7 طرق حلال للتغلب على التضخم

إن التضخم آخذ في الارتفاع، وهو بالفعل مشكلة عالمية. فالاقتصادات المتقدمة والأسواق الناشئة والاقتصادات النامية تشهد جميعها ارتفاعاً، وإن كان ذلك لأسباب مختلفة.

من المهم أن تحمي أموالك ومحفظتك الاستثمارية من التضخم أينما كنت. ونقطة البداية الجيدة هي معرفة مستوى التضخم في المكان الذي تعيش فيه ومن ثم دمج عدد من هذه التكتيكات الاستثمارية/المالية في محفظتك الاستثمارية.

في هذا المقال، سوف أشاركك سبع استراتيجيات يمكنك استخدامها للتحوط من التضخم بطريقة حلال. للتخفيف من تأثيره على أموالك، من المهم أن يكون لديك خطة محكمة تتكون من مزيج من الأصول والاستراتيجيات.

1. خفض النفقات غير الضرورية

يجب القيام بذلك في كثير من الأحيان، بغض النظر عن الضغوط التضخمية. راجع كشوف حساباتك المصرفية، وانظر في كل معاملة على حدة، وحدد الأشياء التي يمكنك العيش بدونها. كما أنه سيوفر لك بعض الراحة وهو تمرين ممتاز لفهم وضعك المالي. فيما يتعلق بمدفوعاتك الشهرية، يجدر بك التحقق من حصولك على أفضل الصفقات لأي عضويات أو اشتراكات قد تكون لديك.

2. طلب زيادة الراتب

ولسوء الحظ، لم تواكب الأجور تكاليف المعيشة. هناك قلق من أن تواجه بريطانيا أسوأ ضغط على دخل الأسرة منذ السبعينيات. إذا كنت ترغب في تقييم وضعك، فإن هذه الأداة المفيدة من قبل مكتب الإحصاءات الوطنية في المملكة المتحدة (أو هذه الأداة إذا كنت في الولايات المتحدة) تحسب مقدار الزيادة التي يجب أن يزيد راتبك لمواكبة معدل التضخم الحالي.

مع ارتفاع تكاليف المعيشة، يمكن أن يكون ذلك نقطة بداية جيدة لمطالبة مديرك بزيادة راتبك. ابدأ بالتأكد من أنك تستطيع تزويد مديرك بحجة مقنعة حول سبب استحقاقك للزيادة، وليس فقط بسبب التضخم. يمكن أن تشمل الأسباب الأداء الأعلى، أو النتائج، أو ذكر أن لديك عروض عمل خارج الشركة (فقط إذا كان لديك بالطبع!). من الشائع أن يتم زيادة رواتب الموظفين فور تسليمهم إشعار العمل، حيث يرغب المديرون في الاحتفاظ بالموظفين الجيدين وتجنب عملية التوظيف المضنية، والتي قد تكلفهم الكثير على المدى الطويل.

لنفترض أنك محظوظ بما فيه الكفاية لتكون في وضع يكون لديك فيه عرض حقيقي من مكان آخر. في هذه الحالة، يجب ألا تخجل من الضغط بكل احترام للحصول على أقصى راتب من صاحب العمل الحالي والمحتمل.

تتمثل إحدى الاستراتيجيات التي يمكنك اتباعها لضمان ارتفاع أجرك مع التضخم في طلب تعديل راتبك وفقًا للتضخم. ووفقًا للمفتي فراز آدم من شركة أمانة للاستشارات، فإن هذا الأمر مقبول تمامًا من المنظور الشرعي.

"إن القيمة الزمنية للنقود (TVM) أو التضخم أو فقدان القوة الشرائية هو حقيقة واقعة ومفهوم معترف به في الشريعة الإسلامية. وعلى هذا النحو، فقد أجاز العلماء مقايسة الأجور والإيجارات." - المفتي فراز آدم

3. حسابات التوفير الحلال

لا يمكن للمسلمين الاستفادة من الاحتفاظ بأموالهم في حسابات التوفير التقليدية في البنوك التقليدية لأن هذه الحسابات تدر فائدة، وهو أمر محرم. ونتيجة لذلك، يختار العديد من المسلمين وضع مدخراتهم في حسابات نقدية (حسابات لا تدر عوائد). تكمن المشكلة في هذه الحسابات في أنه كلما زاد التضخم، انخفضت قيمة أموالك.

