What is MNZL? A Guide to the Manzil Russell Halal USA Broad Market ETF

The halal ETF market in North America has grown steadily over the past several years, giving Muslims more options for building Shariah-compliant portfolios. In November 2025, Manzil entered the space with their first exchange-traded fund: the Manzil Russell Halal USA Broad Market ETF, trading under the ticker MNZL.

In this post, we'll break down what MNZL offers, how it differs from existing options, and why you might want to consider it for your porfolio.

What Is MNZL?

MNZL is a passively managed ETF that seeks to track the performance of the Russell IdealRatings Manzil Halal USA Broad Market Index. The fund provides exposure to large and mid-cap US equities that pass both Shariah compliance screening and an additional ethical screen focused on human rights.

The fund launched on November 18, 2025, and trades on the Nasdaq exchange.

What makes MNZL different?

While MNZL shares the same basic structure as other halal ETFs (passive management, market-cap weighting, US equity focus), it differentiates itself in three meaningful ways.

1. Broader index, more holdings

Most halal ETFs available to US investors track filtered versions of the S&P 500 or similar large-cap indexes. After Shariah screening, these funds typically hold somewhere between 200 and 250 stocks.

MNZL takes a different approach. The fund tracks a Shariah-compliant subset of the Russell 1000 Index, which includes approximately 1,000 of the largest US companies by market capitalization. This broader starting universe, which captures both large-cap and mid-cap companies, results in a fund with over 450 holdings after screening.

More holdings generally means greater diversification. With a larger number of stocks spread across more market segments, the fund's performance is less dependent on any single company or sector. For investors concerned about concentration risk, particularly the heavy technology weighting common in halal portfolios, broader diversification offers some mitigation.

The inclusion of mid-cap companies is also notable. Mid-caps occupy an interesting space in the market: they're typically more established than small-caps but may offer more growth potential than large-caps. They're often underrepresented in halal portfolios simply because many Shariah-compliant funds focus exclusively on large-cap indexes.

2. Human rights screening

Like most halal ETFs, MNZL uses the AAOIFI applies an AAOIFI-based Shariah screening criteria, which filters out companies involved in prohibited industries (alcohol, tobacco, gambling, conventional financial services, pork, weapons, adult entertainment) as well as companies that exceed certain financial thresholds related to debt and other interest-bearing securities.

MNZL then applies a second layer of screening that none of the other halal ETFs currently offer: the American Friends Service Committee (AFSC) human rights criteria.

The AFSC is a Quaker organization that has developed a methodology for identifying companies involved in what they term "grave human rights violations." This includes companies with demonstrated links to apartheid, ethnic cleansing, genocide, and other systematic human rights abuses. Companies that pass Shariah screening but fail this additional ethical screen are excluded from the index.

It's worth noting that this type of ethical screening isn't new in the broader investment world. ESG (Environmental, Social, and Governance) investing has grown significantly in recent years, and many conventional funds now apply similar human rights criteria. MNZL is simply the first halal ETF to formally incorporate this approach.

Islamic principles extend beyond the technical requirements of halal and haram. Concepts like adl (justice), ihsan (excellence in conduct), and the prohibition against dhulm (oppression) suggest a broader ethical framework that encompasses how we interact with the world, including where we invest our money.

For some investors, standard Shariah screening addresses the core requirements but leaves a gap when it comes to companies that may pass on paper while still engaging in activities that conflict with Islamic values around human dignity and social justice.

The AFSC screen attempts to address this gap. It's not a perfect solution but it represents a meaningful step toward aligning investments with a more comprehensive understanding of Islamic principles.

3. Lowest expense ratio

MNZL's expense ratio of 0.40% makes it the most cost-efficient halal ETF currently available in North America. The differences may appear small in percentage terms, but they compound over time.

Here’s a simple illustration assuming a $50,000 investment earning an average annual return of 8% over 20 years.

| Expense Ratio | Ending Value | Fees Paid |

|---|---|---|

| 0.40% | $224,645 | $8,755 |

| 0.50% | $220,714 | $12,686 |

| 0.60% | $216,856 | $16,191 |

| 0.70% | $213,068 | $19,979 |

| 0.80% | $209,348 | $23,699 |

| 0.90% | $205,694 | $27,353 |

| 1.00% | $202,104 | $30,943 |

Expense ratios represent the annual cost of owning a fund, deducted directly from returns.

