Is Betting on Presidential Elections Halal or Haram?

With the rise of new investment tools, election markets have emerged as a popular, high-stakes way for individuals to “bet” on the outcomes of major political events, such as the U.S. presidential election. Platforms like Robinhood, Kalshi, and Polymarket allow users to purchase event contracts—financial instruments that pay out based solely on the occurrence of a specific event, in this case, whether a particular candidate wins or loses. While these markets are making headlines and attracting widespread interest, their permissibility from a Shariah perspective remains a significant concern.

Election markets operate as a direct form of gambling, with users taking on financial risk purely for the chance of profit based on an uncertain outcome. This is a clear example of maysir, an Arabic term for gambling or games of chance, which is strictly prohibited in Islam.

Maysir refers to any activity where a person risks their wealth on an uncertain outcome in hopes of gaining more wealth. The winner gains at the expense of the loser, without either party providing fair compensation or undertaking productive effort. This type of transaction is emphatically prohibited in Islam.

Allah says in the Quran:

They ask you about wine and gambling. Say: "In them both lies grave sin, though some benefit, to mankind. But their sin is more grave than their benefit." (2:219)

Shariah principles encourage fair, ethical, and productive investments, and gambling-based markets stand in direct opposition to these values. In this article, we’ll break down how election markets work and explain why they fall under the category of maysir.

What are election markets?

Election markets allow individuals to place financial bets on the outcomes of political events. These markets are made possible through a new asset class called event contracts, which give investors the ability to trade directly on their opinions about a specific yes-or-no question. For example, through Robinhood's election market, users can purchase contracts on which candidate will win the 2024 U.S. presidential election. Each contract has a set payout, typically $1, which users receive if their prediction is correct.

The pricing of these contracts fluctuates based on demand and perceived probabilities. For instance, a contract for a particular candidate might sell for $0.45 if the candidate’s chances are seen as low, or $0.57 if the likelihood is higher. Buyers profit when the outcome they bet on comes true, as the contract then pays out at $1, while the initial price they paid is generally lower. Conversely, if their prediction is incorrect, they lose their initial investment.

Event contracts like these differ fundamentally from traditional investments. They offer no ownership stake, equity, or claim on any underlying asset and exist solely to facilitate bets on future events. This makes them purely speculative and inherently risky, as users are essentially wagering on outcomes they cannot control or influence. Islamic law sees such transactions falling squarely under the prohibition of maysir because they involve taking financial risk purely for speculative gain.

How election markets constitute maysir

In Islamic finance, maysir refers to any transaction that involves gambling, or taking unnecessary financial risks purely for profit. Unlike conventional investments, which channel capital into productive assets like businesses or property, maysir offers no inherent value creation. It relies entirely on chance and uncertainty, which leads to profits or losses based solely on the outcome of an event.

Election markets are a clear example of maysir. Here’s why:

- Risk without productive purpose: In election markets, users wager money on outcomes with no tangible return or productive value. There’s no underlying asset, service, or benefit being generated from these transactions. This contrasts sharply with Shariah-compliant investments, which must contribute to genuine economic growth and development.

- Profit based on uncertain events: The profitability of an election contract depends purely on the occurrence of an unpredictable event. Participants have no control over the political outcome they are betting on, making it entirely a matter of chance rather than informed, value-driven investment.

- Encourages speculative behavior: Election markets attract participants not because of any intrinsic value in the contracts themselves but because of the speculative opportunity to “win” against the odds. This emphasis on speculation rather than economic productivity directly opposes the principles of Islamic finance, which promote financial stability and societal benefit over risky, unproductive gains.

By placing financial gains in the hands of pure chance, election markets mirror the dynamics of gambling. Islamic finance seeks to avoid such speculation, encouraging investments that are stable, ethical, and beneficial to society. Election markets, however, foster the opposite: high-risk speculation with no value-added contribution, categorically marking them as a form of maysir and therefore non-compliant with Shariah.

Conclusion

While election betting markets may offer insights into public sentiment and political trends, the core activity of wagering on uncertain political outcomes for profit falls squarely within the Islamic definition of gambling. Therefore, directly participating in these markets is not permissible and should be avoided.

