6 Prinsip Islam untuk Mencapai Kesejahteraan Kewangan

We live in a world that is consumer-driven, fast-paced, and ever-evolving. It can be easy to get caught up in chasing wealth and material possessions and lose sight of our true purpose as Muslims. The teachings of Islam provide us with a blueprint to help us navigate the balance between faith and financial well-being. This article will explore the principles and attitudes derived from Islamic teachings that promote a balanced approach to financial well-being.

Drawing inspiration from the research paper titled "Psychology of Wealth: An Islamic Perspective on Personal Finance," published by the Yaqeen Institute for Islamic Research, we will delve deeper into Islamic perspectives on personal finance.

#1. Understanding wealth from an Islamic perspective

As human beings, we were designed to have an exceptional love for wealth. Allah informs us of this in the Qur’an, and the Prophet (PBUH) warns of the responsibilities of having an abundance of wealth and misusing it. In Islam, we believe in rizq, which is sustenance provided by Allah. This rizq is both a means for us to provide for ourselves and our families and also a test from Allah that can either bring us closer to Him or lead us astray.

Muslims are encouraged to view their wealth through the lens of Islamic teachings, which emphasize the importance of using one's resources to benefit others and pursue spiritual growth. This perspective, grounded in the concept of rizq, encourages individuals to maintain a sense of gratitude and humility regarding their wealth and recognize that, ultimately, all wealth belongs to Allah.

We are taught to have a balanced approach when it comes to wealth. It can be easy to be consumed by the need to provide for oneself, but ultimately, it is Allah who provides. Focusing solely on earning for this life will result in financial anxiety, whereas earning for the hereafter will lead to financial contentment.

#2. The importance of halal earnings and ethical spending

As Muslims, we aim to live our lives according to Islamic principles, this extends to our earning and spending. It is vital that what we earn and spend are permissible within the bounds of Islam. We are told to steer away from haram sources of income, such as interest, gambling, and illicit trade, and are taught to engage in ethical and responsible consumption.

When it comes to spending, stinginess and excessive spending on oneself have no place in Islam. It is important that we spend moderately and give a portion of our wealth to our family and a portion to charity. With the right intention, this can be classed as a type of charity.

#3. The role of charity

Charity is vital to a flourishing Islamic economic system. This is shown as one of our five pillars, zakat, which is a compulsory charity. The beauty of this system is that when you give charity, both the receiver and the giver benefit. Giving away money with the right intention helps develop a sense of empathy, compassion, and gratitude.

Muslims are encouraged to not only give zakat but also voluntarily give charity (sadaqah), with the understanding that charity does not decrease wealth but serves to purify and multiply one's wealth. The act of giving away money that we have earned can act as a protection from the negative consequences of wealth, such as arrogance and materialism.

#4. The need for investing

To invest is to purchase assets that will increase in value over time. As Muslims, living in this world, it is important to invest our wealth productively, and shariah-compliant investing is encouraged. Let’s say you have $15,000 in the bank for one year. That money is subject to inflation, and you would also have to pay zakat on it. So a year later, your $15,000 would be worth $14,025 (based on an average inflation rate of 4% and 2.5% of zakat). Money not utilized productively will devalue over time. Hence, it is crucial that we put our money to use, even if, at most, we wish to just maintain our wealth.

Islam puts focus on putting our wealth in halal investments to safeguard our wealth. By increasing our wealth, we are able to spend more on our families and communities and give more in charity–ultimately leading to investing for our akhirah.

#5. The concept of barakah

At the center of Islamic finance is barakah, or divine blessings. Barakah can make our wealth more productive, efficient, and valuable. By seeking halal income and spending opportunities, Muslims can attract barakah into their lives and experience greater satisfaction, fulfillment, and success in their financial endeavors.

Barakah refers not only to the quantity of wealth but also to the quality and influence of that wealth. Barakah can appear in many forms, such as meeting one's needs with a modest income, being content with one's possessions, or seeing one's wealth positively affect others. The key to attracting barakah is to follow Islamic principles in all aspects of financial life, from income to spending and everything in between.

#6. Abundance over scarcity

A scarcity mindset and poverty can affect a person's perspective on wealth, causing them to believe that there is not enough for everyone. This leads to a diminished financial well-being and poor financial decisions. The Qur’an describes scarcity and abundance as opposing sources that lead to immoral or moral financial behavior, respectively.

The Prophet (PBUH) advised making downward social comparisons to feel blessed and grateful for one's blessings and avoid the scarcity mindset that leads to stinginess. As Muslims, we are warned against looking to the wealthy as a reference point and reminded that their wealth is a test from Allah that should not be desired.

