3 Halal ETFs That Beat the S&P 500 in 2025

For years, skeptics questioned whether halal investing could keep pace with the broader market. In 2025, three Shariah-compliant ETFs answered definitively: not only can halal investing compete with conventional strategies, it can outperform them.

While the S&P 500 returned 17.72% this year, all three major halal equity ETFs did better. Let's break down what makes each of these funds tick, and why Shariah-compliant screening may actually be a competitive advantage.

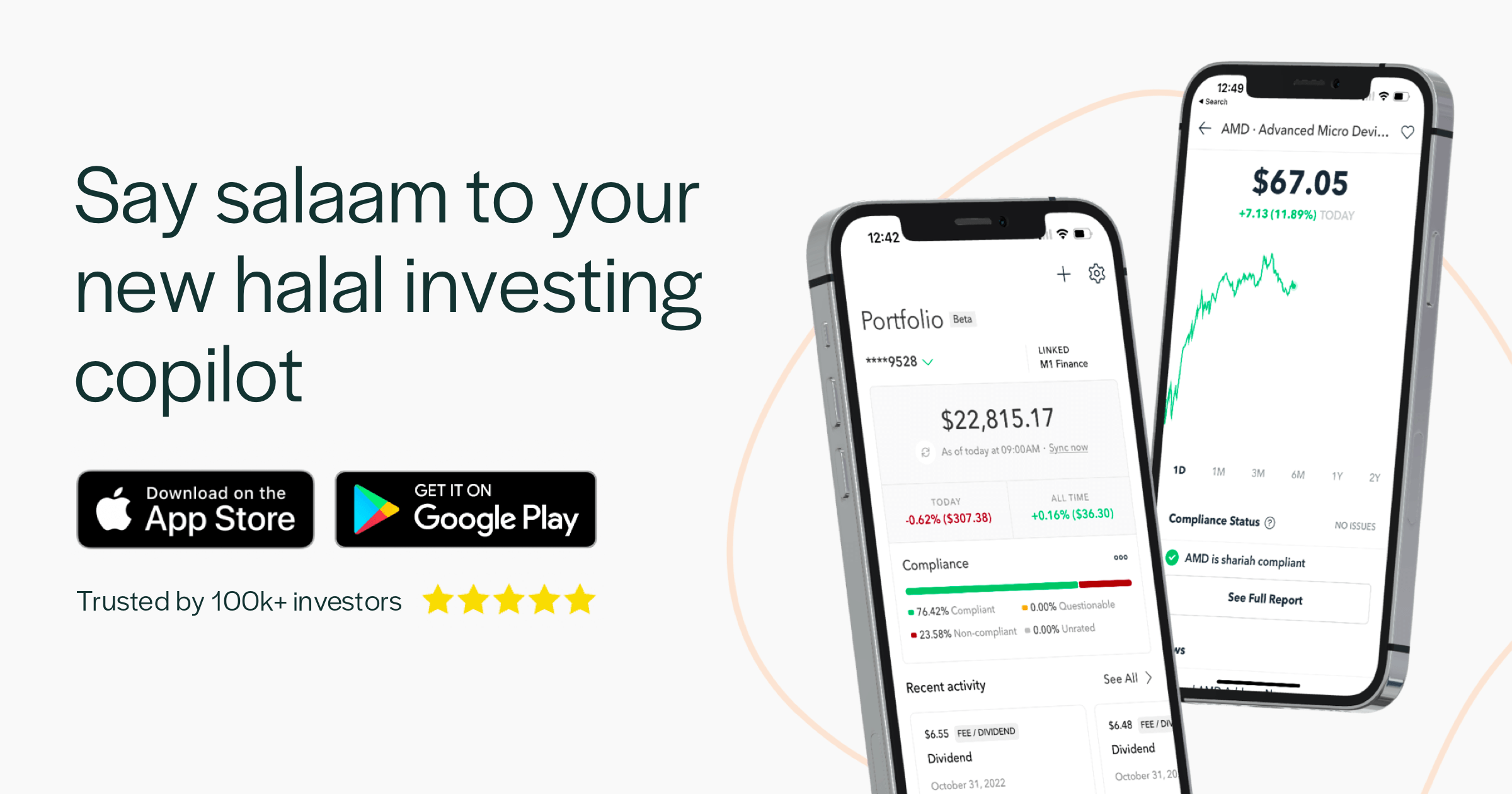

Zoya: Halal Investing App

Zoya makes halal investing easy by helping you build and monitor a Shariah-compliant portfolio with confidence and clarity.

Best performing halal ETFs in 2025

Here's a closer look at what each fund offers and how they performed.

1. SP Funds S&P Global Technology ETF (+26.37%)

The SP Funds S&P Global Technology ETF crushed both its peers and the S&P 500 with a 26.37% return in 2025. This fund tracks the S&P Global 1200 Shariah Information Technology Capped Index, giving investors exposure to large and mid-cap technology companies across 16 countries.