The difference between 0.40% and 0.50% on a $50,000 investment amounts to roughly $4,000 over two decades, assuming average market returns. For larger portfolios or longer time horizons, the gap widens further.

For passive funds tracking similar markets, lower costs are one of the few variables investors can control, and one of the most reliable predictors of long-term results. When two funds offer comparable exposure, the cheaper option has a structural advantage.

What's inside MNZL?

As a market-cap weighted fund, MNZL's largest holdings are the largest Shariah-compliant companies in the Russell 1000.

Top 10 holdings

As of January 2026, the top 10 holdings account for approximately 38% of the fund. That's significant concentration, but still somewhat lower than more narrowly focused funds.

| Company | تيكيت | Weight |

|---|---|---|

| Apple | AAPL | 14.55% |

| Broadcom | AVGO | 5.95% |

| Tesla | TSLA | 4.71% |

| Eli Lilly | LLY | 3.24% |

| Johnson & Johnson | JNJ | 2.08% |

| Micron Technology | MU | 1.78% |

| AMD | AMD | 1.57% |

| AbbVie | ABBV | 1.52% |

| Home Depot | HD | 1.45% |

| Procter & Gamble | PG | 1.35% |

Sector allocation

Like all halal equity funds, MNZL has a structural tilt toward certain sectors. When you screen out conventional financial services, technology and healthcare companies naturally rise to fill the gap.

The fund has notable exposure to:

- Technology: The largest sector by weight, including semiconductors, software, and hardware companies

- Healthcare: Pharmaceuticals, medical devices, and healthcare services

- Consumer Discretionary: Retail, automotive, and consumer products

- Industrials: Manufacturing, logistics, and business services

Investors should be aware of this sector composition when thinking about overall portfolio allocation. If you already have significant exposure to technology stocks through individual holdings, adding a halal ETF will increase that concentration further.

How MNZL fits into a halal portfolio

MNZL is designed to serve as a core holding for US equity exposure. The fund's broad diversification, passive management approach, and low cost structure make it suitable for investors who want to build a foundation and hold it for the long term.

Some potential use cases:

- As a primary US equity position: For investors who want simple, diversified exposure to the US stock market without selecting individual stocks, MNZL can serve as a one-fund solution for the domestic equity portion of a portfolio.

- As part of a multi-fund approach: Investors who want to combine different halal ETFs (perhaps to gain exposure to different asset classes) could include MNZL alongside other options.

- For those who prioritize the human rights screen: Investors who specifically value the AFSC ethical criteria now have an option that incorporates this screening by default.

- For cost-conscious long-term investors: Those focused on minimizing fees over long holding periods may find MNZL's expense ratio advantage compelling.

How does purification work for MNZL?

Like all halal equity funds, MNZL may hold companies that earn a small portion of their revenue from non-compliant activities. These amounts fall below the thresholds that would disqualify a company from the index, but they still require purification: the process of donating a portion of investment income that derives from impermissible sources, such as interest.

Manzil handles the purification calculation for investors. The fund publishes the per-share purification amount on a quarterly basis on their website, generally prior to the fund's quarterly dividend distribution. This makes it straightforward to determine exactly how much needs to be donated based on the number of shares you hold.

Final thoughts on MNZL

The launch of MNZL reflects the continued maturation of the halal investing space. Muslim investors in North America now have multiple ETF options with different underlying indexes, screening methodologies, and cost structures.

This is a positive development. More options mean investors can choose funds that align with their specific priorities.

MNZL's combination of broader diversification, additional ethical screening, and competitive pricing gives it a distinct profile. Whether those features matter to you depends on your investment philosophy and what you're trying to achieve with your portfolio.

MNZL is available on most major brokerages. For complete information, including risks and disclosures, review the full prospectus.

This post is for informational purposes only and does not constitute investment advice.