إذا كنت محظوظاً بما فيه الكفاية للعيش في بلد يتوفر فيه بنك متوافق مع الشريعة الإسلامية، يمكنك استخدام حساب التوفير الحلال، والذي سينمي أموالك من خلال الاستثمارات المتوافقة مع الشريعة الإسلامية. عادة، سيكون لديك خيار فتح إما حساب وديعة محددة الأجل (حيث يتم الاحتفاظ بأموالك لفترة محددة) أو حساب إشعار (حيث يمكنك سحب الأموال في وقت أقرب). كلما طالت المدة الثابتة، كان العائد أفضل. ومن الأمور التي يجب وضعها في الاعتبار أنك قد تتعرض لعقوبات إذا قمت بسحب أموالك قبل تاريخ الاستحقاق.

يجب عليك أن تتسوق للحصول على أفضل صفقة وتسأل نفسك عن مدى سهولة وصولك إلى أموالك وما إذا كان لديك أي استثمارات كبيرة تخطط لها. على الرغم من أنك لن تتغلب على الأرجح على التضخم من خلال وضع جميع أموالك في حساب توفير حلال، إلا أنها قد تكون خيارًا جيدًا للادخار على المدى القصير إلى المتوسط لأنها منخفضة المخاطر وقليلة العائد.

4. المخزونات

من المحتمل أن يكون الاستثمار في الأسهم هو أعلى استراتيجية للمخاطرة مقابل العائد. وبالطبع يمكن أن تكون العوائد أعلى بكثير من معدل التضخم. ومع ذلك، من المهم أن تستثمر بما يتماشى مع رغبتك في المخاطرة، لأن عدم القيام بذلك يمكن أن يؤدي إلى قرارات استثمارية سيئة.

خلال أوقات التضخم، تعاني الشركات من زيادة التكاليف التي تؤثر على هوامش أرباحها. في هذه الحالة، تكون الأسهم ذات القوة التسعيرية خيارًا أكثر أمانًا بشكل عام. يمكن لهذه الشركات تمرير الزيادة في تكاليفها إلى عملائها.

5. السلع الأساسية

السلع هي وسيلة للتحوط من التضخم ويجب أن تشكل جزءًا من محفظتك الاستثمارية. فهي تشكل مجموعة واسعة من الأصول، مثل المعادن والنفط والكهرباء. ويمكن أن تكون متقلبة أيضًا، فعندما ترتفع الأسعار، ترتفع السلع أيضًا. وقد رأينا ذلك مؤخرًا مع الصراع بين روسيا وأوكرانيا، حيث ارتفعت أسعار الطاقة.

يُصنف الذهب على أنه سلعة وكان تقليديًا أصلًا آمنًا للمستثمرين؛ ومع ذلك، فقد عانى من بعض التقلبات. فمع قيام الحكومات بزيادة أسعار الفائدة، لن تستفيد من ارتفاع العوائد.

عند شراء السلع، فأنت بحاجة إلى ملكية فعلية للأصل الأساسي لكي تكون الصفقة متوافقة مع الشريعة الإسلامية. تعتمد العديد من من منصات تداول السلع على اتفاقيات العقود مقابل الفروقات (CFD)، والتي لا تتوافق مع الشريعة الإسلامية لأنك لا تملك الأصل الذي تتداوله.