What sets SPTE apart is its global reach. While most U.S. tech funds concentrate entirely on domestic holdings, SPTE allocates roughly 47% to international stocks. These are companies pioneering e-commerce, cloud computing, and healthcare technology worldwide.

Key details:

- Expense ratio: 0.55%

- Holdings: ~103 securities

- Launch date: November 2023

- 2025 return: +26.37%

For investors bullish on global tech innovation, SPTE offers Shariah-compliant exposure that's been difficult to find elsewhere.

2. SP Funds S&P 500 Sharia Industry Exclusions ETF (+19.77%)

The SP Funds S&P 500 Sharia Industry Exclusions ETF represents the closest thing to a halal version of the S&P 500. It holds approximately 230 of the index's constituents that pass Shariah screening, and it beat the conventional index by over 2 percentage points in 2025.

Key details:

- Expense ratio: 0.45%

- Holdings: ~230 securities

- Launch date: December 2019

- 2025 return: +19.77%

Since its inception in late 2019, SPUS has delivered an average annual return of approximately 18%, outperforming the S&P 500 over the same period.

3. Wahed FTSE USA Shariah ETF (+18.30%)

The Wahed FTSE USA Shariah ETF was one of the first U.S.-listed halal ETFs when it launched in July 2019, and it continues to deliver. Tracking the FTSE Shariah USA Index, HLAL holds large and mid-cap U.S. companies that meet the Shariah screening criteria set by FTSE's Shariah advisory board.

HLAL's portfolio is heavily weighted toward technology (44%) and communication services (19%), with meaningful allocations to healthcare and consumer discretionary sectors.

Key details:

- Expense ratio: 0.50%

- Holdings: ~200 securities

- Launch date: July 2019

- 2025 return: +18.30%

HLAL's track record now spans more than five years, giving investors a meaningful performance history to evaluate. The fund has delivered competitive returns in both bull and bear markets, demonstrating that Shariah compliance doesn't require sacrificing long-term performance.

Why do halal ETFs outperform the market?

The consistent outperformance of halal ETFs raises an obvious question: why would limiting your investment options lead to better returns? The conventional wisdom says more choices should produce better outcomes. But the data tells a different story.

Several structural factors help explain why Shariah-compliant portfolios have performed well.

Low debt requirements

Shariah compliance requires companies to maintain total debt below 30-33% of their market capitalization. This single requirement eliminates a large swath of highly leveraged companies from consideration.

From a purely financial perspective, this screen functions as a quality filter. Companies with low debt have more flexibility to weather economic downturns, invest in growth opportunities, and return capital to shareholders. They're less vulnerable to rising interest rates and less likely to face distress during credit crunches.

What began as a religious principle, rooted in Islam's prohibition on interest-based transactions, turns out to align remarkably well with sound investment practice. Warren Buffett has long advocated for investing in companies with strong balance sheets and manageable debt loads. Shariah screening enforces this discipline automatically.

No exposure to financial services

Traditional financial institutions are excluded from halal portfolios because their core business model involves lending money at interest. This means no exposure to commercial banks, investment banks, insurance companies, or asset managers that earn fees from interest-bearing products.

In recent years, this exclusion has been particularly beneficial. The banking sector has faced headwinds from interest rate volatility, regulatory pressure, and concerns about commercial real estate exposure. By avoiding these challenges entirely, halal ETFs have sidestepped a source of drag on broader index returns.

Of course, there will be periods when financial stocks outperform and halal funds lag as a result. But over the long term, the absence of bank exposure has contributed positively to returns.

Technology and healthcare overweight drives returns

When you exclude financials from a market-cap weighted index, the remaining sectors automatically receive larger allocations. For halal ETFs, this means significant overweights in technology, healthcare, and consumer discretionary stocks.

During the past decade, technology has been the dominant driver of U.S. equity returns. Companies like Apple, Microsoft, Nvidia, and Amazon have grown to represent an outsized portion of total market capitalization. Halal funds, with their structural tilt toward these winners, have benefited accordingly.

This sector bias cuts both ways. If technology stocks underperform for an extended period, halal ETFs will likely lag the broader market. But for investors who believe technology will continue creating value, the built-in overweight is a feature rather than a bug.

The bottom line

The 2025 results add another year of evidence to a growing body of data: Shariah-compliant investing can compete with, and often beat, conventional benchmarks. The structural characteristics of halal portfolios, particularly their emphasis on low debt and exclusion of financial services, appear to offer genuine advantages.

For Muslim investors, the message is clear. You don't have to choose between your faith and your financial future. The funds available today allow you to invest in accordance with Islamic principles while pursuing competitive long-term returns.

For all other investors, the performance of halal ETFs raises interesting questions about conventional portfolio construction. If screening out highly leveraged companies and interest-based businesses consistently produces better outcomes, perhaps the ancient wisdom embedded in Islamic teachings has something to teach modern investors.

Either way, halal ETFs have earned their place as serious investment vehicles worthy of consideration by anyone building a diversified portfolio.