The Complete Guide to Building Your Own Halal Index Fund

Inflation is here and has already eroded the purchasing power of your money. The price of many essential goods and services has increased, straining the pursestrings of households everywhere. In times like these, preserving the value of your money is paramount. A tried and tested strategy is investing your money in assets that can preserve and grow your wealth.

Yet many new investors struggle to find the right investments. Invest incorrectly, and you can end up worse off than when you started.

"The first rule of investing is don’t lose money. And the second rule of investing is don’t forget the first rule." - Warren Buffett

Investing in index funds is widely seen as one of the most suitable choices for everyday investors. This is mainly due to the diversification benefit as index funds are typically comprised of dozens of different companies, which can protect you from the bad performance of a few stocks.

However, Muslim investors are excluded from most index funds as they often contain impermissible investments. The few remaining Shariah-compliant funds don't offer much choice. This article will address how Muslims can construct their own index fund and how to practically action this in a low-cost manner.

What are index funds, and why do they matter?

The most common way to invest is to invest in funds. A fund consists of a pool of money from various investors allocated for a specific investing purpose. Funds either track an index (group of stocks such as the FTSE 100) or follow a particular theme (e.g., space exploration or eSports stocks).

Funds can be either passive or actively managed. Passive funds aim to track the performance of a particular market or index. It’s akin to adopting a buy and hold strategy, and as a result, they have low fees due to the lack of oversight.

Actively managed funds are funds where the fund manager actively tries to outperform the market. Active funds will have higher fees as more oversight is required, and you are paying a premium for the fund manager’s expertise. There will also be more trading activity as the fund manager rotates in and out of investments, resulting in greater transaction costs.

Exchange-traded funds (ETFs) are a low-cost alternative to traditional funds. These are funds traded on a stock exchange (such as the New York Stock Exchange or the Nasdaq). Thus they are more accessible and liquid (can be converted to cash easily) than traditional funds. ETFs are popular as they are a great way to get passive exposure to many different companies at a low cost.

Index funds are important because picking stocks to invest in on your own can be a risky endeavor. It requires expertise and time to analyze individual stocks adequately. Having too few stocks leaves you more exposed if your stocks don’t perform well. Research has shown that most stocks underperform and that the stock market’s overall gain has come from a small minority of stocks that have tremendously outperformed. Between 1990 and 2018, roughly 75% of the wealth created by the stock market was due to the performance of just 0.5% of all stocks.

This is why experts such as Warren Buffet recommend that individual investors invest in index funds instead of picking single stocks. Funds provide you with instant diversification, which is when you allocate your capital across many different investments. This can reduce your risk, which we’ll cover more below. In summary, funds can save you time and provide you with a diversified portfolio at a low cost.

The problem with existing index funds for Muslim investors

Muslim investors face some critical challenges in the current index fund market.

Most index funds are not 100% halal

As Muslims, we must invest our money in a halal manner. Thus, a fund must be comprised of shariah-compliant companies. In short, you need to ensure that each company's primary activities are halal and that their financial behavior is also within permissible limits.

Yet, most stock funds will contain stocks that are not Shariah-compliant. For example, the S&P 500 index tracks the 500 largest public companies in the US and is widely used as a benchmark for the stock market. Unfortunately, it is exposed to many impermissible industries such as financial services that deal in prohibited activities such as interest. For example, it includes companies such as the Bank of America and JPMorgan.

Shariah-compliant options are limited (and expensive)

Thankfully, there are a few Shariah-compliant ETFs and mutual funds available that have been certified by scholars. Here is a list of some of them:

- SP Funds S&P 500 Sharia Industry Exclusions ETF

- SP Funds S&P Global REIT Sharia ETF

- SP Funds Dow Jones Global Sukuk ETF

- Wahed FTSE USA Shariah ETF

- Wahed Dow Jones Islamic World ETF

- iShares MSCI USA Islamic UCITS ETF

- iShares MSCI World Islamic UCITS ETF

- iShares MSCI EM Islamic UCITS ETF

- Wealthsimple Shariah World Equity Index ETF

- Almalia Sanlam Active Shariah Global Equity UCITS ETF

- HSBC Islamic Global Equity Index Fund

- Schroder Islamic Global Equity Fund

- Amana Mutual Funds (Growth - Income - Developing World - Participation)

- Oasis Crescent Funds

However, the number of options available is paltry compared to the 120k+ funds available worldwide. There is also a lot of overlap between the different options leaving little choice for Muslim investors.

The available halal ETFs aren’t as diversified as their conventional counterparts. Let’s take a look at the SPUS ETF. It aims to track the S&P 500 minus the impermissible holdings, which leaves it with just 215 companies. It has an almost 50% allocation to the technology sector, of which roughly 23% alone is invested in Apple and Microsoft. Meanwhile, the S&P 500 only has a 27% allocation to the technology sector. This makes sense given that they have stripped out the impermissible industries such as financial services and gambling. Unless you’re a big fan of technology, this level of diversification may not be satisfactory.

These ETFs also have higher fees than their mainstream counterparts. When evaluating ETFs, you want to pay attention to their total expense ratio (TER). The TER covers all annual management, trading, and admin fees charged by the ETF. The above Shariah-certified ETFs have TERs of 0.5%, which is larger than the ETF industry average of 0.24%. One of the most popular ETF providers, Vanguard, has an average expense ratio of 0.06%, a fraction of the fees charged by the Shariah-certified ETFs.

