4 Reasons Why You Can't Rely on Social Security or State Pensions for Retirement

Do you have money taken out of your paycheck every month that you're hoping to see again when you put your feet up and stop working? Are you hoping this money will help cover your costs in retirement? I’d suggest you reconsider that plan.

Social Security (US) or your state pension (UK, EU, Canada, Australia, New Zealand) are kind of like that flaky friend that promises to be there for you at the party you don't want to go to, then doesn't show up or ditches you after only a little while.

Let me explain.

In many developed countries, state pensions are a benefit your government promises you in retirement. You involuntarily pay into the system throughout your working life and can later access those funds upon retirement age (this varies by country, but it's usually around age 65-67). Many folks rely on this guarantee to help them cruise through retirement, but as the population of the world shifts and life expectancy increases, this is becoming a less solid plan for many.

Let's look at all the reasons Social Security is a flaky friend. I'll be using the examples of the US and UK below, but the concepts apply to other countries as well.

1. It's just not enough money to live on

Let's get real here. The amount many state pensions dole out is not enough to live on comfortably. In the US, the average Social Security payout is around $1,657 per month as of 2022, which is approximately $19,884 annually (Brandon, 2021). In the UK, that amount is around £179.60 a week, or about £778.26 per month, which is around £9,339.20 annually (Gov.UK). Given that the average employee’s annual salary in the US was about $53,383 in 2020 (Social Security Administration (SSA)), and around £31,772 for a UK employee in 2021 (Pometsey & Taylor, 2022), the income you'll have from these state pensions is significantly less from a pure numbers standpoint. The amount you get from your state pension isn't enough for you to live on today, much less in retirement. While some folks in retirement have lower expenses because they have paid off things like student loans or their mortgage by then, folks still need sufficient funds to live, travel, and take care of their increased healthcare expenses (more on that below).

2. Social Security and state pensions will eventually be depleted

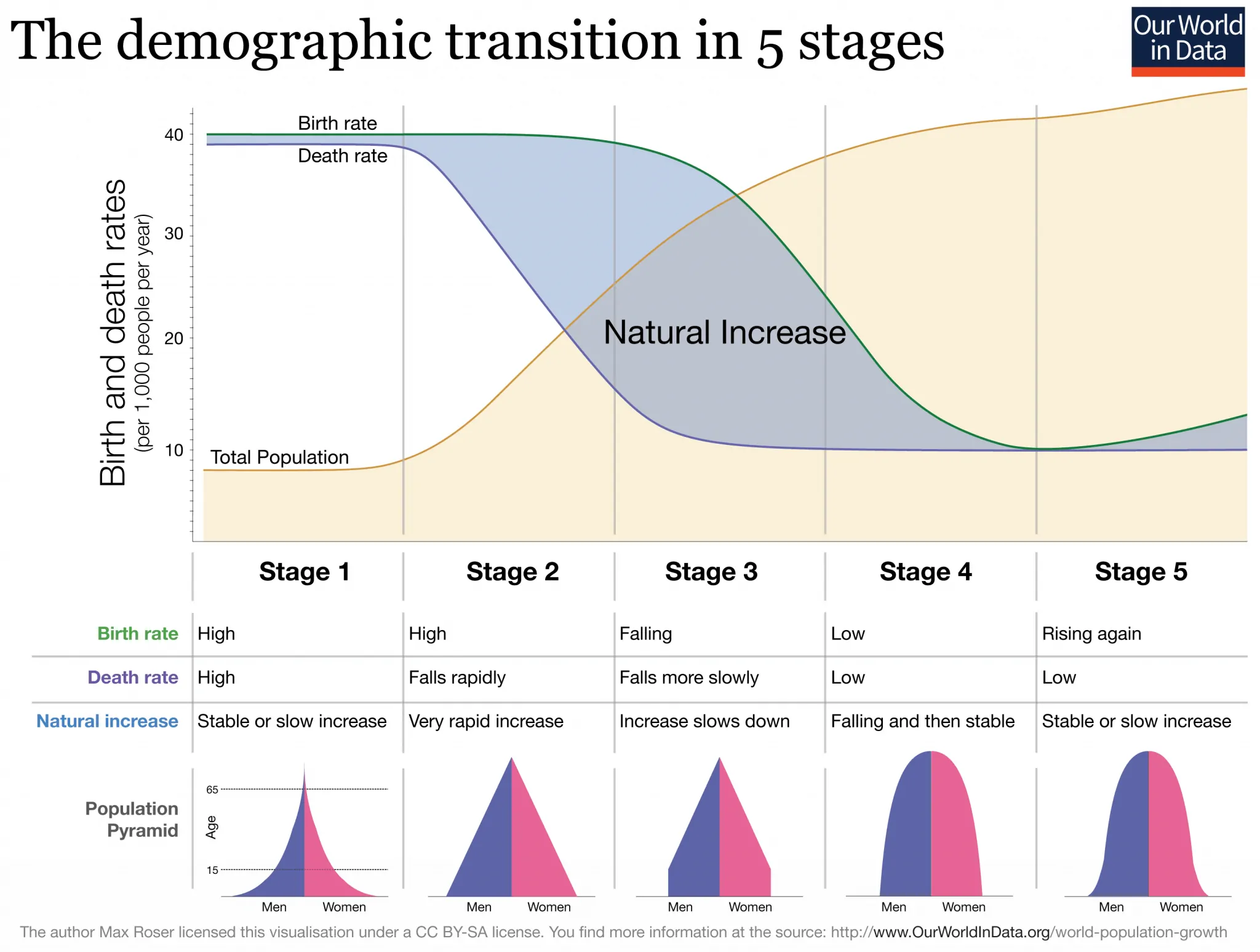

We are going to dive into the wonderful world of demography. Simply put, the world's population is moving towards an aging population structure. This means that the proportion of people in the population who are considered elderly (65+) will be more significant than the proportion of people in the working-age population (15-64) and the proportion of youth (ages 0-15). This is because many countries have begun the "demographic transition," or the transition in human societies from "traditional high birth/high death" societies to “modern low birth/low death" societies (Dyson, 2010). Changes in public health, biomedicine, nutrition, and industrialization have led to decreases in fertility and increases in life expectancy. On average, people are living longer and having fewer children.

