Is the S&P 500 Halal or Haram? The Definitive Guide for Muslim Investors

The S&P 500 is a popular choice for investors looking to gain exposure to the U.S. stock market. But you might be wondering: is investing in the S&P 500—or in funds like the SPY ETF that track it—halal?

In this guide, we'll break down the S&P 500 and SPY ETF from a Shariah perspective, explain what makes an investment halal or haram, and offer practical insights to help you make informed decisions.

What is the S&P 500 and SPY ETF?

The S&P 500 is a widely recognized stock market index that represents 500 of the largest publicly traded companies in the United States, covering sectors like technology, healthcare, and consumer goods. It’s a reliable gauge of the overall health of the U.S. economy since it accounts for roughly 80% of the total U.S. stock market value.

The SPY ETF (SPDR S&P 500 ETF Trust) is an exchange-traded fund that aims to replicate the performance of the S&P 500. By purchasing SPY, you can effectively buy into the entire index, gaining exposure to all 500 companies with a single transaction, making it an efficient way to diversify across major U.S. industries.

Is the S&P 500 Shariah-compliant?

The S&P 500 is highly diversified, but many of its companies do not meet Shariah compliance standards. According to Zoya, there are 226 companies in the S&P 500 that meet the criteria, which means that more than half of the index is non-compliant.

Common non-compliant sectors include financial services, which rely heavily on interest-based income, as well as industries like alcohol, gambling, firearms, tobacco, and others involved in haram activities. As a result, the S&P 500 as a whole cannot be considered Shariah-compliant.

Since the SPY ETF is designed to replicate the S&P 500, it also includes both Shariah-compliant and non-compliant companies, making it unsuitable for halal investing.

Best halal alternatives to the S&P 500 and SPY ETF

If you want to achieve similar market exposure while ensuring your investments are halal, consider the following options:

Shariah-compliant ETFs

- SP Funds S&P 500 Shariah Industry Exclusions ETF (SPUS): The SPUS ETF aims to replicate the S&P 500 while excluding companies that do not meet Shariah standards. It typically holds around 220-250 stocks from the S&P 500, providing exposure to the same large-cap U.S. companies but without the non-compliant sectors.

- Wahed FTSE USA Shariah ETF (HLAL): The HLAL ETF focuses exclusively on Shariah-compliant stocks within the U.S. It provides a diversified mix of companies across multiple sectors, similar to the S&P 500, while excluding non-compliant ones.

- iShares MSCI USA Islamic UCITS ETF (ISUS/ISDU): This ETF provides exposure to U.S. companies that meet Shariah compliance, offering flexibility for investors as it trades in different currencies—ISUS in GBP and ISDU in USD. Unlike the other two, this ETF is dual-listed on the London Stock Exchange.

These halal ETFs offer the benefits of broad market diversification, with the added assurance that their holdings are vetted for Shariah compliance.