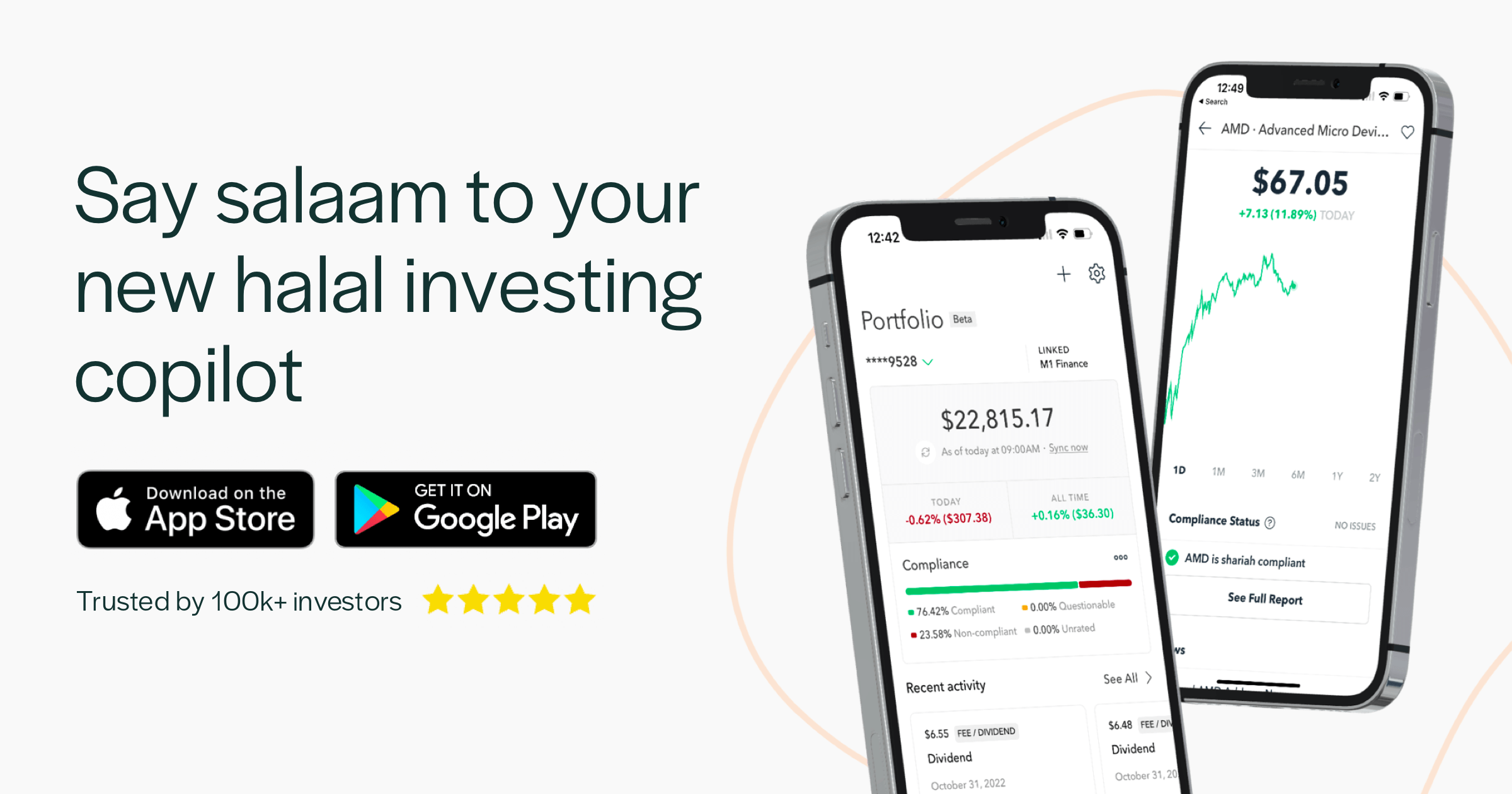

زويا: تطبيق الاستثمار الحلال

تجعل Zoya الاستثمار الحلال سهلاً من خلال مساعدتك في بناء محفظة استثمارية متوافقة مع الشريعة الإسلامية ومراقبتها بثقة ووضوح.