Is My 401(k) Plan Halal?

A note to the reader: In this article, I will be using the term “401(k)” for the sake of simplicity. This article will also apply to you if your employer offers you a 403(b) or a 457 plan. The terms and conditions of these types of accounts are very similar.

I can’t tell you how many times I’ve heard Muslims say something along the lines of “Oh, yeah – I’m not contributing to my 401(k). I don’t know if it’s halal so I’d rather not”.

As a financial coach, I cringe when I hear that statement because there are so many wonderful perks to contributing to your employer’s 401(k) plan that you simply don’t have access to otherwise.

On the flip side, I also hear Muslims telling me they are invested in their company’s 401(k) plan, but they’re not monitoring whether the investments are halal. Both positions are extreme and must be met halfway, which is the beauty of our faith.

Do I really need a 401(k)?

In short - yes. You need a 401(k) because you can’t rely on Social Security alone during retirement. I wrote an in-depth article on why here, but in a nutshell, you need to be investing for retirement outside of Social Security because it’s not enough. You will need a large nest egg (think $1M+) to cover your expenses in retirement when you won’t have income coming in.

Furthermore, employers in the US don’t force you to contribute to the retirement plans they offer you – it’s all voluntary. If you don’t take deliberate action yourself to invest for retirement, you might find yourself without resources come retirement time – which is definitely a situation you don’t want to find yourself in.

Beyond that, 401(k) plans come with two main perks that employees should be excited about:

Perk #1: Tax advantages

- Any amount you contribute to a traditional 401(k) plan is pre-tax money. This means that amount is deducted from your income, thereby reducing your taxable income today. It’s a great hack as it could result in landing you in a lower tax bracket. You end up paying taxes on the amount you withdraw annually in retirement. For example, if you have a $1M pre-tax nest egg in retirement inside your 401(k), and you withdraw only $50,000 from it annually, you get taxed on the $50,000 only (as well as other sources of income you may have.)

- You are protected from paying capital gains tax if you choose to buy and sell investments within the account through the years.

Perk #2: Employer matching/profit-sharing

Your employer may offer you free money through your 401k plan. This usually can come in two forms:

- Matching: Your employer will match what you contribute to your plan up to a certain percentage (e.g. your employer will match 100% of your contributions up to 3%).

- Profit-sharing: Your employer will offer you a one–time annual contribution at the end of the year, based on their profits for the year.

That all sounds wonderful, right? The only problem is that the investment options within a 401(k) plan can be limited, and might not have a halal option. Usually, unless you elect to change your investment options yourself, your employer’s plan will have you investing into a default fund that often has interest-bearing investments (bonds), companies that are not shariah compliant, or worse yet - both.

So, what do you do? Let’s explore some of your options.

Option #1: Request a Self-Directed Brokerage Account (The ideal solution)

Some companies offer what is called a Self-Directed Brokerage Account (SDBA). This option allows you to customize your 401(k) by giving you the flexibility to choose your own investments. You will have to reach out to HR to find out if this option is offered. If it's available to you, just ask them to set it up.

As money is taken from your paycheck and deposited into this account, make sure you take the time to actually invest it. Otherwise, it will just sit there as cash.

Here is a list of Shariah-compliant ETFs and mutual funds available in the US that you should be able to choose from.

Shariah-compliant mutual funds

- ADJEX: Azzad Ethical Fund

- AMAGX: Amana Growth Fund

- AMANX: Amana Income Fund

- AMDWX: Amana Developing World Fund

- AMAPX: Amana Participation Fund

- IMANX: Iman Fund

- WISEX: Azzad Wise Capital Fund

- SPTAX / SPTMX: The SP Funds 2030 Target Date Fund

- SPTBX / SPTNX: The SP Funds 2040 Target Date Fund

- SPTCX / SPTOX: The SP Funds 2050 Target Date Fund

Shariah-compliant ETFs

- HLAL: Wahed FTSE USA Shariah ETF

- SPRE: SP Funds S&P Global REIT Sharia ETF

- SPSK: SP Funds Dow Jones Global Sukuk ETF

- SPUS: SP Funds S&P 500 Sharia Industry Exclusions ETF

- SPWO: SP Funds S&P World (ex-US) ETF

- SPTE: SP Funds S&P Global Technology ETF

- UMMA: Wahed Dow Jones Islamic World ETF

Option #2: Identify the fund with the least exposure to impermissible holdings (The band-aid solution)