تتمثل إحدى طرق الاستثمار في السلع من خلال الصناديق المتداولة في البورصة (ETFs). وتشمل بعض الخيارات المتوافقة مع الشريعة الإسلامية في البورصات المدرجة في الولايات المتحدة ما يلي:

- صندوق المؤشرات المتداولة في سلة المعادن الثمينة (المؤشر: GLTR)

- صندوق iShares Gold Trust (رمزها: IAU)

- صندوق iShares Silver Trust (المؤشر: SLV)

- صندوق SPDR Gold Trust: (رمزها: GLD)

- صندوق SPDR Gold MiniShares Trust (المؤشر: GLDM)

6. الصكوك

تُستخدم الصكوك، المعروفة أيضًا باسم السندات الإسلامية، لجمع التمويل للمشاريع الكبيرة. ومع ذلك، هناك بعض الاختلافات الرئيسية مقارنة بالسندات التقليدية. الاختلاف الأكثر أهمية هو الطبيعة المدعومة بالأصول لهذه الصكوك. على سبيل المثال، عندما تستثمر في الصكوك، فإنك تمتلك بعض السلع (على سبيل المثال، الأراضي والمعدات) وتحصل على حصص في الأرباح. على عكس السندات التقليدية، حيث تكون مقرضًا وتتلقى مدفوعات في شكل فوائد.

يمكن أن تكون الصكوك أداة جيدة لربط التضخم لأنها توفر وسيلة تسمح للناس بالاستثمار في مشروع ما خلال أوقات الصعوبات المالية والتضخم المرتفع. وينبغي تصميم مشروع صكوك جيد التخطيط بحيث يحقق عوائد تتجاوز التضخم. ولسوء الحظ، لا يمكن الوصول إليها بسهولة، كما أنها ليست متاحة بسهولة وليست متوفرة بكثرة مثل السندات التقليدية. ومع ذلك، فهي خيار متوافق مع الشريعة الإسلامية للمستثمرين المسلمين.

أحد أماكن الاستثمار فيها هو الصناديق المتخصصة. وتشمل بعض الأمثلة على ذلك:

- صندوق داو جونز داو جونز للصكوك العالمية المتداولة في البورصة (رمزها: SPSK)

- صندوق أزاد وايز كابيتال (رمزها: WISEX)

- صندوق الأمانة للمشاركة (رمزها: AMAPX)

7. العقارات

خلال فترة الوباء، ارتفعت أسعار العقارات بشكل كبير مع انخفاض أسعار الفائدة وزيادة الطلب على المساكن بشكل أسرع من المعروض من المساكن الجديدة. وفي الوقت الحالي، لا يوجد خوف حقيقي من انخفاض الأسعار، وقد شهدنا ارتفاعها باستمرار لسنوات عديدة، مما يجعلها مكانًا جيدًا لتخزين ثروتك وتنميتها.

إذا كان لديك المال، يمكنك الاستثمار عن طريق الشراء بنفسك. وبدلاً من ذلك، إذا لم يكن لديك الكثير من المال، يمكنك القيام بذلك من خلال شركة استثمار عقاري أو عن طريق شراء أسهم في صندوق استثمار عقاري متداول (REIT). توفر شركات التمويل الجماعي للعقارات المتوافقة مع الشريعة الإسلامية، مثل شركة Yielders في المملكة المتحدة، وصناديق الاستثمار المتداولة الحلال مثل صندوق الاستثمار المتداول SP Funds Global REIT Sharia ETF (رمزها: SPRE) في الولايات المتحدة خياراً للمستثمرين المسلمين.

على الرغم من ارتفاع الأسعار بشكل مطرد، إلا أن أحد الأشياء التي يجب الانتباه إليها هو كيفية تأثير الزيادة في سعر الفائدة عليك، خاصةً اعتماداً على كيفية تمويلك لعملية الشراء.

ما هي الاستراتيجية المناسبة لك؟

كل استراتيجية من الاستراتيجيات المذكورة أعلاه لها حدود مختلفة للمخاطرة مقابل العائد. سيسمح لك تنويع محفظتك الاستثمارية بمزيج من هذه الاستراتيجيات بتخفيف المخاطر وتنمية ثروتك للتغلب على التضخم، وهو الهدف النهائي.

