5 Halal Investment Strategies That Work (And How to Pick the Right One for You)

Most of us invest decades into our education to find a career from which we can make an income. From early schooling to university or apprenticeship programs, we spend a lot of time and often a lot of money. Yet, once we settle into our careers and obtain a regular income, that same approach to education is forgotten. We don’t invest as much time into financial literacy (understanding how to best manage our finances) as we do in acquiring money.

One key tenet of financial literacy is working out how to make your money work for you. You can do this by investing your money into assets that provide growth through either price appreciation or income. However, before you race to the stock and crypto market and buy GameStop or DogeCoin because they are the latest hype, you need a game plan. Ideally, it would be best if you spent time researching what the best game plan is for you, as choosing the right one could transform your finances.

In this article, I will provide an overview of some of the most popular investment strategies and guide you in choosing the right strategy based on Islamic principles.

What is an investment strategy?

An investment strategy is your investment plan to achieve your financial goals based on your values, time horizon, and risk appetite. Let’s break down each point.

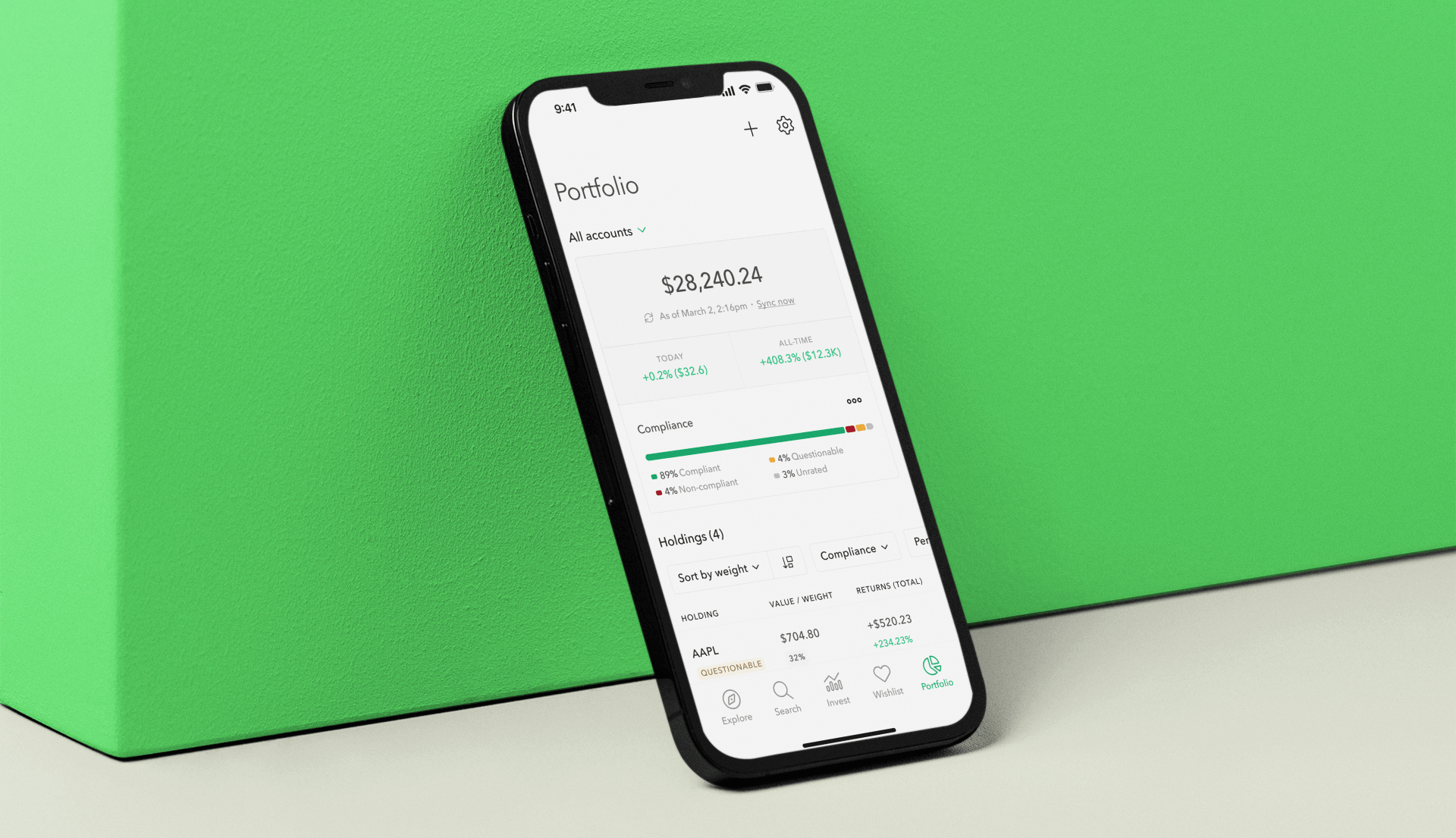

First up is your values. Some people will only invest in certain areas that align with their morals. For example, environmentally conscious investors may choose only to invest where no harm is done to the environment. For Muslims, this means, at the very least, investing according to the shariah. So investments in impermissible sectors such as gambling or bonds that payout interest would be a no-go. When investing in companies, you need to ensure that their primary activities are halal and their financial behavior is also within permissible limits. You can screen individual stocks and funds by using the Zoya app.

The next factor to consider is your time horizon. This is the timeline you expect to invest in and will inform your strategy. For example, if you are investing for a short period (e.g., to fund a Hajj trip), you would look for investments with low risk and low volatility (price fluctuations). Conversely, if you have a long time horizon, you would be more open to higher-risk and more volatile investments with long-term investment potential.

Your investment strategy should reflect your risk appetite. This is the amount of risk you are willing to accept to reach your investment goals. An investor with a low-risk appetite is someone who doesn’t want to see their investments suffer large drawdowns. Instead, they are willing to accept a lower return in exchange for the greater stability afforded by low-risk options. A high-risk appetite suits investors who are willing to accept large drawdowns to achieve large gains.

It’s important that you invest in line with your risk appetite, as not doing so can lead to poor investment decisions. For example, you may have a low tolerance for risk but decide to invest in a high-risk asset anyway. If that asset promptly falls 30% due to market fluctuations, it could panic you into selling. This could lead you to subsequently miss the 70% gain it might make over the next year. You would have been better off sticking to lower-risk assets in this situation.

