Introducing the Zoyaverse Index

Muslim retail investors are emerging as an increasingly influential force in public markets. Until now, however, there has been no reliable way to track the investment trends of this growing segment.

Today, we are launching the Zoyaverse Index (ZOYA100), a first-of-its-kind benchmark offering a transparent, data-driven view into the investment decisions of this community. Drawing from over $600 million in aggregated and anonymized portfolio data, the index tracks the 100 most widely-held stocks among Zoya users. Each company's inclusion is determined by how many investors hold the stock and how much of their portfolio they’ve allocated to it.

The Zoyaverse Index is more than just a list of companies; it’s a real-time reflection of where the Muslim investor community sees value, opportunity, and the future.

A benchmark weighted by conviction

Unlike traditional indices where a company’s influence is dictated by its market capitalization, the Zoyaverse Index methodology is different. Here, influence is democratized.

We measure conviction by looking at the average percentage of a portfolio that an investor allocates to a single stock. If users are dedicating a larger portion of their portfolios to a specific company, that company will have a greater influence on the index. This method ensures that all users’ holdings contribute equally, regardless of their portfolio size, providing a more democratic view of where conviction truly lies.

The result is a more authentic benchmark that represents the collective belief of everyday investors. The index is rebalanced monthly and focuses exclusively on publicly traded U.S. equities to give the clearest picture of direct stock ownership.

A glimpse into the Zoyaverse

The inaugural index paints a compelling and multifaceted picture of the community. Three clear themes emerge:

1. A strong belief in foundational technology

The data reveals a significant focus on the architects of our digital world, with the Technology sector making up 51.4% of the index. This points to a clear conviction in the foundational trends shaping our economy, from the artificial intelligence revolution to the software and cloud platforms that power global business.

2. A preference for blue-chip stability

While embracing innovation, the community’s strategy is firmly anchored in stability. An overwhelming 95.8% of the index is composed of large-cap stocks. This strong preference for large, established companies, the "blue-chips" of the market, suggests a long-term, risk-aware approach over short-term speculation. These are global leaders with proven business models, forming a reliable bedrock for a growth-oriented portfolio.

3. The complex reality of values-based investing

The data also highlights the complex decisions investors navigate today. The high ranking of some technology companies, for instance, exists alongside ongoing community discussions about their corporate stances on global issues. This reflects a practical reality many investors face: balancing the essential role these companies play in the market with deeply held personal principles.

Conversely, the data shows clear support for businesses with aligned leadership. The inclusion of Hims & Hers (HIMS) is a notable example, as its founder, a Palestinian-American, has been a vocal supporter of Palestinians, and many in the community have invested accordingly. This suggests a growing trend of "thesis-driven" investing, where capital is actively allocated to support founders and companies that reflect the community's values.

Ultimately, the Zoyaverse Index captures the nuanced and sometimes contradictory realities of being a Muslim investor today. It shows a community that is both pragmatic and principled, making deliberate choices to build a secure financial future in a complex world.

The start of a new conversation

The Zoyaverse Index is more than just a tool. It is the start of a new, data-driven conversation about our community's financial identity and future. Muslim investors now have a benchmark that reflects their specific behaviors and priorities, a tool that was previously unavailable.

Our mission is to empower you with these insights, foster more informed financial discussions, and provide a clear mirror that reflects the intelligence, prudence, and optimism of the modern Muslim investor.