There are five stages to the demographic transition, with many developed countries in the 4th or aging stage (Agarwal, 2020). You can best visualize this through population age pyramids. Figure 1 depicts the five stages of the demographic transition. When societies are in the earlier stages, they have younger populations and tend to have a more "pyramid-like" shape, with the proportion of younger people on the bottom larger than the older people. As the society transitions to an aging population, the weight in the pyramid shifts and somewhat inverts, with the weight of the older population becoming heavier.

Figure 1: The Five Stages of the Demographic Transition

For retirement/pension systems, this means that there are fewer working-age people paying into the system, but more people needing benefits. This becomes problematic when many state pension systems are designed to be "pay-as-you-go," meaning that current workers pay for the current older population's benefits. This rides on the hope that when those workers retire, they will be provided for by the younger generation (Schnaubelt, 2018). However, the number of workers per beneficiary has fallen significantly. For example, Social Security had four workers per beneficiary in 2000, but that number dropped to 2.7 workers in 2017 and is projected to drop to 2.2 workers by 2035. 2035 is also the year that Social Security is set to have all of its funds depleted if Congress doesn't take any preventative measures (Schnaubelt, 2018). Eventually, the system will collapse or, with some reforms, will have to reduce benefits significantly, which will further reduce retirees' ability to rely on it.

3. You need a large chunk of money in retirement

The paltry amount your state pension will give you is a far cry from the actual amount you'll need in retirement. Most financial experts say you'll likely need at least 80% of your annual income to live comfortably in retirement (Kindness & Probasco, 2022). A general method you can use is the 4% rule, which stipulates that you take 80% of your pre-retirement income and divide it by 0.04 to get the total nest egg you need in retirement (Kindness & Probasco, 2022). This rule theorizes that if you only take out 80% of your pre-retirement income annually in retirement from your nest egg, you will theoretically not run out of money in 30 years. If you live longer than 30 years or plan to splurge outside of the annual income you set, you might need a larger nest egg.

Let’s break down some numbers. For example, your annual pre-retirement income was $75,000. 80% of that income is $60,000. If you divide $60,000 by 4%, your nest egg will be $1.5 million for 30 years. If you calculate the benefits that Social Security will supposedly give you—assuming you receive the average monthly payment of $1657 and assuming Social Security isn't depleted—you will receive around $596,520 over 30 years. You would theoretically be about $900,000 to $1 million short in retirement if you just relied on Social Security, so you need to supplement the amount your state pension gives you from your retirement contributions.

4. You need a lot of money for healthcare/social care costs

The 4% rule is a great starting point, but it often doesn't include rising healthcare costs and the fact that you will likely have greater healthcare costs in retirement than in your working years. While it's true that there is often some form of socialized care for the elderly, such as Medicare in the US and the ongoing NHS services in the UK, many people in old age often need care beyond what socialized medicine can provide. In the US, for example, it's estimated that retirees will need to use approximately 15% of their retirement income to pay for health care expenses, and that current retirees might need around $300,000 to cover all of their costs (Fidelity, 2021). While actual healthcare costs might be covered in the UK, “social care” – or care that involves helping the elderly with basic day-to-day activities or moving into a nursing home – is not covered under the NHS. Most people have to pay out-of-pocket for it, and payment is typically pulled from your pension pot and any other assets you have (Money Helper). So not only is your state pension not going to cover your basic living costs in retirement, but it certainly won't cover your healthcare/social care costs either.

How to prepare for your own retirement

Now that we’ve covered why your state pension is a flaky friend, you might be asking yourself how to get a better, more reliable friend for retirement. Perhaps begin with altering your mindset if you had been relying a little extra on your state pension/Social Security benefits. Consider your state benefits a bonus amount on top of the retirement funds you will save for yourself, and don’t count the pennies before you actually see them.

Many people are currently not saving enough for retirement. A recent survey by the Federal Reserve found that the average value in Americans' retirement accounts was around $255,000 (Parker et al., 2021), a far cry from the actual amounts needed in retirement, as we explored. The average amount saved differs across age groups, but most people generally need to contribute more. Depending on someone's age when they start saving for retirement, and when they want to retire, they will need to save around 15%-20% of their income for retirement annually to hit the nest egg amount they need (HSBC UK). The amount you need to save for might be lower if you're planning to retire in countries that have a lower cost of living, such as Turkey or Malaysia.

In my experience as a financial coach, the majority of my clients were only contributing around 5%-10% max into their retirement accounts before they began working with me, which I find very alarming. I highly encourage you to start contributing to your retirement plans at work, such as a 401(k)/403(b) in the US and workplace pensions in the UK and other countries. I'd even encourage you to take advantage of other tax-advantaged accounts (Roth/Traditional IRAs in the US or SIPP/ISA in the UK) on top of your workplace plans to reach the total amount you need for your nest egg. You don't want to rely on the flaky friend to show up to the party – you want to count on the dependable, steadfast one who you know will be by your side.

Zoya: Halal Stocks, ETFs, Mutual Funds

Zoya makes halal investing easy by helping you build and monitor a shariah compliant investment portfolio with confidence and clarity.