Finally, your desired investment strategy shouldn’t be static. It should be reevaluated whenever your circumstances change. For example, if you are young with little responsibilities you may have a greater risk appetite than someone who is older with dependents.

The importance of having a sound strategy

In Islam, we are told to avoid squandering wealth as per the below hadith.

The Messenger of Allah (ﷺ) said, "Verily, Allah likes three things for you and disapproves three things for you. He likes that you should worship Him Alone, not to associate anything with Him (in worship) and to hold fast to the Rope of Allah and not to be divided among yourselves; and He disapproves for you irrelevant talk, persistent questioning and the squandering of the wealth." (Riyad as-Salihin 1781)

We are also cautioned against hoarding wealth and not making good use of it as per the below narration.

Umar ibn al-Khattaab (may Allah be pleased with him) said: Whoever takes care of an orphan who has wealth, let him do business for him [with his wealth] and not leave it to be consumed by zakaah. (ad-Daaraqutni 2/109)

This shows us the importance of being diligent in preserving your wealth and putting your wealth to productive use. Therefore having the right investment strategy before you invest is critical.

5 popular halal investment strategies

Now that we understand what an investing strategy is and its importance, let's take a look at the most popular strategies for investing in the stock market.

1. ETF Investing

The most common way to invest is to invest in funds. A fund consists of a pool of money from various investors allocated for a specific investing purpose. Funds either track an index (group of stocks such as the FTSE 100) or follow a particular theme (e.g. transport or cloud stocks). Funds are popular as they are a great way to get passive exposure to many different companies.

Exchange-traded funds (ETFs) are a low-cost alternative to traditional funds. These are funds that are traded on a stock exchange (such as the New York Stock Exchange or the Nasdaq). Thus they are more accessible and liquid (can be converted to cash easily) than traditional funds. ETFs are widely seen as the most suitable choice for the average investor. Legendary investor Warren Buffet agrees, telling new investors in 2021 that he recommends investing in the S&P 500 index fund which holds 500 of the largest US companies.

2. Dividend investing

Dividend investing is where you invest in companies that pay out income from their profits to their shareholders. Companies pay dividends as an incentive to investors to purchase their shares. These companies are also usually established operators without high growth prospects and therefore don’t have much better to do with their profits. Meanwhile, high-growth companies prefer to reinvest their profits into the business to drive growth.

Dividend stocks are regarded as lower risk than growth stocks, given that they tend to be companies that have already executed and have healthy cash flows. You want to aim for stocks with a sustainable dividend yield (size of the dividend relative to the current share price) of between (2-6%) and a consistent history of making dividend payments. You should be wary of stocks that promise high yields (>8%) as it suggests the company is in trouble and is desperate to attract investors.