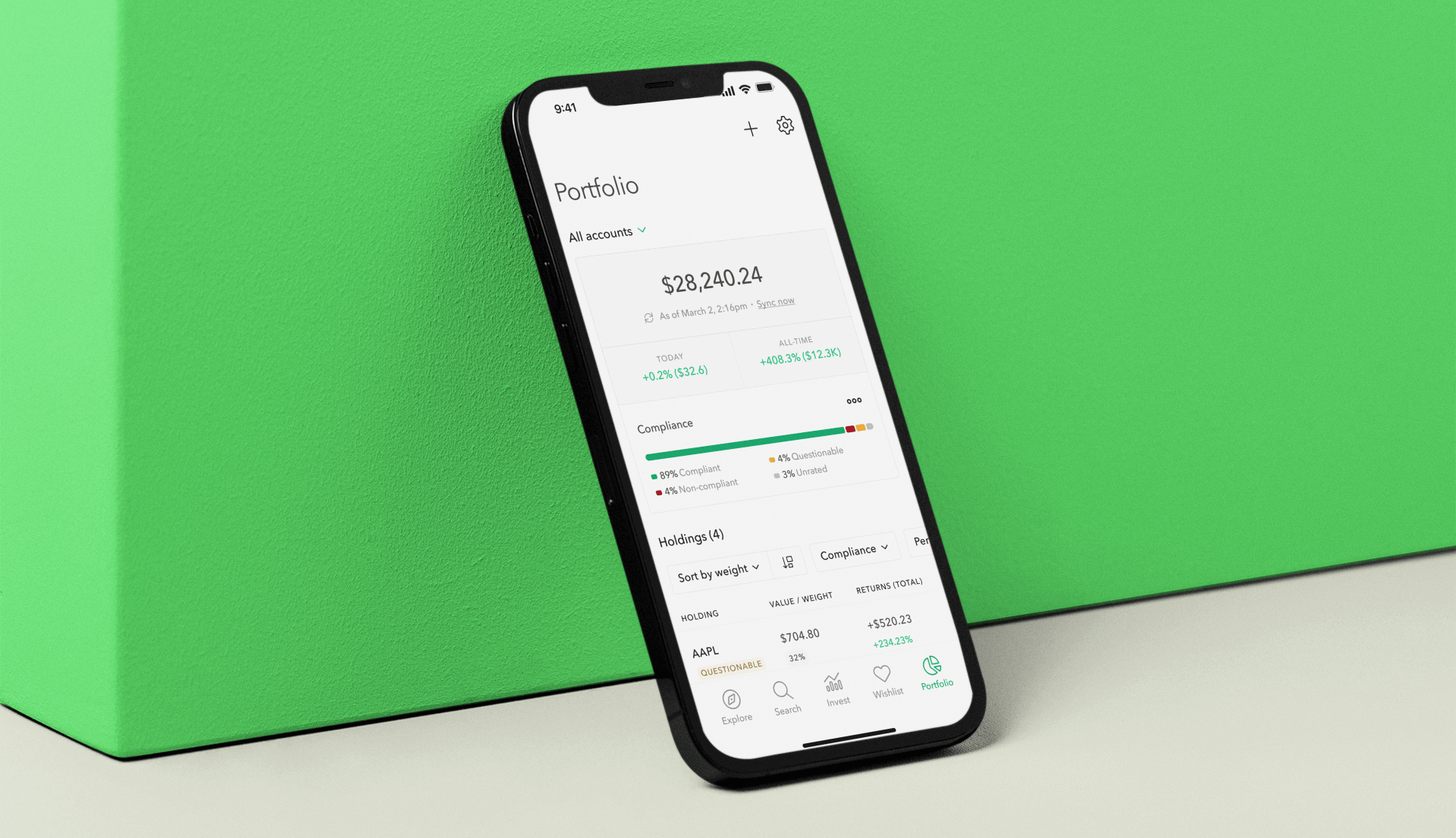

Zoya: الأسهم الحلال وصناديق الاستثمار المتداولة وصناديق الاستثمار المتداولة

تجعل Zoya الاستثمار الحلال سهلاً من خلال مساعدتك في بناء محفظة استثمارية متوافقة مع الشريعة الإسلامية ومراقبتها بثقة ووضوح.