If the self-directed brokerage account isn’t an option for you, then the alternative is to choose the fund with the least number of impermissible holdings and then purify your earnings from the impermissible portion. This is a better option than foregoing your employer’s plan altogether so you can still take advantage of the perks mentioned earlier.

Most of the default options offered in your 401(k) are going to be stock/bond ETFs or mutual funds and are only going to list the top 10 holdings within the fund out of potentially hundreds of holdings. This is what makes it difficult to go through each stock in the fund.

So what we can do is the next best thing; we look at sectors in which the fund is invested. If you see that your fund has bonds or “fixed income,” you can automatically count those as impermissible. If you see “defense” or “financial” sectors, you can automatically assume those are impermissible as well. The “consumer goods” sector is mixed, so you can go with the assumption that a third to a quarter of it is impermissible.

Once you identify a fund with the least exposure to impermissible sectors, you'll then need to cleanse your earnings from the portion that is impermissible by way of purification. For example, if 20% of the fund is invested in the financial sector, you’ll have to purify 20% of your profits (Islamic Finance Guru, n.d.).

If you aren’t comfortable with these assumptions and would like a more accurate reading, Zoya’s Fund Screener is a great tool to use to help you screen which fund is the most shariah compliant within your 401(k). Zoya uses the standards set by the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) to screen the fund’s underlying assets and help us know how much of each fund is compliant, questionable, or non-compliant. Let’s look at two real-life examples of funds you might find in your 401(k).

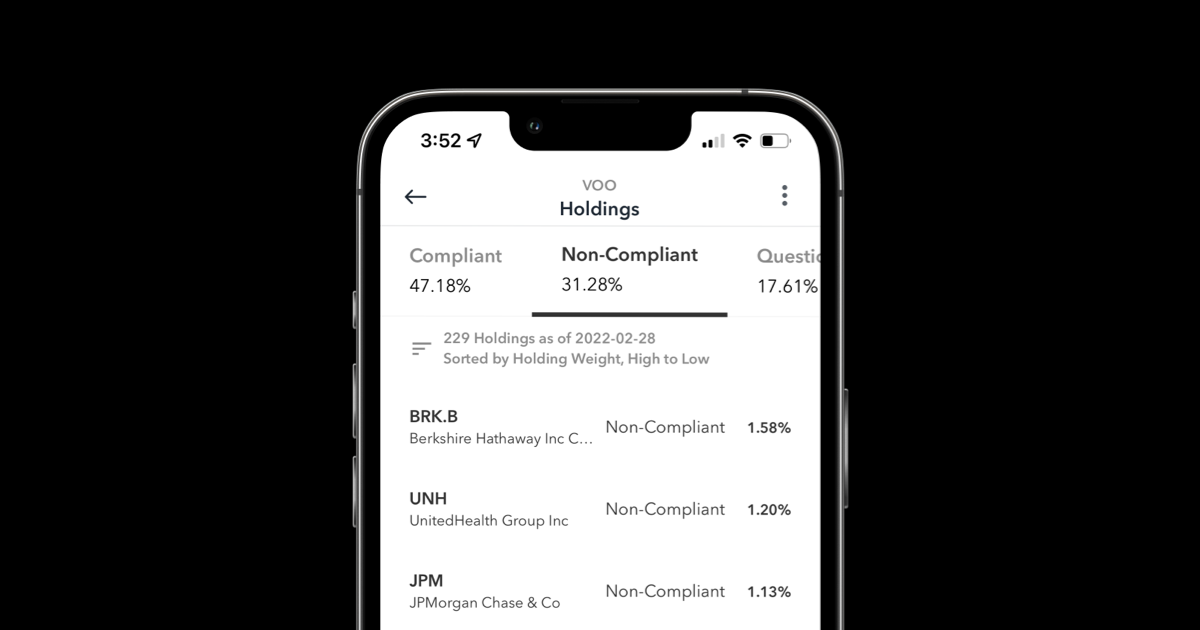

Example #1: Vanguard S&P 500 ETF (VOO)