This is a popular investment strategy for individuals who want to create a passive income stream. For example, a $1m investment portfolio with a dividend yield of 4% could provide you with an impressive annual income of $40k.

3. Growth investing

Growth investing regularly appears in the headlines. For instance, Tesla’s share price has 10xed (from $90 a share to $900+) since the March 2020 coronavirus lows and is regularly featured in the media. This success case shows the appeal of growth investing.

The strategy is to invest in high-growth companies that are relatively small that are expected to outgrow the rest of the market. Growth investors typically look at earnings growth and profit margins when analyzing companies. You also want to look at new, rapidly expanding industries such as cloud or clean energy, where new advancements are being made. However, there are many risks to consider. There is a lot of execution risk for these companies to deliver on their growth plans. It can also be difficult to predict which companies will emerge as the market leaders of new industries.

Many investors balance their portfolios and manage their risk by only allocating a certain proportion of their capital to growth stocks. The rest is then allocated to more conservative options such as ETFs or commodities (e.g. gold).

4. Value investing

Value investing is the approach made famous by investing legend Warren Buffet. Value investing is where you look for stocks that trade for less than your perceived intrinsic value of the stock. The intrinsic value of a stock is the measure of what the asset is worth. There is no standard method to determine this which is where the opportunity lies for the value investor. Typically, you would consider the financials of the company, its growth prospects, and market conditions.

You are essentially looking to buy solid merchandise at discounted prices. This approach suits the patient investor who is adept at analyzing companies and their balance sheets. Your success relies on you successfully finding companies that are trading for less than their intrinsic value and banking on the market to realize this eventually.

However, beware of value traps. These are stocks that appear cheap and of good value but the underlying performance is poor. So you should look for companies that can execute well and have genuine prospects.

5. Growth at a Reasonable Price (GARP)

GARP investing seeks to combine both growth and value investing. In a nutshell, GARP investors want to find companies with strong growth prospects but at a reasonable price. A key metric of interest is the Price Earnings Growth (PEG) ratio. This ratio takes into account both current earnings and projected growth. A low PEG ratio suggests that a stock is undervalued and typically GARP investors look for stocks with a ratio of 1 or less.

Wall Street legend Peter Lynch favored this approach, who achieved an astonishing 29.2% average annual return between 1977 and 1990. We covered three key lessons you can learn from his approach in this article here.

How to allocate your capital

Capital allocation is an underrated area of investment and can play a key role in how successful your investments are. We’ll explore the two most common approaches below.

Lump-sum investing

You could invest via a lump sum and deploy your investments in one go. This is the simplest approach where you buy and hold in line with your time horizon. You could also supplement this lump sum by topping up every year once you have access to more capital.

Your investment returns doing this approach, however, are time-sensitive. If you manage to invest near a market bottom, you could make tremendous gains. Yet timing the market correctly is a near-impossible task for even seasoned investors.

Dollar-cost averaging

The potential downside to a lump sum investing approach is that you may buy at a local peak and then miss the opportunity to take advantage of any lower prices that may follow.

This is where the dollar-cost averaging approach shines. In this approach, you commit to spreading your investment over a certain period. Commonly this would be every month as you receive your pay. For example, every payday you may deploy $500 into your portfolio. This approach takes out the stress in deciding when to invest as you now have an automated process. It also helps to smooth out your average purchase price by continuously buying regardless of whether it has spiked or dipped.

How to choose the right investment strategy for you

So now that you know the importance of having a sound strategy and understand the most common approaches, the final thing that remains is to work out the right strategy for you.

We mentioned earlier that there are three factors to consider when crafting your investment strategy; your values, time horizon, and risk appetite. Spend some time reflecting on each of these factors and studying the above investing approaches in more detail. You want to find the approach that resonates the most with your personality, time commitment, and outlook on life.

The power of dua cannot be emphasized enough and is a powerful tool of the believer. I suggest the following one, in particular, to aid you in your investing journey.

اَللّٰهُمَّ إِنِّيْ أَسْأَلُكَ عِلْمًا نَّافِعًا ، وَرِزْقًا طَيِّبًا ، وَعَمَلًا مُّتَقَبَّلًا.

“O Allah, I ask You for beneficial knowledge, wholesome sustenance, and deeds which are accepted.”

Finally, when you are ready to choose your approach, pray Istikhara (prayer of guidance) before proceeding.

Zoya: Halal Stocks, ETFs, Mutual Funds

Zoya makes halal investing easy by helping you build and monitor a shariah compliant investment portfolio with confidence and clarity.