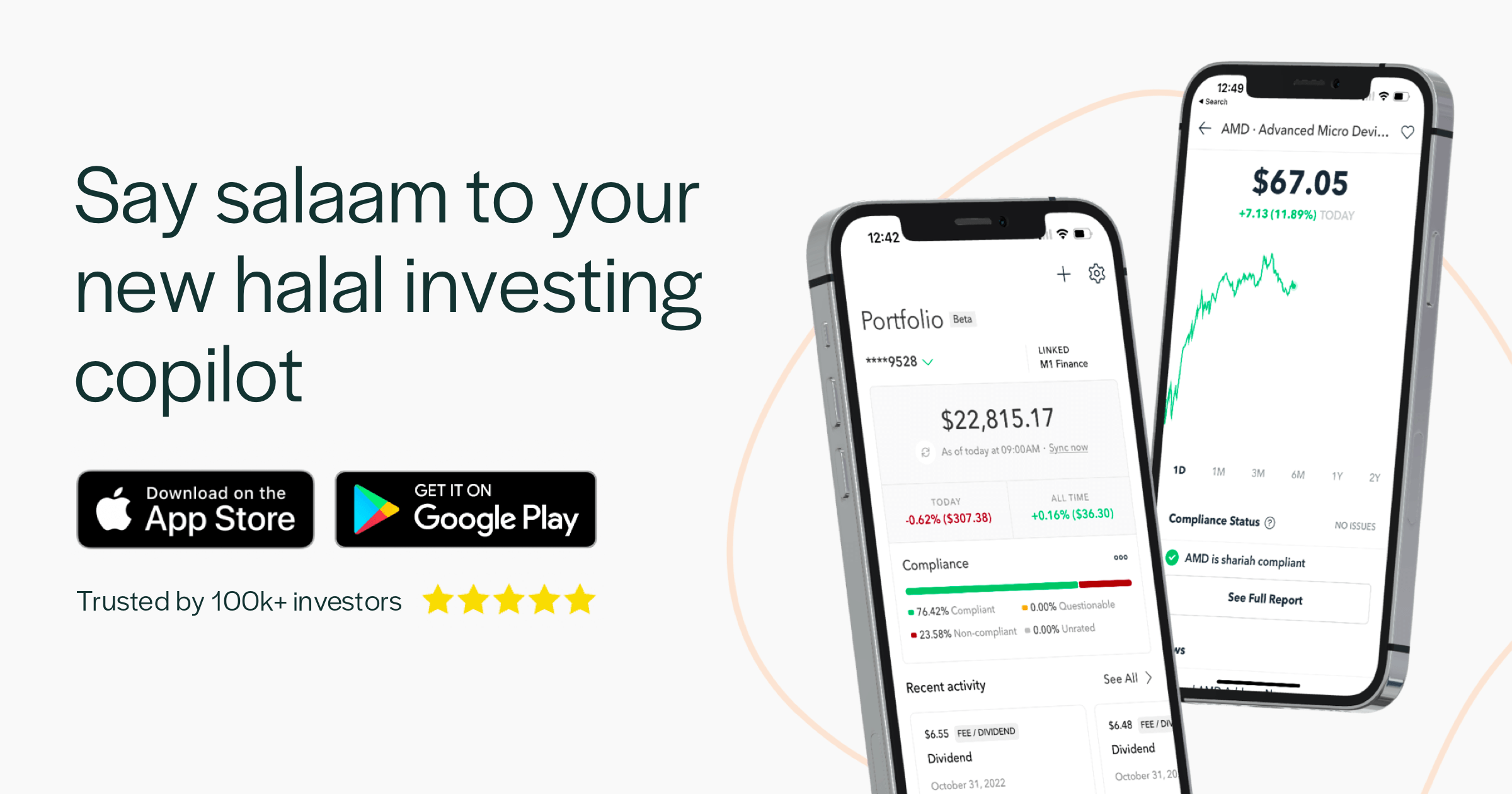

Zoya: Halal Investing App

Zoya makes halal investing easy by helping you build and monitor a shariah compliant investment portfolio with confidence and clarity.