أكبر 10 مفاهيم خاطئة عن المال

على مدى قرون، كان المال موضوعًا للعديد من المفاهيم الخاطئة والأساطير، مما تسبب في تبني العديد من الناس لمواقف غير صحية تجاه الثروة والإدارة المالية. وينطبق هذا الأمر حتى في العالم الإسلامي، حيث يحمل الأفراد من مختلف الخلفيات والطبقات الاجتماعية والمهن وجهات نظر مختلفة حول المال، وغالبًا ما تتشكل هذه الرؤى من خلال تجاربهم الشخصية.

وعلى الرغم من التوجهات الفردية، فإن هناك موقفًا إسلاميًا من المال وكيفية كسبه والتصرف فيه. وفي وسط هذه المواقف تقف بعض المفاهيم العامة الخاطئة فيما يتعلق بالمال.

#1. المال هو أصل كل الشرور

لقد توارث الناس مقولة "المال أصل كل الشرور" من جيل إلى جيل.

يعتقد الناس أنه بمجرد حصولك على المال، فإنه يدفعك إلى القيام بما لا يمكن تصوره. لا يستغل الأفراد أصحاب هذا التوجه الفرص المتاحة لكسب المال؛ فهم يرون أن من يستغلون مثل هذه الفرص جشعين. ويجعلهم اعتقادهم هذا يرغبون في التخلص من المال بسرعة (ربما عن طريق الإنفاق والتبرع)، معتقدين أن قطع الورق التي بين أيديهم شريرة.

بالإضافة إلى ذلك، يرى المسلمون الذين يحملون هذه العقلية أن إخوانهم المسلمين الأثرياء هم أناس يعيشون من أجل الحياة الدنيا فقط وليس الآخرة. فهم يعتقدون أن المال سيبعدهم عن عبادة الله.

الواقع: المال ليس بالضرورة أصل كل الشرور. العبارة نفسها هي آية من الكتاب المقدس (1 تيموثاوس 6:10) تم تفسيرها بشكل خاطئ. تقول: "محبة المال أصل كل الشرور" بدلاً من "المال أصل كل الشرور". عندما ننظر إلى الآية الصحيحة، نجدها واضحة جدًا. فالمال في حد ذاته لا يمكن أن يبعدك عن عبادة الله أو يجعلك تأثم. إنه مجرد قطعة من الورق. إن علاقتك بالمال وطريقة تعاملك معه تُحدث فرقًا. في الواقع، حب المال هو أصل كل الشرور.

يلتزم الكثير من الأثرياء بمساعدة الآخرين، والمساهمة في قضية ما، وانتشال الناس من الفقر. ومن المحتمل أن تجد أن بعض هؤلاء الأثرياء المسلمين ينفقون في سبيل الله، ويبنون المساجد، ويكفلون الناس للذهاب للحج والعمرة، ويعطون الزكاة والصدقات، ويصلون الأرحام بثرواتهم. كل هذه الأعمال تقربهم إلى الله تعالى ولا تبعدهم عنه.

وقد كان النبي صلى الله عليه وسلم يتعوذ بالله من الفقر، لعلمه أن الفقر إذا اشتدّ بالمرء كفر. والقرآن ينص صراحة على أن الغنى من زينة الدنيا (سورة الكهف، الآية 46). ليس المال هو القضية الرئيسية هنا، ولكن الإفراط في حب المال واستخدامه الضار هو القضية الرئيسية.

#2. لديك متسع من الوقت للادخار

هناك اعتقاد خاطئ آخر سائد بين بعض الشباب الذين يعملون بجد، وهو أن الادخار غير ضروري، خاصةً إذا كانوا لا يخططون للتقاعد قريبًا. وبالتالي، فهم لا يعطون الأولوية للادخار.

الواقع: أفضل نصيحة يمكن أن يقدمها أي شخص هي البدء في الادخار على الفور. سواء كنت تدخر للتقاعد أو مجرد ادخار المال لمشروع أو إجازة قادمة، لا تؤخر الادخار. فكلما بدأت مبكراً، كلما كان وضعك المالي أفضل.

ضع في اعتبارك أن الوقت ليس بلا حدود، لذا من الضروري ألا تنتظر حتى يصبح لديك دخل كبير لتبدأ في الادخار. فكلما زاد دخلك، كلما زاد الإغراء لنمط حياة أكثر بذخاً. كل جزء تدخره، مهما كان صغيراً، يحدث فرقاً في رفاهيتك المالية.

إليك هذا الاقتباس من مورغان هاوسل، والذي أعتقد أنه يمكن أن يكون بوصلتك الإرشادية في رحلة ادخارك: "الفكرة الأولى - وهي فكرة بسيطة ولكن من السهل التغاضي عنها - هي أن بناء الثروة لا علاقة له بدخلك أو عائدات الاستثمار بقدر ما يتعلق بمعدل ادخارك."

