6 مبادئ إسلامية لتحقيق الرفاهية المالية

نحن نعيش في عالم يحركه الاستهلاك، وسريع الوتيرة، ودائم التطور. قد يكون من السهل أن ننشغل بمطاردة الثروة والممتلكات المادية ونغفل عن هدفنا الحقيقي كمسلمين. تزودنا تعاليم الإسلام بمخطط يساعدنا على تحقيق التوازن بين الإيمان والرفاهية المالية. سوف يستكشف هذا المقال المبادئ والمواقف المستمدة من التعاليم الإسلامية التي تعزز النهج المتوازن للرفاهية المالية.

استلهامًا من الورقة البحثية المعنونة"سيكولوجية الثروة: منظور إسلامي للتمويل الشخصي"، الذي نشره معهد يقين للبحوث الإسلامية، سنتعمق أكثر في المنظور الإسلامي للتمويل الشخصي.

#1. فهم الثروة من منظور إسلامي

لقد خُلقنا كبشر مجبولين على حب الثروة بشكل استثنائي. وقد أعلمنا الله تعالى بذلك في القرآن، وحذّر النبي (صلى الله عليه وسلم) من مسؤوليات كثرة الرزق وسوء استخدامه. ونحن في الإسلام نؤمن بالرزق، وهو الرزق الذي يرزقنا الله به. وهذا الرزق هو في الوقت نفسه وسيلة لإعالة أنفسنا وعائلاتنا، وهو أيضًا اختبار من الله تعالى إما أن يقربنا إليه أو يضلنا.

يتم تشجيع المسلمين على النظر إلى ثرواتهم من منظور التعاليم الإسلامية التي تؤكد على أهمية استخدام موارد الفرد لإفادة الآخرين والسعي لتحقيق النمو الروحي. يشجع هذا المنظور، الذي يرتكز على مفهوم الرزق، الأفراد على الحفاظ على الشعور بالامتنان والتواضع فيما يتعلق بثرواتهم وإدراك أن الثروة كلها في النهاية ملك لله تعالى.

لقد تعلمنا أن يكون لدينا نهج متوازن عندما يتعلق الأمر بالثروة. قد يكون من السهل أن تستهلكنا الحاجة إلى توفير الرزق، ولكن في نهاية المطاف، الله هو الذي يرزق. إن التركيز على الكسب من أجل الدنيا فقط سيؤدي إلى القلق المالي، في حين أن الكسب من أجل الآخرة سيؤدي إلى القناعة المالية.

#2. أهمية الكسب الحلال والإنفاق الأخلاقي

كمسلمين، نهدف كمسلمين إلى أن نعيش حياتنا وفقًا للمبادئ الإسلامية، وهذا يمتد إلى كسبنا وإنفاقنا. فمن الضروري أن يكون ما نكسبه وننفقه مباحًا في حدود الإسلام. نحن مأمورون بالابتعاد عن مصادر الدخل المحرمة، مثل الربا والقمار والتجارة غير المشروعة، ومأمورون بالابتعاد عن مصادر الدخل المحرمة مثل الربا والقمار والتجارة غير المشروعة، ومأمورون بالاستهلاك الأخلاقي والمسؤول.

عندما يتعلق الأمر بالإنفاق، فإن البخل والإسراف في الإنفاق على النفس لا مكان له في الإسلام. من المهم أن ننفق باعتدال وأن نعطي جزءًا من ثروتنا لأسرتنا وجزءًا للصدقة. مع النية الصحيحة، يمكن تصنيف ذلك كنوع من الصدقة.

#3. دور العمل الخيري

الصدقة أمر حيوي لازدهار النظام الاقتصادي الإسلامي. ويتجلى ذلك في أحد أركاننا الخمسة، وهو الزكاة، وهي صدقة واجبة. يكمن جمال هذا النظام في أنه عندما تتصدق فإن كلاً من المتلقي والمعطي يستفيد من الصدقة. يساعد التصدق بالمال بنية صحيحة على تنمية الشعور بالتعاطف والتراحم والامتنان.

يتم تشجيع المسلمين ليس فقط على إخراج الزكاة، ولكن أيضًا على التصدق طوعًا (الصدقة)، على أساس أن الصدقة لا تنقص من الثروة بل تعمل على تطهير ثروة المرء ومضاعفتها. إن التصدق بالمال الذي اكتسبناه يمكن أن يكون بمثابة وقاية من العواقب السلبية للثروة، مثل الغرور والمادية.