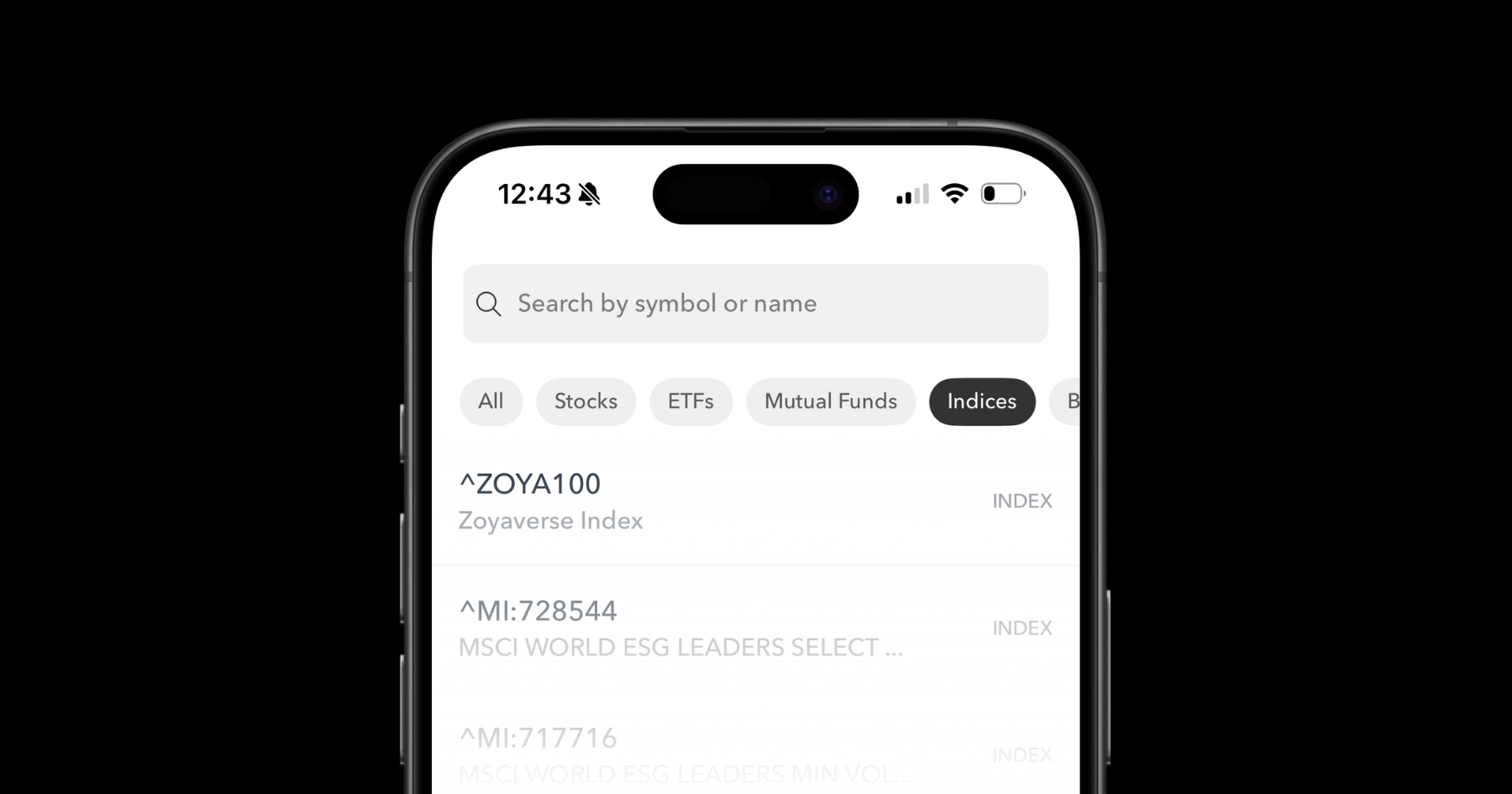

Want to see the full list? Dive into all 100 constituents of the Zoyaverse Index, updated monthly, exclusively in the Zoya app.

زويا: تطبيق الاستثمار الحلال

تجعل Zoya الاستثمار الحلال سهلاً من خلال مساعدتك في بناء محفظة استثمارية متوافقة مع الشريعة الإسلامية ومراقبتها بثقة ووضوح.

Index methodology

- The index considers all equity securities listed on major U.S. exchanges (NYSE, NASDAQ) that are held by Zoya users. It excludes ETFs, mutual funds, options, cryptocurrencies, and fixed-income securities to provide the clearest view of direct stock ownership. To provide the most accurate and unfiltered picture of what Zoya users are actually investing in, the index includes all stocks held in their brokerage accounts, regardless of their Shariah compliance status.

- Stocks are first ranked by popularity, which is determined by the number of unique Zoya users who hold them. The top 100 most-held stocks are selected for inclusion in the index.

- The index is conviction-weighted. For each user, we calculate the percentage that each stock represents of their total eligible equity portfolio. We then average this percentage across all users who hold the stock. This "average conviction" score is then normalized across all 100 constituents to form the final index weights. This ensures each user’s conviction is counted equally, regardless of their portfolio size.

- The index is rebalanced monthly using end-of-month holdings data.

إخلاء المسؤولية

The Zoyaverse Index is a non-investable, informational index that reflects aggregated and anonymized investment behavior among Zoya users with connected brokerage accounts. It does not constitute financial advice or a recommendation to buy or sell any securities. The index may not be representative of the broader Muslim investor population and is subject to change without notice.