#3. المزيد من المال = المزيد من السعادة

غالبًا ما يربط الناس السعادة بامتلاك المزيد من المال. فالبعض يكتفي بامتلاك ما يكفي من المال لدفع فواتيره، في حين يعتقد البعض أنه كلما زاد المال الذي تملكه كلما كنت أكثر سعادة. ويعتقدون أن امتلاك نمط حياة مترف وقيادة سيارة فارهة والعيش في قصر يعني تلقائيًا أنك راضٍ.

الواقع: الجميع يريد المال، لكن الحب المفرط للمال سيجعلك غير سعيد. إن النظر إلى المزيد من المال كوسيلة للسعادة لن يؤدي إلا إلى خلق حلقة لا نهاية لها من الاحتياجات التي لا يمكن إشباعها. وفي النهاية، ستغرق في هاوية من الحزن والفراغ.

روى أنس بن مالك أن رسول الله - صلى الله عليه وسلم - قال: "لو أن لابن آدم وادياً من ذهب أحب أن يكون له واديان من ذهب، لأنه لا يملأ فاه إلا التراب. وإن الله يغفر لمن تاب إليه". - صحيح البخاري، 6439.

هذه الدنيا ابتلاء، وحياة القناعة بقضاء الله تعالى لمن أراد أن يرى السعادة في أبهى صورها.

#4. تحتاج إلى الكثير من المال قبل أن تتمكن من البدء في الاستثمار

جزء من المفاهيم الخاطئة التي تحيط بالمال هو أن الناس يعتقدون أن أي شخص يحتاج إلى المزيد لا ينبغي أن يفكر في الاستثمار.

الواقع: يجب ألا يمنعك عدم امتلاكك للمال الكافي من الاستثمار. فالاستثمار في الأساس هو استثمار طويل الأجل، والحقيقة أنك لا تحتاج إلى الكثير من المال للبدء. يمكنك الاستثمار في الأسهم الكسرية، والتي تسمح لك بشراء أجزاء من السهم، وبناء مركزك بمرور الوقت.

من الأفكار الجيدة أن تخصص مبلغًا محددًا من أرباحك للاستثمار (حتى لو كان دولارًا واحدًا فقط) وأن تبني ببطء عادة الاستثمار. تذكر أنه لا يوجد استثمار صغير جداً.

#5. لا يمكنك التقاعد حتى الستينيات من عمرك

يعتقد بعض الناس أنه لا يمكنك التقاعد إلا عندما تبلغ 65 عاماً، وعندها فقط يمكنك أن تبدأ حقاً في التروي والاستمتاع بحياتك.

الواقع: بشكل افتراضي، يطرق التقاعد بابك في سن 65 عامًا، على الرغم من أن ذلك يختلف حسب المنطقة. على سبيل المثال، في المملكة المتحدة والولايات المتحدة، يتراوح سن التقاعد في المملكة المتحدة والولايات المتحدة ما بين 62-67، ولكن لا شيء ينص على أنه لا يمكنك التقاعد قبل ذلك. ما تضعه لتأمين تقاعد مبكر لنفسك مهم.

إن وجود خطة ونظام مناسبين يمكن أن يسمح لك بالتقاعد في وقت مبكر في الثلاثينيات من عمرك. ألقِ نظرة على المقالة أدناه، والتي تتعمق في طريقة FIRE (الاستقلال المالي، التقاعد المبكر)، وكيف يمكنك تطبيقها كمسلم.

#6. ليس لديك ما يلزم لتكون ثريًا

هناك اعتقاد خاطئ آخر هو أن بعض الناس يعتقدون أنهم لا يستطيعون أن يكونوا أثرياء لأنهم يفتقرون إلى المهارات المطلوبة. ومع ذلك، عندما تسألهم عن المهارات التي يفتقرون إليها، فإنهم يختلقون الأعذار، وستجد أنهم بدلاً من افتقارهم للمهارات، ليس لديهم الدافع للاستفادة منها. هذه عقلية غير صحية.

الواقع: يجب على أي شخص يرغب في أن يصبح ثرياً أن يكون مستعداً لبذل الجهد، حيث لا توجد طرق مختصرة. اسأل نفسك:

- ما هو أسوأ شيء يمكن أن يحدث إذا قررت المخاطرة بالعمل الجاد ليلاً ونهاراً؟

- ما هو أفضل شيء يمكن أن يحدث إذا كان عملي الجاد يؤتي ثماره؟

- لماذا أحاول جاهدًا أن أتأقلم مثل الآخرين بينما يمكنني أن أقرر أن أكون متميزًا؟

- ما هي مهاراتي الطبيعية، وكيف يمكنني تسخير قوة تلك المهارات؟

فغالبًا ما يتحلى الفقراء بعقلية سلبية ويقللون من شأن أنفسهم، في حين أن الأغنياء عادةً ما يتحلون بعقلية الوفرة على حساب عقلية الندرة.