#4. الحاجة إلى الاستثمار

الاستثمار هو شراء أصول تزداد قيمتها بمرور الوقت. ونحن كمسلمين نعيش في هذا العالم، من المهم أن نستثمر ثرواتنا بشكل منتج، ونشجع الاستثمار المتوافق مع الشريعة الإسلامية. لنفترض أن لديك 15,000 دولار في البنك لمدة عام واحد. يخضع هذا المال للتضخم، وسيتعين عليك أيضًا دفع الزكاة عليه. لذا بعد مرور عام، ستصبح قيمة الـ 15,000 دولار الخاصة بك بعد عام واحد 14,025 دولارًا (على أساس معدل تضخم متوسط قدره 4% و2.5% من الزكاة). الأموال التي لا يتم استخدامها بشكل منتج ستنخفض قيمتها بمرور الوقت. وبالتالي، من الأهمية بمكان أن نستخدم أموالنا في الاستخدام، حتى لو كنا نرغب في الحفاظ على ثروتنا فقط.

يركز الإسلام على وضع ثرواتنا في استثمارات حلال للحفاظ على ثرواتنا. من خلال زيادة ثروتنا، نستطيع أن ننفق أكثر على عائلاتنا ومجتمعاتنا ونتبرع أكثر في الأعمال الخيرية - مما يؤدي في النهاية إلى الاستثمار في الآخرة.

#5. مفهوم البركة

تقع البركة أو البركة الإلهية في قلب التمويل الإسلامي. يمكن للبركة أن تجعل ثروتنا أكثر إنتاجية وفعالية وقيمة. من خلال البحث عن فرص الدخل والإنفاق الحلال، يمكن للمسلمين جذب البركة إلى حياتهم وتجربة المزيد من الرضا والوفاء والنجاح في مساعيهم المالية.

لا تشير البركة إلى كمية الثروة فحسب، بل تشير أيضًا إلى نوعية تلك الثروة وتأثيرها. يمكن أن تظهر البركة في العديد من الأشكال، مثل تلبية احتياجات المرء بدخل متواضع، أو القناعة بما يملك، أو رؤية ثروته تؤثر بشكل إيجابي على الآخرين. إن مفتاح استجلاب البركة هو اتباع المبادئ الإسلامية في جميع جوانب الحياة المالية، من الدخل إلى الإنفاق وما بينهما.

#6. الوفرة على الندرة

يمكن أن تؤثر عقلية الندرة والفقر على منظور الشخص للثروة، مما يجعله يعتقد أنه لا يوجد ما يكفي للجميع. ويؤدي ذلك إلى تضاؤل الرفاهية المالية وسوء القرارات المالية. يصف القرآن الكريم الندرة والوفرة كمصدرين متعارضين يؤديان إلى سلوك مالي غير أخلاقي أو أخلاقي على التوالي.

وقد نصح النبي صلى الله عليه وسلم بعقد مقارنات اجتماعية تنازلية ليشعر المرء بالنعمة والشكر على النعم، ويتجنب عقلية الشح التي تؤدي إلى البخل. وقد حذّرنا كمسلمين من النظر إلى الأغنياء كمرجعية، وذكّرنا بأن غناهم ابتلاء من الله لا ينبغي أن نتمناه.

الخاتمة

تقدم التعاليم الإسلامية في مجال التمويل الشخصي نهجاً شاملاً ومتوازناً لإدارة الثروات يعزز النجاح المادي والنمو الروحي. فنحن نتعلم فهم الثروة من منظور إسلامي، والتركيز على الدخل الحلال والإنفاق الأخلاقي، وإعطاء الأولوية للعمل الخيري، والسعي إلى البركة، والموازنة بين التطلعات المادية والروحية. يمكن بناء الثروة والعلاقات الصحية على الإيمان.

من خلال دمج هذه المبادئ في حياتنا الاقتصادية، يمكننا استخدام هذه الموارد لإفادة أنفسنا وعائلاتنا والمجتمع ككل، مع تحقيق النجاح في الآخرة والتمتع بمزيد من الرضا والوفاء. بالإضافة إلى ذلك، تُعد هذه المبادئ بمثابة أدلة قيّمة لأولئك الذين يسعون إلى اتباع نهج أكثر شمولية وأخلاقية في التمويل الشخصي، بغض النظر عن الخلفية الدينية.