Conclusion

Islamic teachings on personal finance offer a comprehensive and balanced approach to wealth management that promotes both material success and spiritual growth. We are taught to understand wealth from an Islamic perspective, focus on halal income and ethical spending, prioritize philanthropy, pursue barakah, and balance material and spiritual aspirations. Wealth and healthy relationships can be built on faith.

By incorporating these principles into our economic lives, we can use these resources to benefit ourselves, our families, and society as a whole, while also being successful in the hereafter and experiencing greater satisfaction and fulfillment. Additionally, these principles serve as valuable guides for those seeking a more holistic and ethical approach to personal finance, regardless of religious background.

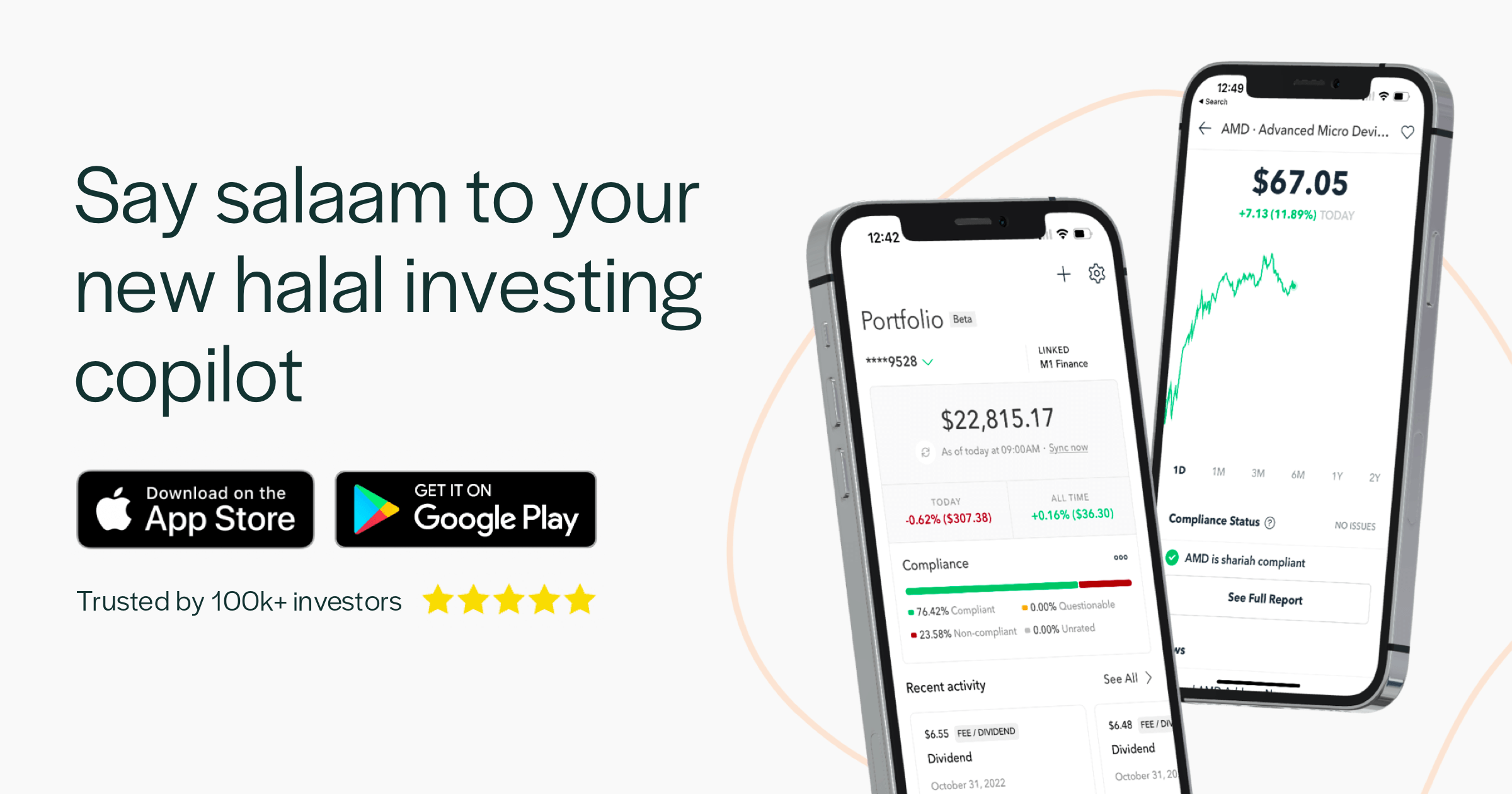

Zoya: Aplikasi Pelaburan Halal

Zoya memudahkan pelaburan halal dengan membantu anda membina dan memantau portfolio pelaburan patuh syariah dengan yakin dan jelas.