#7. المال = الأمان

غالبًا ما يسيء الناس فهم امتلاك المال على أنه أمان. فهم يعتقدون أنه بمجرد أن تكون غنيًا، فأنت فوق كل التجارب والمحن. هل يمكن أن يكون هذا صحيحًا؟

الواقع: امتلاك المال لا يعني أن تكون آمنًا. فقد تظل طريح الفراش بسبب المرض. لن يكون لديك ما يكفي من المال للتحكم في كل شيء. فكثير من الأغنياء يموتون بأمراض مميتة؛ فلا شيء آمن. نحن كمسلمين نعلم أن الله فوق كل شيء، وهو يبتلي من يشاء.

نعم، تمنحك الثروة راحة لا يستطيع الناس العاديون الحصول عليها، لكنها لا تجعلك محصنًا من المساس بها.

#8. كلما زاد المال الذي تملكه، قلّت مخاوفك

يعتقد الكثير من الناس أن الحصول على المزيد من المال يترجم إلى قلة الهموم. على سبيل المثال، يعتقدون أن المال يحل جميع المشاكل ويمكن أن يُلقى به في مواجهة أي تحدٍ. وهذا الاعتقاد الخاطئ هو في الواقع اعتقاد خطير.

الواقع الواقع يخالف ذلك. فغالبًا ما يعني المزيد من المال المزيد من الهموم. فبالنسبة للمسلم، هناك القلق الأكبر على الإطلاق: قلق المحاسبة. إن حقيقة أن المرء سيحاسب على كل دولار ينفقه في الدنيا يوم القيامة أمر يستحق القلق.

عَنْ ابْنِ مَسْعُودٍ رَضِيَ اللَّهُ عَنْهُ عَنْ النَّبِيِّ صَلَّى اللَّهُ عَلَيْهِ وَسَلَّمَ قَالَ "لا تزول قدما ابن آدم من بين يدي ربه يوم القيامة حتى يُسأل عن خمس: عن عمره فيما أفناه، وعن شبابه فيما أبلاه، وعن شبابه فيما أبلاه، وعن ماله من أين اكتسبه وفيما أنفقه، وعن علمه ماذا عمل به". (رواه الترمذي (2422)، وصححه الألباني في صحيح الترمذي (2422)، وصححه الألباني في صحيح الترمذي (1969)

#9. الدين أمر طبيعي

يعيش بعض الأشخاص مع الاعتقاد الخاطئ بأن وجود ديون على بطاقات الائتمان والحصول على قروض هو أمر طبيعي ولا يدعو للقلق.

الواقع: ربما يكون هذا المفهوم الخاطئ هو الأسوأ لأنه يمكن أن يشلّك مالياً. إن خلق عادة شراء الأشياء التي لا يمكنك تحمل تكلفتها هو طريق أكيد إلى الخراب المالي. فوفقًا لشركة Experian، تمت إضافة أكثر من تريليون دولار إلى إجمالي الديون التي تحملها المستهلكون في عام 2022 - وهي زيادة غير عادية لم نشهدها منذ أكثر من عقد من الزمان.

قاوم الرغبة في تطبيع الديون الكبيرة لأنها ستمنعك من بناء الثروة وتجبرك على توجيه الجزء الأكبر من مواردك نحو تسوية الديون. ومن المهم أيضًا أن تنفق في حدود إمكانياتك.

#10. أنت تستحق أن تشتري أشياء جميلة لأنك تعمل بجد

بعد العمل الشاق، من الشائع أن يكافئ الناس أنفسهم بشراء "أشياء جميلة". في هذا السياق، تشير الأشياء الجميلة إلى الأشياء باهظة الثمن بالنسبة لشخص مهتم ببناء الثروة. ولكن نظرًا لأنهم يريدون أن يشعروا بالرضا عن أنفسهم ويهتمون أكثر بما يعتقده الآخرون، فإن السعر الفعلي للسلعة غير مهم.

الواقع: يعيش بعض الأشخاص الذين يشترون لأنفسهم "أشياء جميلة" من أموالهم التي يكسبونها بشق الأنفس من راتبهم.

من المعروف أن المليارديرات مثل مارك زوكربيرج وكارلوس سليم ووارن بافيت وغيرهم يعيشون أسلوب حياة مقتصد. وعلى الرغم من أنه من الجيد أن تكافئ نفسك بالهدايا، إلا أن تعلم تأخير الإشباع يمكن أن يوفر لك المكافأة النهائية على المدى الطويل.