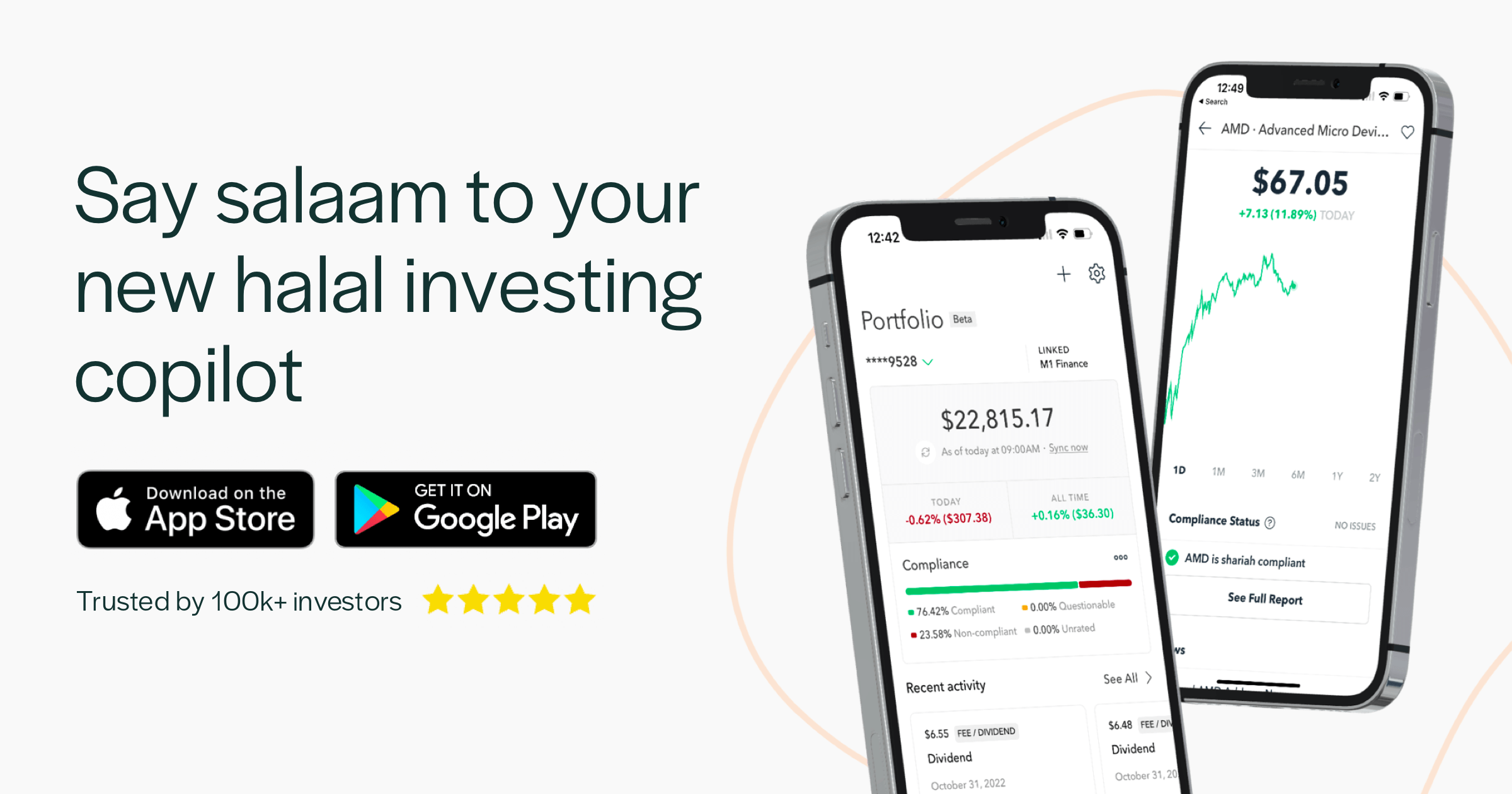

زويا: تطبيق الاستثمار الحلال

تجعل Zoya الاستثمار الحلال سهلاً من خلال مساعدتك في بناء محفظة استثمارية متوافقة مع الشريعة الإسلامية ومراقبتها بثقة ووضوح.