كيفية تنقية الأسهم: دليل خطوة بخطوة

عندما يتعلق الأمر بالاستثمار الحلال، فإن أحد المفاهيم التي غالبًا ما يقابلها قدر كبير من الالتباس هو عملية التطهير. فغالبًا ما يؤدي تعقيد هذه العملية إلى سوء الفهم أو التشكيك، مما يجعلها تبدو مهمة شاقة للعديد من المستثمرين.

Yet, understanding purification is key to maintaining a halal portfolio. To make this easier, let’s break it down into three main points:

- What purification means in the context of halal investing

- Why purification is necessary even when investing in shariah-compliant stocks

- How to go about the purification process

This guide aims to simplify purification for you, offering a straightforward, step-by-step approach to getting it right. By the end of this read, you'll be equipped with knowledge and strategies to purify your portfolio effectively, fostering a more confident approach to halal investing.

What is purification?

Purification refers to removing or "cleansing" any non-permissible income that may be earned from your investments. Contrary to popular belief, even if one invests solely in halal assets, unintended or unavoidable encounters with haram elements can occur. These haram elements could be due to the company's operations, liquidity provisions, or simply the way the company manages its funds.

Whatever the source of these elements, they pose a serious challenge to maintaining the halal status of your investment. Purification allows you to avoid benefiting from such activities directly.

Why purification is necessary

Purification serves as a means to cleanse our wealth from any possible haram elements. Just as we purify our wealth every year through zakat, purification allows us to cleanse earnings that may have become mixed with haram.

The Prophet Muhammad (PBUH) warned about the importance of the source of our earnings in a hadith reported in Sahih al-Bukhari (2083):

Certainly a time will come when people will not bother to know from where they earned the money, by lawful means or unlawful means.

This emphasizes the importance of ensuring our wealth does not contain any haram elements, even if they are unintentionally acquired. Purification thus becomes a necessary step as it helps maintain the purity and barakah of our wealth.

Different methods of purification

There are a few common methods used for purification:

- Dividend purification method: Only the dividends earned are purified by donating the percentage of non-compliant income (also known as the purification factor).

- Capital gains method: Only a certain percentage of any capital gains are purified upon selling your shares.

- AAOIFI method: The exact amount of non-compliant income attributable to each share is calculated. This amount per share is then purified on an annual basis.

Step-by-step guide to calculating purification

Having understood the concept of purification and why it's important, let's look at a step-by-step guide on how it's calculated.

Dividend purification method

Dividend purification focuses solely on cleansing any dividend income earned from stocks in proportion to any non-compliant revenue reported by the company.

Here are the steps:

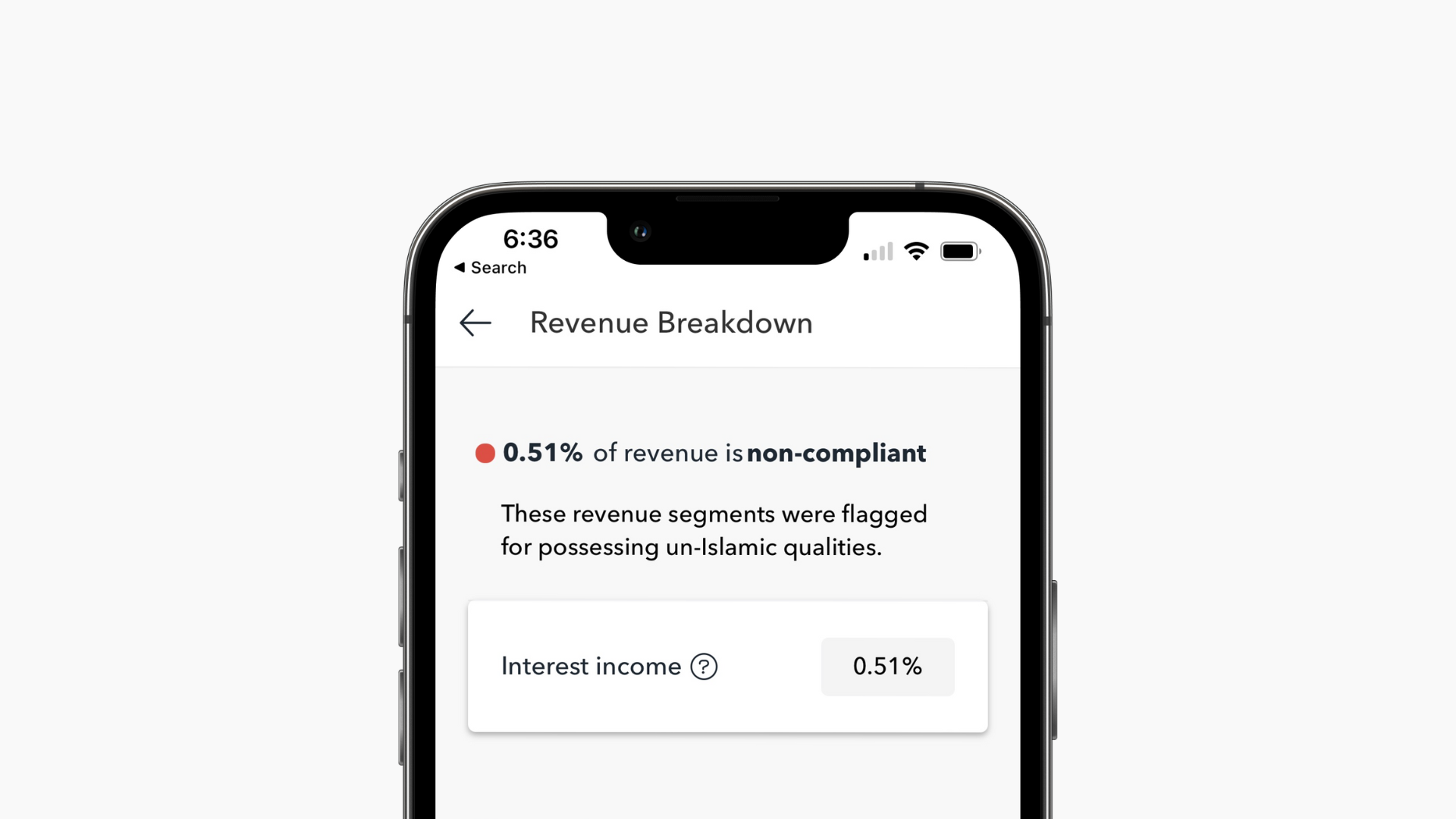

- Use Zoya to determine the total percentage of non-compliant income for the company. This can be found by navigating to the compliance report for a particular stock. For example, let's assume Company A has 2% non-compliant revenue as a result of earning interest income.

- When you receive dividends from Company A, calculate 2% of the total dividend amount.

- Donate this 2% to charity.

For example, if you earned $100 in dividends from Company A, you would donate $2 to charity and keep $98. This method purifies only the dividend income to avoid direct benefit from haram sources.

Capital gains purification method

Capital gains purification involves purifying a certain ratio of the capital gains earned when shares are sold at a profit. Here are the steps:

- Calculate the total capital gain from sale of shares, which is the sale price less purchase price.

- Use Zoya to determine the total percentage of non-compliant revenue for that company. Let's assume 2% again for this example.

- Calculate 2% of the capital gains amount.

- Donate this 2% to charity.

For example, if you bought Company A shares for $500 and later sold them for $700, your capital gain is $200. You would donate 2% of $200, which is $4, to charity and keep the remaining $196.

The AAOIFI purification method

The Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) has prescribed their own guidelines for purification. The key difference is that under the AAOIFI methodology, purification is required on an annual basis based on the actual non-compliant revenue for that year. This applies regardless of whether the investor made any capital gains or received dividends.

Here are the steps:

- Determine the total non-compliant revenue for the company for the financial year. Again, you can use Zoya to find this information by navigating to the compliance report screen, clicking "See breakdown by segment" button, and then clicking on the non-compliant segment to toggle between the percentage and the as-reported amount.

- Divide this by the total outstanding shares of the company to calculate non-compliant revenue per share. The number of outstanding shares can be found by viewing the company's most recent balance sheet, which is available on most finance websites like MarketWatch and Yahoo Finance.

- Multiply this by the number of shares you hold to find the total non-compliant revenue attributable to your shares.

- Purify this amount by donating to charity.

For example, if Company A earned $5,000 in non-compliant revenue last year and had 50,000 outstanding shares, the non-compliant revenue per share is $5,000/50,000 = $0.10.

If you held 1,000 shares of Company A, the non-compliant portion of revenue attributable to your shares is 1,000 * $0.10 = $100. Therefore, you must donate $100 to charity to purify your investment.

This method aims to purify the exact amount of non-compliant revenue you are exposed to.

How to choose the right purification method for you

Choosing the right purification method depends on several factors, including your investment style and horizon.

Day traders may prefer the capital gains method as it's simple and quick. On the other hand, income-focused investors relying on consistent cash flow from dividends may prefer the dividend purification method. For a comprehensive approach, Zoya's shariah advisors recommend combining both dividend and capital gains purification.

Regardless of the method you choose, it's essential to make a reasonable effort and ask Allah for forgiveness.

Where to donate your haram earnings

A common question that comes up when purifying your investments is where you should donate the money.

It's essential to remember that purification money does not earn any reward, nor does it count towards your annual zakat obligations; it should be disbursed separately as voluntary charity (sadaqah). However, as the Prophet (PBUH) has mentioned in a hadith reported by Ibn Ḥibbān from Abu Huraira:

Whoever gathered impermissible wealth then gave it in charity will have no reward for doing so and its sin will be upon him.

As this hadith emphasizes, purifying our wealth is a necessity, not a deed that earns us reward.

So, where should this money go? Here are a few suggestions:

- Public welfare initiatives: Consider donating to projects that benefit the community at large, such as building roads, parks, and libraries.

- Supporting the poor and needy: Charities that focus on helping the poor, hungry, and homeless in your area are good options.

- Zakat-eligible causes: Although the purification money doesn't count as zakat, it can be directed towards any of the eight approved categories of zakat recipients. These include the poor, needy, zakat administrators, new Muslims, those in prison, debt relief, supporting the stranded traveler, and spending in the cause of Allah.

Before you donate, make sure to conduct due diligence to ensure the receiving organization is reputable and will use the funds responsibly. It's also recommended to maintain a record of the purification amounts you donated for personal reference.

الخاتمة

Halal investing is not solely about selecting shariah-compliant stocks. It is a commitment to safeguard the integrity of your rizq. By understanding the different purification methodologies and implementing them regularly, you can ensure your wealth remains free of any haram elements.

زويا: تطبيق الاستثمار الحلال

تجعل Zoya الاستثمار الحلال سهلاً من خلال مساعدتك في بناء محفظة استثمارية متوافقة مع الشريعة الإسلامية ومراقبتها بثقة ووضوح.