الخاتمة

المال هو جانب أساسي من جوانب حياتنا، وفهم طبيعته الحقيقية يمكن أن يؤثر بشكل كبير على قراراتنا المالية ورفاهيتنا بشكل عام. تذكر دائمًا أن اكتساب المال وإدارته واستخدامه بشكل صحيح بما يتماشى مع التعاليم الإسلامية يمكن أن يجلب العديد من البركات والفرص. وفي الوقت نفسه، يمكن أن يكون الحب المفرط للمال والممتلكات المادية ضارًا برفاهية المرء الروحية والعاطفية. كمسلمين، من الضروري أن نحقق التوازن الصحيح بين مساعينا الدنيوية وأهدافنا الروحية.

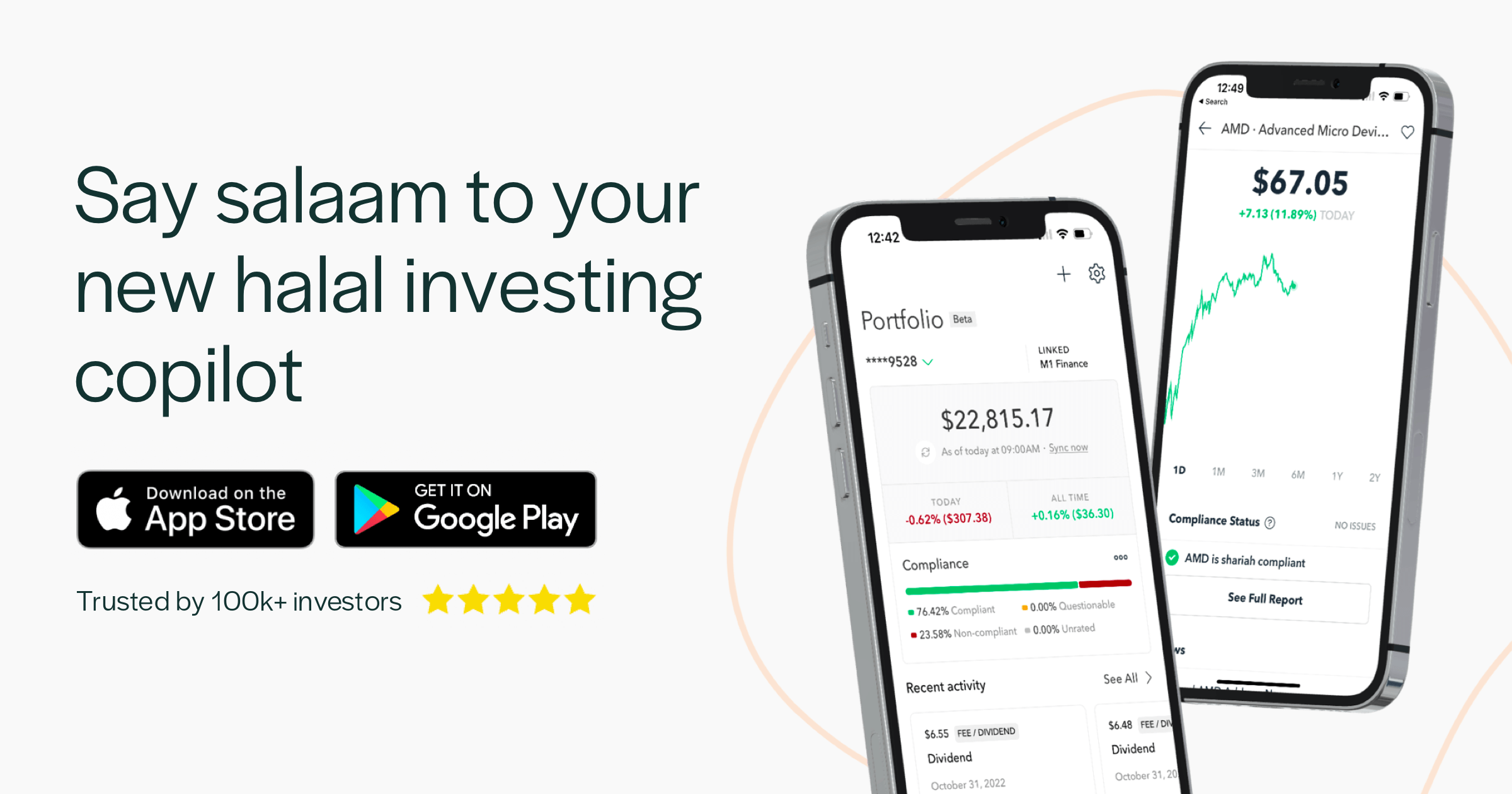

زويا: تطبيق الاستثمار الحلال

تجعل Zoya الاستثمار الحلال سهلاً من خلال مساعدتك في بناء محفظة استثمارية متوافقة مع الشريعة الإسلامية ومراقبتها بثقة ووضوح.