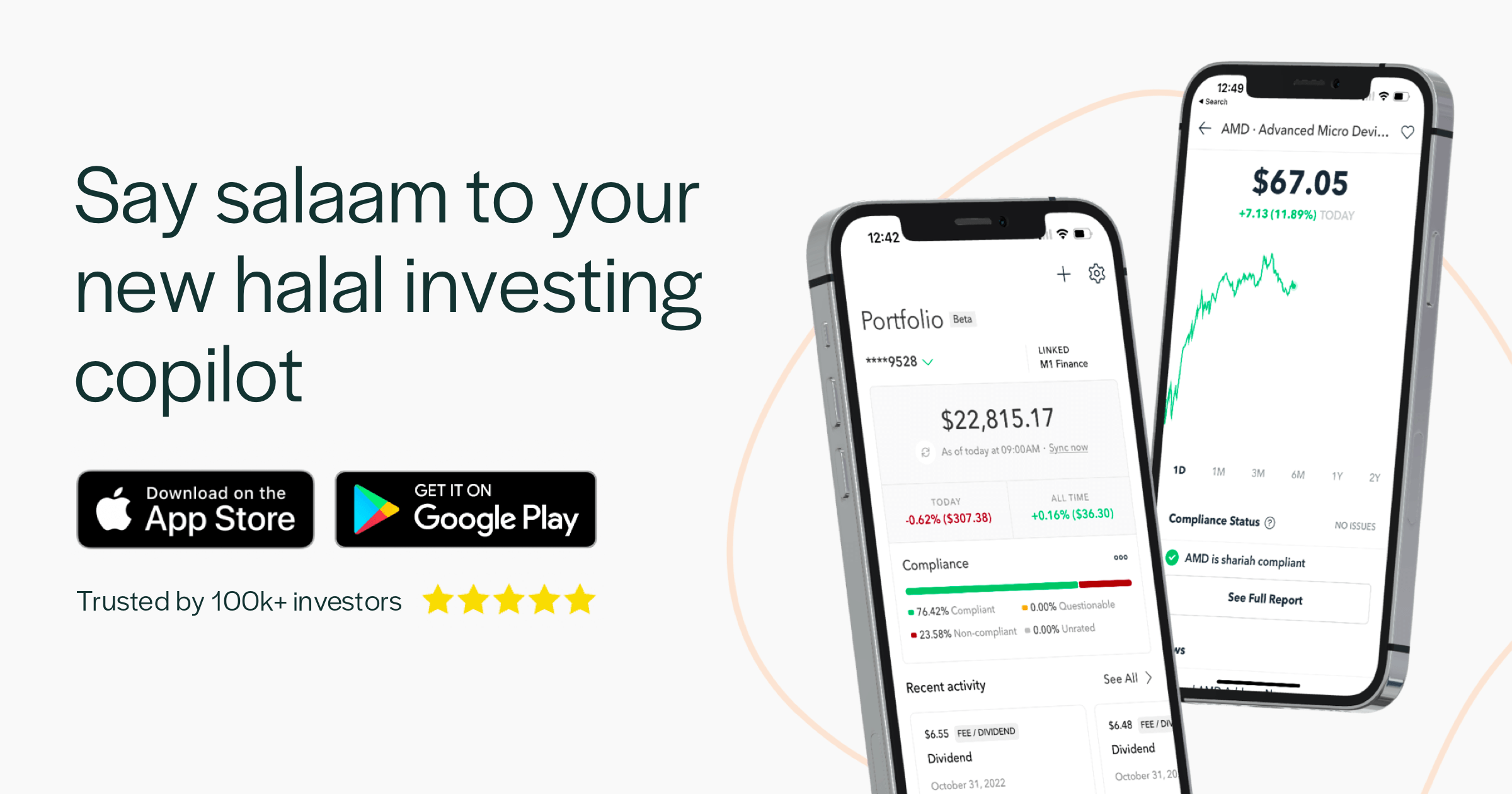

Zoya: Halal Investing App

Zoya makes halal investing easy by helping you build and monitor a shariah compliant investment portfolio with confidence and clarity.