This Vanguard fund tracks the S&P 500 index which consists of the top 500 companies in the US. Any ETF or mutual fund that tracks the index will include those companies found within the index. According to Zoya, approximately 31% of the fund consists of companies that do not pass shariah compliance.

Now, let’s look at a better example.

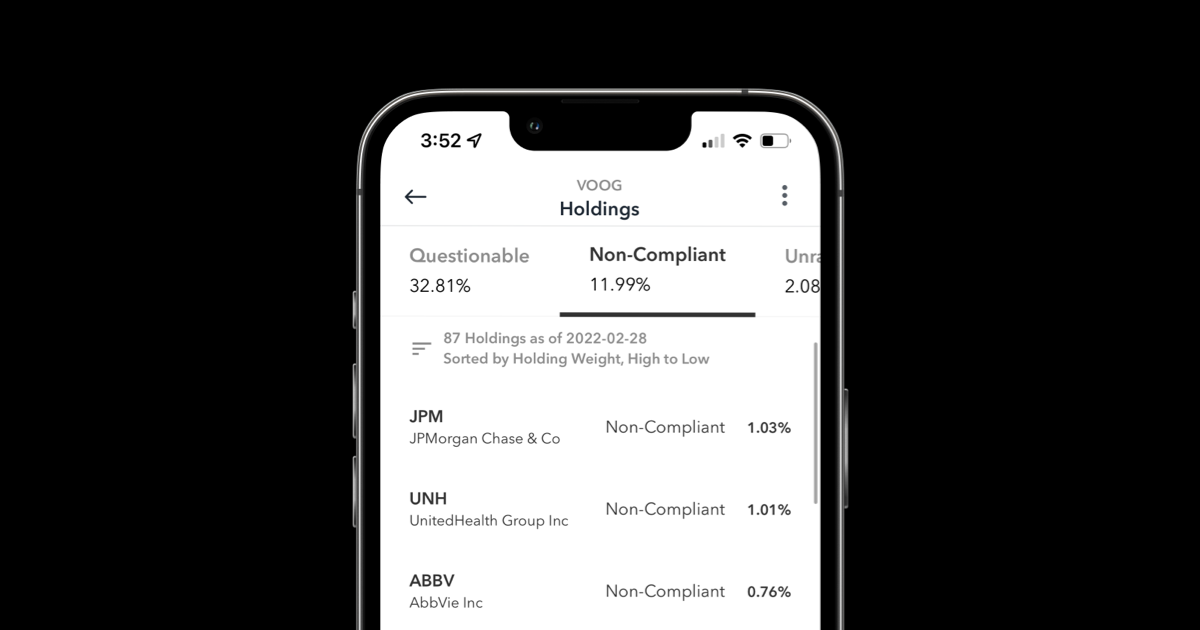

Example #2: Vanguard S&P 500 Growth ETF (VOOG)

This fund by Vanguard consists only of companies with growth characteristics from the S&P 500 index. According to Zoya, approximately 12% of the fund holdings are non-compliant which makes it a much better option when compared to VOO.

Bonus: How to advocate for a Self-Directed Brokerage Account

While investing in a fund with the least amount of impermissible holdings is a viable option, it should only be treated as a temporary fix and you should think about moving to a more ideal situation very quickly.

Sheikh Joe Bradford, one of the shariah advisors for Zoya and a renowned Islamic finance expert, often mentions that Muslims shouldn’t agree to things that are morally questionable and not in line with our values. This definitely applies if something isn’t available to us at work, like a prayer room.

