Introducing More Ways to Screen for Shariah Compliance in Zoya

If you've been investing for a while, you’ve probably run into something strange: look up a stock’s Shariah compliance, and you’ll often get different answers depending on where you check. One methodology might screen it out, while another gives it a pass.

Dealing with conflicting information is frustrating—even paralyzing—and can make investment decisions unnecessarily difficult.

The reality is more nuanced than simply "compliant" or "non-compliant." Over the past few decades, as Islamic finance has grown more sophisticated, different institutions have collaborated with scholars to develop their own approaches to evaluating companies. Each reflects a distinct perspective on how to apply Islamic principles to modern markets.

Today, we’re making it easier to navigate these differences.

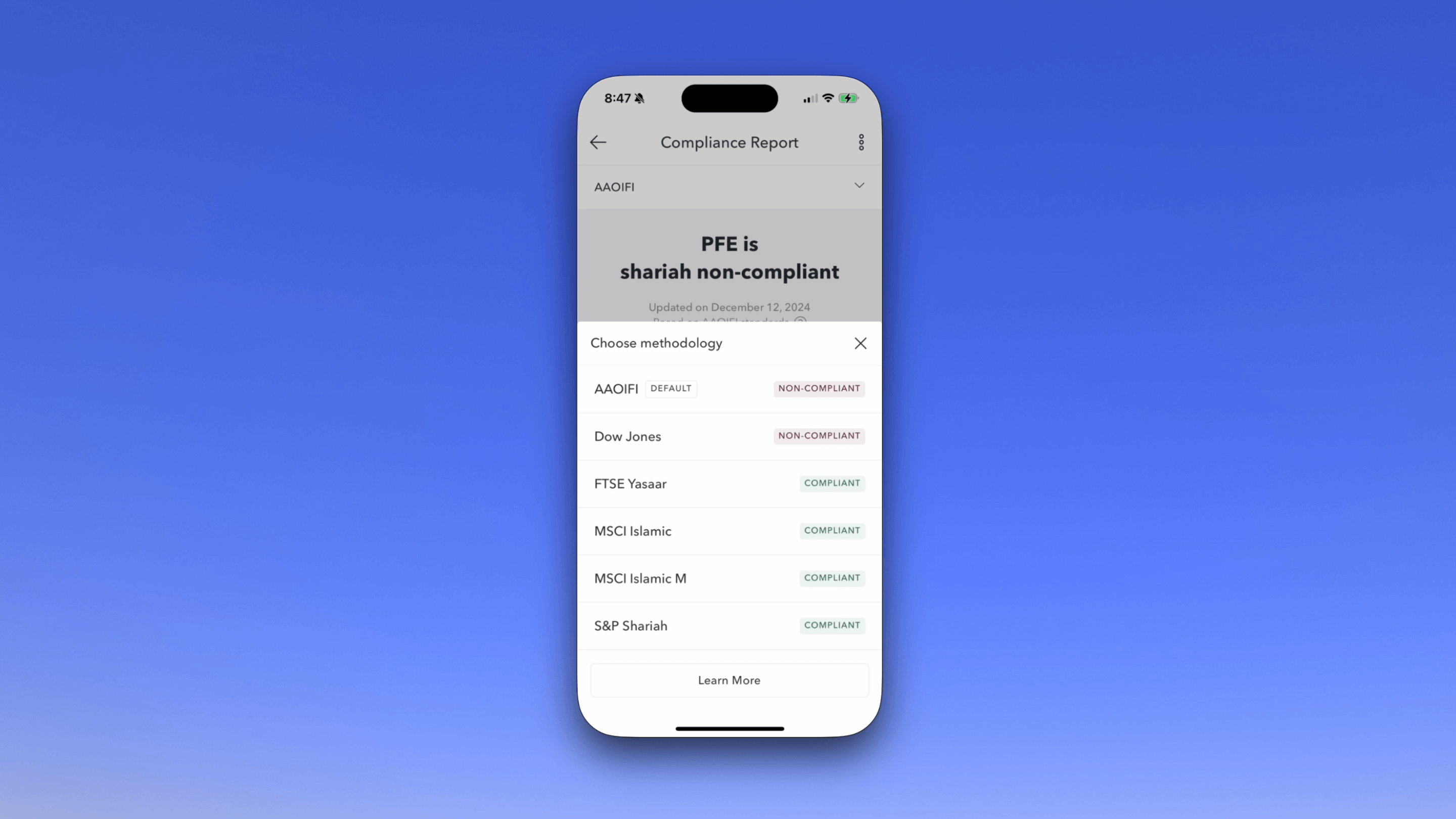

Zoya now supports multiple Shariah screening methodologies. For the first time, you can see how a stock measures up across the top globally recognized standards—AAOIFI, MSCI, S&P, Dow Jones, and FTSE—all in one place.

These differences aren’t just technical—they matter depending on what you’re investing in and how you invest:

- Tech companies tend to be valued based on intellectual property and intangible assets, making market cap-based methodologies a better fit.

- Industrial and manufacturing stocks often have significant tangible assets, where asset-based methodologies provide a more accurate financial picture.

- During market volatility, different averaging periods (e.g., 24 vs. 36-month market caps) can impact compliance in meaningful ways.

We’re not here to tell you which methodology is “best.” Each has its strengths and trade-offs. What we are doing is giving you the tools to compare, understand, and make decisions that align with your personal convictions and investing strategy.

This feature is currently in beta and can be accessed through the new methodology switcher at the top of any stock’s compliance report. Soon, we’ll integrate it into filters and global settings, making it even easier to customize your experience.

We’d love to hear how you use these new tools and what other insights would help you invest with greater confidence.

Disclaimer: Zoya provides Shariah screening based on our independent interpretation and replication of publicly available methodologies. We are not affiliated with the organizations behind these methodologies. While we strive for accuracy, our results may vary from their official determinations.

زويا: تطبيق الاستثمار الحلال

تجعل Zoya الاستثمار الحلال سهلاً من خلال مساعدتك في بناء محفظة استثمارية متوافقة مع الشريعة الإسلامية ومراقبتها بثقة ووضوح.