A Muslim Couple's Guide to Achieving Financial Success

You have big financial goals for yourself and your family but for some reason, they don’t seem to translate into your everyday lives. Why might you ask? I’m going to share a fundamental framework to help you achieve your shared financial goals and what has fueled my family’s success with this (with the help of Allah SWT).

In a survey conducted by the American Psychology Association, 36% of respondents said they were uncomfortable talking about money within their households, and 18% stated that money is a taboo subject in their families. If these numbers reflect Americans in the West, imagine what those numbers are like in Muslim households? We have to become comfortable having regular, meaningful conversations about money with our partners and include money talk in our everyday conversations. Do this, and I promise you it will get easier to achieve your goals for this life and the hereafter.

To get the most out of your conversations, I strongly recommend that you and your partner track your finances and spending for at least 30 days – it will give you a much greater perspective and context to your discussion.

What is goal setting, and why is it important?

Our everyday lives are cumbersome yet fulfilling in every way, whether that's getting through the hustle of the morning routines and off to work or school, settling in from your work to home desk, or getting the kids set up with their curriculum from home for the day, we often fulfill our daily tasks mindlessly and habitually.

Goal setting describes the method of identifying something you would like to achieve or see happen and formulating measurable actions within a prescribed set of time to get you there. Examples of goals related to financial well-being may include:

- Saving up $3,000 by the end of the year to go on a family cross-country trip

- Saving up $1,500 before next Ramadan so you can donate extra charity

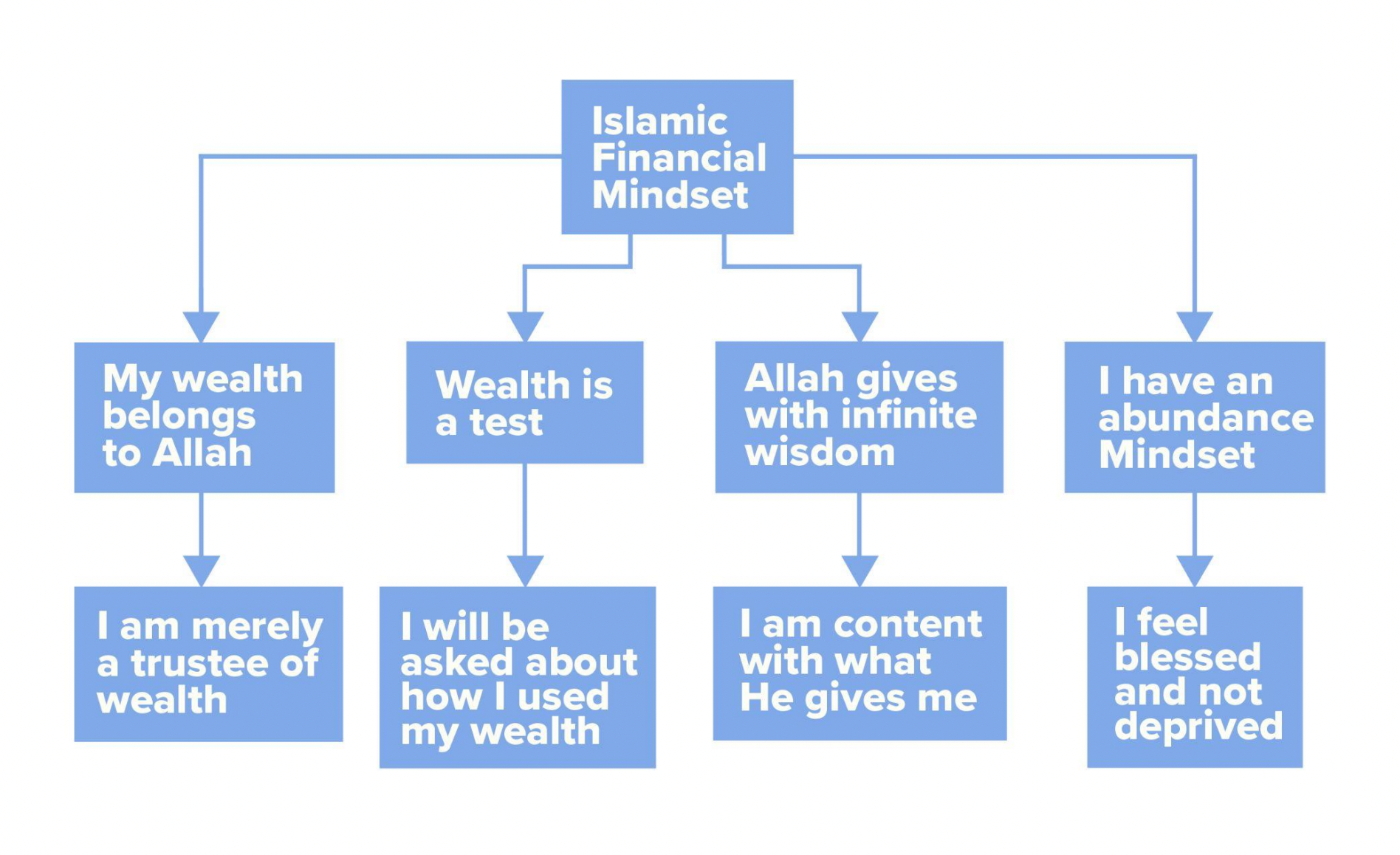

Setting the goal is the first part; getting into the mindset will be the second part. The Islamic Financial Mindset, at its core, is understanding that our wealth belongs to Allah (SWT), and He provides us with infinite wisdom. We can use this in our framework to have an abundant mindset towards our finances and situation.

Goals need small actionable tips that need to be implemented daily and weekly, and movement towards these goals will not occur if we do not keep them in our everyday conversations. This will help to keep your ideas at the forefront.

How do you get on the same page?

Where do you start? Set aside some time with your partner for a budget meeting. It can be named whatever you'd like; just make sure it's a place where you both feel comfortable and casual.

Bring to the meeting your shared goals, aspirations, plans for the future (financial or not). Both parties should agree to this as it can be vulnerable and revealing; there needs to be an element of trust and non-judgment. Be as open and honest as possible, knowing that there will likely be goals that may not align or need some adjusting. For example, if both of you want to pursue a higher education degree and have a young family, this will require further discussion.

Plan to talk about it and keep it casual

Bring the finances into it after you’ve had a good discussion surrounding your goals and aspirations. Money is a tool and a resource, and we will be asked about how we used it in the hereafter. Setting our intention surrounding our plan is just as important as the plan itself.

“The son of Adam will not be dismissed from his Lord on the Day of Resurrection until he is questioned about five issues: his life and how he lived it, his youth and how he used it, his wealth and how he earned it and spent it, and how he acted on his knowledge.” - Prophet Muhammad ﷺ (Ibn Mas’ud, Sunan al-Tirmidhī 2416)

A good budget meeting will include questions and discussion focused on practical realities and future goals:

- Do our goals align with our spending?

- How is our spending trending compared to our budget? Do we need to cut back, or are we not being realistic?

- Is there overspending we need to deal with? Where should that money come from? Do we have an income or an expenses gap?

- What surprised us this month? Are there things we should consider moving forward? Do we need to add or adjust any categories to prepare better next month or next year?

- What do we have coming up next month? Any events or expenses we need to prepare for?

- Are we on track with our long-term goals? If not, why is that? Is it not as important to us as we thought it was?

- Do we need to cut back somewhere else? Should we adjust the goal to make it more realistic?

- Last chance—have any of our priorities changed? Yours, mine, or ours? How can or should we adjust?

Remember that these topics do not all need to be tackled at once. These ideas can provide you with a framework to help start the conversation. You can use them throughout multiple meetings to help create a regular habit of making money a part of your everyday conversation.

Use this framework to keep each other accountable

Aim to have regular check-ins at least monthly to review progress and goals. Why will this make you stronger as a couple? Shared goals can help create shared purpose and thus make your everyday struggles feel more meaningful.

Holding each other accountable between your budget meetings will build you both up. Remember, doing this in a non-judgmental and supportive manner is key. If your actions do not align with what you’ve expressed as your goals, some deeper engrained behaviors may be reflected in our actions (think Keeping up with the Jones’).

Embrace the small wins and share your successes

Setting your intentions and with the help of Allah (SWT), you will be on your way to achieving your combined goals. Making money a part of your everyday conversations can not only help you become clearer on your shared family goals but help you hold each other accountable in the day-to-day tasks that require discipline and persistence. You will find a greater sense of shared purpose when you instill this regularly in your conversations (and strengthen your relationship as a bonus).

Zoya: Halal Stocks, ETFs, Mutual Funds

Zoya makes halal investing easy by helping you build and monitor a shariah compliant investment portfolio with confidence and clarity.