ShariaPortfolio Brings Its Model Portfolios to Zoya

We’re excited to announce a new partnership with ShariaPortfolio that brings Shariah-compliant model portfolios designed by their team of experts directly into Zoya.

ShariaPortfolio is a boutique investment advisory firm with over two decades of experience serving the Muslim community. They are also the team behind SP Funds, the largest family of Shariah-compliant ETFs in North America with over $2.5 billion in assets under management.

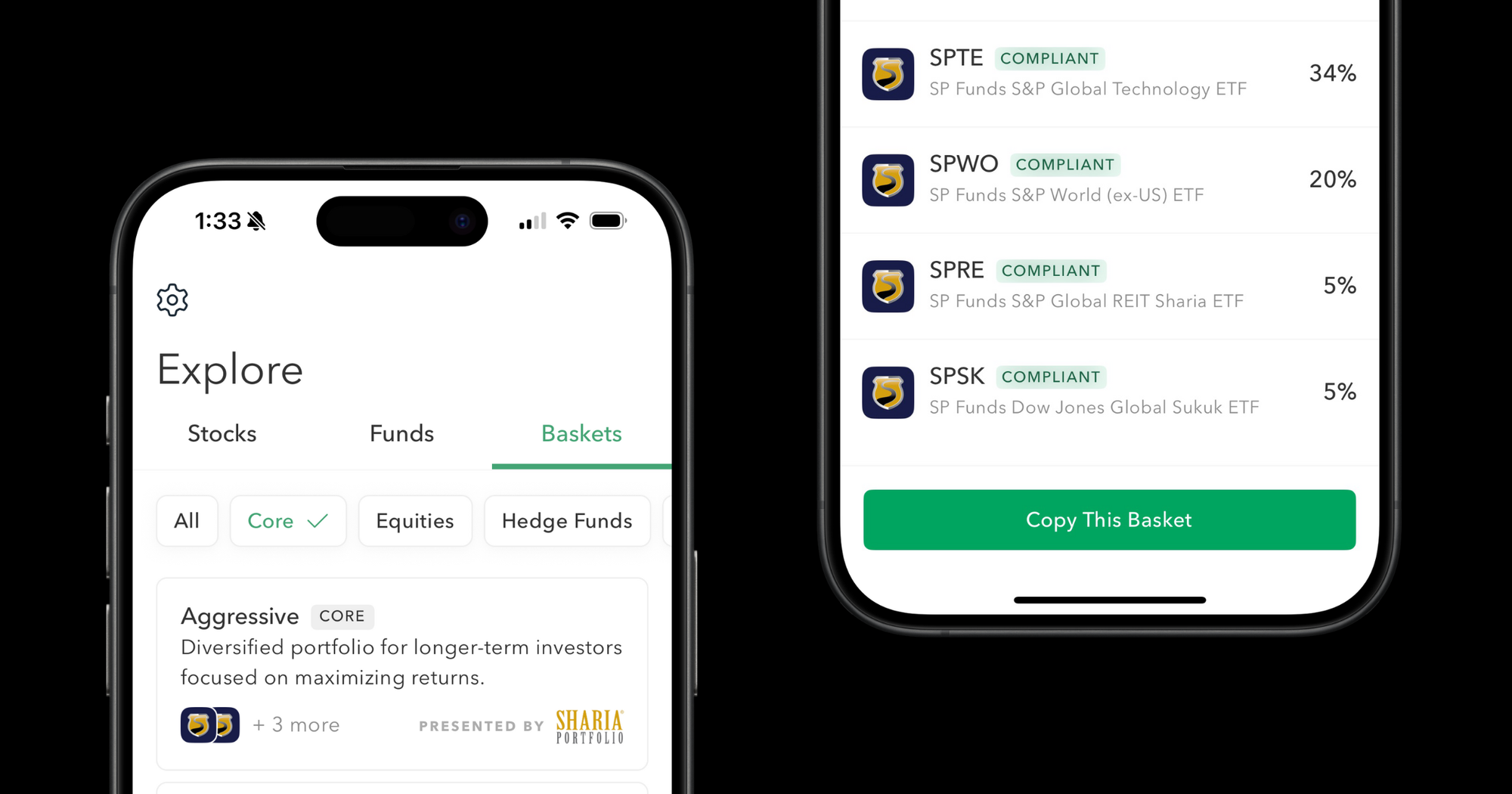

This initiative introduces our new Core category of Baskets, allowing you to explore model portfolios that reflect different investment strategies for a variety of risk profiles. Each Core Basket is designed by the ShariaPortfolio team using SP Funds' ETFs, offering a carefully curated foundation for long-term investing with diversified exposure across asset classes, sectors, and themes.

Like all Zoya Baskets, the new Core Baskets are completely customizable. Think of them as professionally curated strategies which you control. After selecting a portfolio, you retain complete autonomy to adjust it to your personal preferences by modifying allocations or removing any holdings before you invest. It’s a simple way to draw on professional insights from the advisors at ShariaPortfolio while maintaining full control over your portfolio.

“This partnership is a direct response to what our users have been asking for,” said Saad Malik, CEO of Zoya. “They love the control and transparency Zoya offers, and now we’re adding a layer of professional guidance from a trusted name in the Shariah-compliant investment space, empowering the community to make confident decisions.”

Ready to get started? Explore model portfolios in Zoya today.

This content is for informational purposes only and does not constitute investment advice, a recommendation, or a solicitation to buy or sell any security. Zoya is a financial technology company and is not a registered investment advisor or broker-dealer. The availability of these model portfolio Baskets does not create a client or fiduciary relationship. All investments involve risk, including the possible loss of principal. You should always conduct your own research and consult with a qualified financial professional before making any investment decisions.