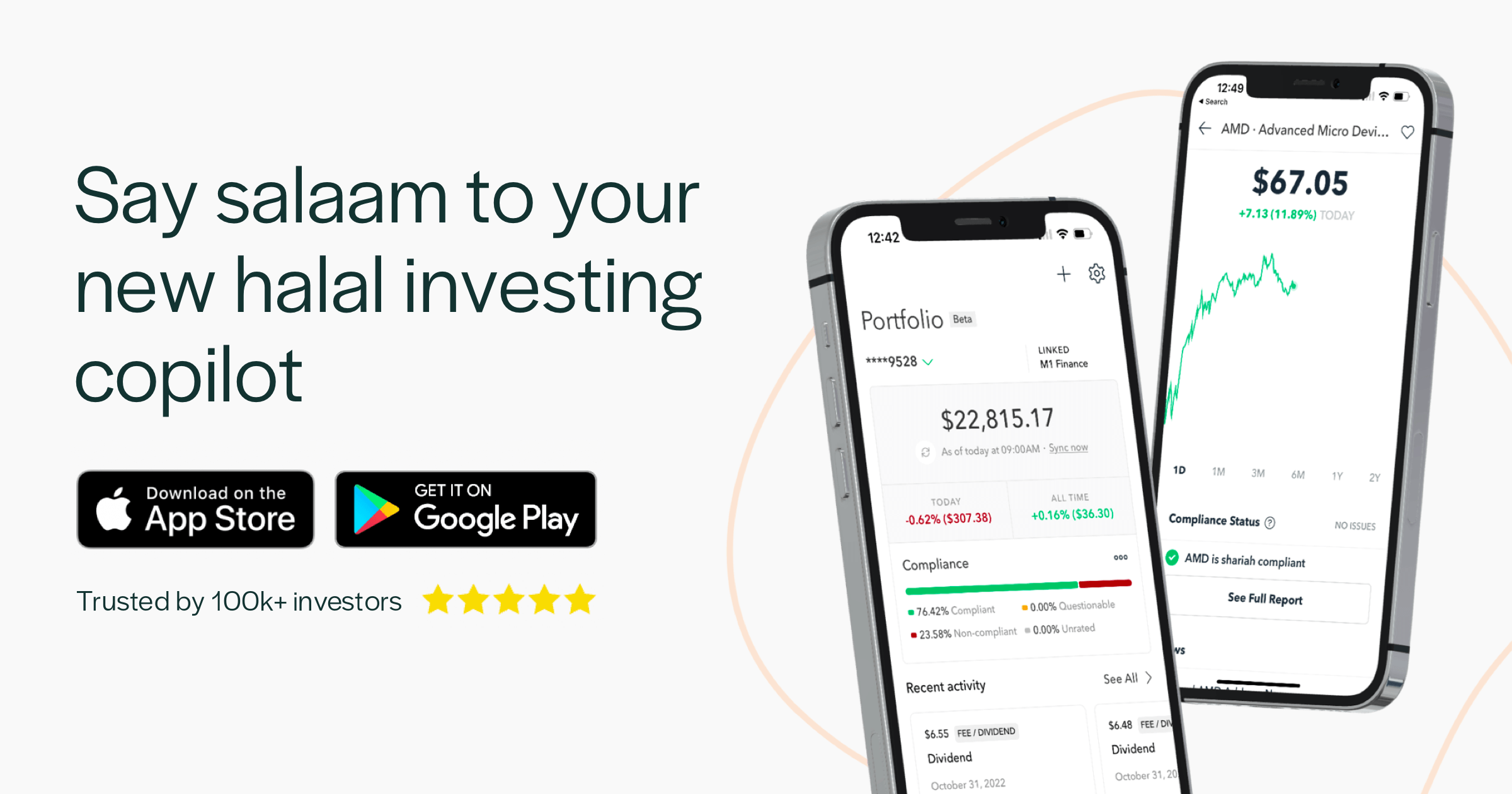

Custom indexing

Another approach is to use Zoya to screen individual stocks from the S&P 500 for Shariah compliance. Zoya's stock screening capabilities allow you to filter out non-compliant companies and create a custom basket of stocks.

By creating your own basket, you get the diversification benefits of the S&P 500 without exposure to non-permissible activities.

- Complete control: Unlike pre-built ETFs, baskets give you the power to choose exactly which companies and sectors to include, while avoiding those that don’t align with your values, convictions, or risk tolerance

- Save on fees: By managing your own basket, you avoid paying the management fees associated with traditional ETFs, which can save you a ton of money in the long run.

- Tax efficiency: With direct stock ownership, you can harvest tax losses on individual positions, something you can't do with ETF shares.

- Real-time monitoring: While ETFs rebalance quarterly, you can respond immediately when a stock's Shariah compliance status changes.

Performance comparison: Halal ETFs vs. S&P 500

A common concern among Muslim investors is whether Shariah-compliant funds can keep pace with their conventional counterparts. The data tells an encouraging story.

In 2024-2025, halal ETFs have performed competitively with—and in some periods outperformed—the S&P 500. This is partly because Shariah screening naturally excludes heavily leveraged companies and financial institutions, which can be a liability during market downturns.

The exclusion of financial services companies, which make up roughly 13% of the S&P 500, means halal ETFs have higher concentration in technology, healthcare, and consumer sectors. When these sectors outperform, halal ETFs benefit disproportionately.

الخاتمة

While investing directly in the S&P 500 or SPY might be problematic, there are several ways to gain similar exposure in a halal way. ETFs like SPUS and HLAL offer exposure to hundreds of Shariah-compliant U.S. equities. Alternatively, you can build your own custom basket of Shariah-compliant stocks with Zoya—giving you complete control over your investments while saving on fees.

With the right tools and approach, you can build a halal investment portfolio that respects both your financial goals and personal values.

زويا: تطبيق الاستثمار الحلال

تجعل Zoya الاستثمار الحلال سهلاً من خلال مساعدتك في بناء محفظة استثمارية متوافقة مع الشريعة الإسلامية ومراقبتها بثقة ووضوح.