Luckily, it’s not that difficult for workplaces to offer an SDBA option. However, it does require some advocacy. You and other Muslims in your workspace can collectively advocate for your employer to offer an SDBA as a form of religious accommodation. You won't get what you want until you ask for it.

Below are some practical tips to help you advocate for this option at work. And yes, you can do this even if you are the only Muslim at your workplace.

- Make dua. At the end of the day, you are doing this for the sake of Allah (SWT) and tawfiq can only come from Him. Ask Him for guidance and help during this process.

- Identify the other Muslims in your workplace and compile a roster with names, emails, positions, and departments. Whether that’s through Jummah (if it’s held in your workplace) or through asking around, make sure you include everyone who wants to be included in this initiative. There is strength in numbers.

- Assign someone to lead this initiative (or take leadership yourself) and send out a collective email to HR and your 401(k) plan administrator requesting this option. Make sure everyone on the roster is copied on the email. Check out a sample email template below.

- Apply frequent pressure. The initiative leader should send HR a follow-up email if they are unresponsive or slow to respond and should ask for an update every 2-3 months.

Sample SDBA Advocacy Email Template

Dear [HR Maager & 401(k) Plan Administrator],

I hope you’re well. My name is [your name] and I work as the/a [your position] at [company name].

I’m sending this email on behalf of myself and my fellow Muslim colleagues, who are all cc’d here. We’re reaching out to you to request that you offer the 401(k) Self-Directed Brokerage Account (SDBA) as an option within your 401(k) plan as a form of inclusivity and religious accommodation.

As Muslims, we have a strict ethical code of conduct we adhere to. This not only applies to how we dress, what we eat, and how we pray, but also to how we invest our money. Muslims subscribe to what’s called halal investing, which is a strict form of ethical investing. Halal means permissible in Arabic, and is typically the word that guides many Muslims in how they conduct their affairs (think of halal meat/food, similar to kosher). Halal investing avoids industries and businesses that are not aligned with Islamic values and those that cause harm to society. Most of the current investment options that exist in the 401(k) plan at [company name] are not halal. This discourages many Muslims from participating in [company name] 401(k) plans, which they are entitled to as part of their benefits package.

As you may know, the SDBA option will allow employees to participate in [company name] 401(k) plan and will provide them the flexibility to choose their own investment options. This would be an ideal situation for [company name] Muslim employees because we can choose the halal investment options that work for us. [If your company has a diversity & inclusion statement/mission, appeal to it here]. As part of [company name] commitment to [include quote from diversity & inclusion statement], providing the SDBA option will allow your Muslim employees to feel included, supported, and accommodated, as they will not need to sacrifice their religious beliefs to participate in and benefit from their retirement benefits.

SDBAs are becoming increasingly popular year by year. More than 40% of employers in the US are offering this option (Pastor, 2021), including top workplaces such as Amazon, Google, and Meta (previously Facebook). SDBAs are a good option to offer your employees as they allow employees to invest according to their values and to manage their portfolios as they see fit (Carosa, 2022). It usually doesn’t cost companies too much extra to offer the SDBA option (Umpierrez, 2021). We’re attaching a few articles for you to look at that talk more about the SDBA option.

We would appreciate it if [company name] accommodated our request. As it stands, some of us are currently choosing not to participate in the 401(k) plan offered to us because we wouldn’t be able to participate in a way that is aligned with our faith. We hope our request will be considered so that we can comfortably participate and fully maximize our retirement benefits.

We look forward to hearing from you soon and will follow up accordingly.

Sincerely,

[Your name and everyone else’s name on the roster]

Conclusion

Keep in mind that you may face some resistance, initially. Just have faith and keep trying. This is especially pertinent if you are the sole Muslim in your workplace. At the end of the day, if your company is truly unwilling to change or offer that option, you might want to consider changing jobs to one that is more inclusive and accommodating. Even if you leave your position, you can leave knowing that you planted the seeds for the Muslims that come after you, and those seeds might bloom later, insha'Allah.

Updated December 2024 to include new Shariah-compliant ETFs and mutual funds.