This makes sense, given mainstream ETFs have greater purchasing power (more customers and capital). Shariah-certified ETFs also have limited competition, so they don’t have to compete as aggressively on fees. However, it’s not ideal for Muslim investors to endure these greater charges.

Despite the availability of Shariah-compliant funds, Muslim investors need more choices.

How to build your own halal index fund

In order to combat these challenges, let’s explore two ways you can build your own halal index fund.

1. Mimic existing funds minus the haram holdings

You could take an approach similar to what the SPUS ETF did. This involves taking an established ETF or mutual fund and stripping out the haram holdings. Some existing ETFs don’t have a large percentage of non-compliant stocks, so they wouldn’t require much intervention.

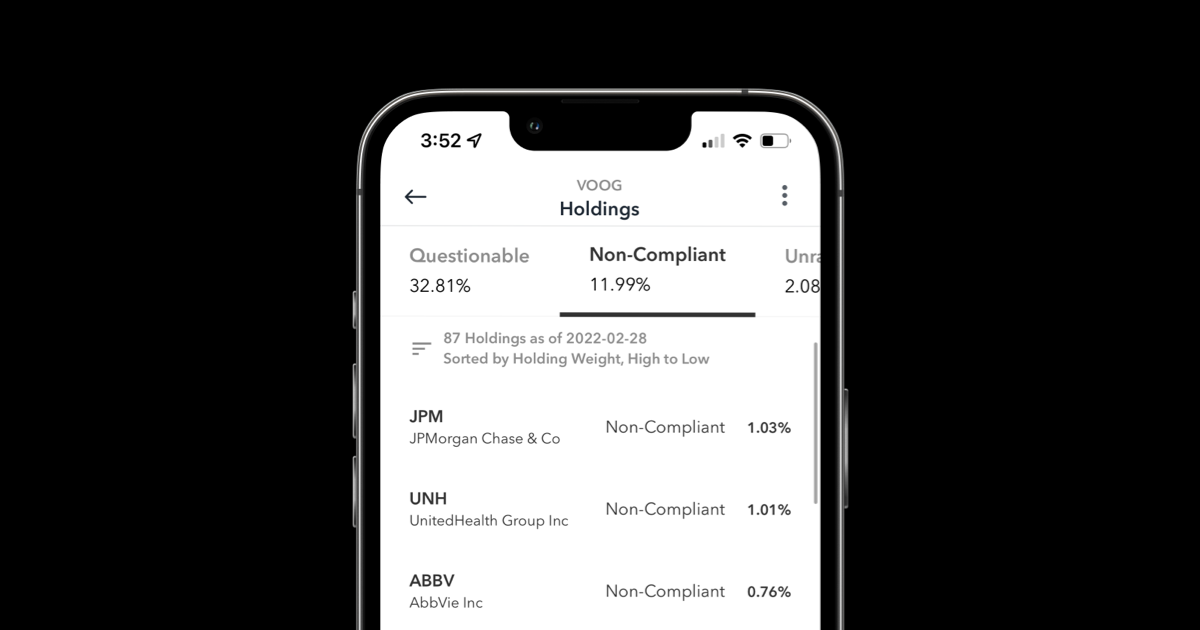

However, manually going in and evaluating the Shariah compliance of all the holdings in a fund would be impractical. This is especially true when funds can consist of hundreds or even thousands of holdings. This is where you need an automated solution that uses technology to do this for you efficiently and cheaply. The Zoya app can do this for you by filtering fund holdings based on their Shariah compliance. You can even boost this strategy by filtering multiple funds to get your desired level of diversification.

Halal Stock Screener and Portfolio Tracker

Zoya makes halal investing easy by helping you build and monitor a shariah compliant investment portfolio with confidence and clarity.

2. Build one from scratch

Alternatively, you could build your own from scratch according to your individual preferences. When doing this, you want to ensure that you are appropriately diversified. You can achieve this in two ways.

Firstly, you want to have the right number of stocks. Too few, and your portfolio could be over-concentrated. Too many, and you lose the benefits of diversification. You could be diluting your returns by having too many stocks and not focusing on your high conviction ideas.

So what is the right number of stocks? This topic is hotly debated. Benjamin Graham, considered the "father of value investing," suggests that between 10 and 30 stocks could be right, with the exact number dependent on your investing style and your comfort levels. If you’re a beginner, you should aim for a larger number of stocks. This will allow to test your investing skills and avoid over-concentrating too early.

You also ideally want a good mix of different industries that are uncorrelated to each other. For example, health and technology stocks are good examples of uncorrelated stock classes. If technology faces a downturn, this should have little effect on how healthcare stocks perform.

You also want to manage your risk appetite when constructing your portfolio. A way to do this is to strike an appropriate balance of conservative, moderate, and aggressive growth options. For example, you may construct your fund using the following breakdown:

- 25% in conservative stocks such as Procter & Gamble, who are behind household brands such as Pampers and Febreze

- 40% in moderate blue-chip (established and well-regarded) companies such as Microsoft or Amazon

- 30% in aggressive growth stocks such as Etsy and AMD

- 5% in highly aggressive investments. For example, young companies that are entering new markets, such as Virgin Galactic, who are trying to solve space tourism

This strategy still contains more risk than investing passively as you are selecting individual stocks. Still, you can mitigate this by ensuring you have a similar diversification to an index fund. Your risk preferences may change over time, so you could change the weights you assign to these buckets.

Maintaining your portfolio

The job isn’t done once you have created your index fund. There are several ongoing maintenance tasks that Muslim investors need to keep in mind.

Monitoring for shariah compliance

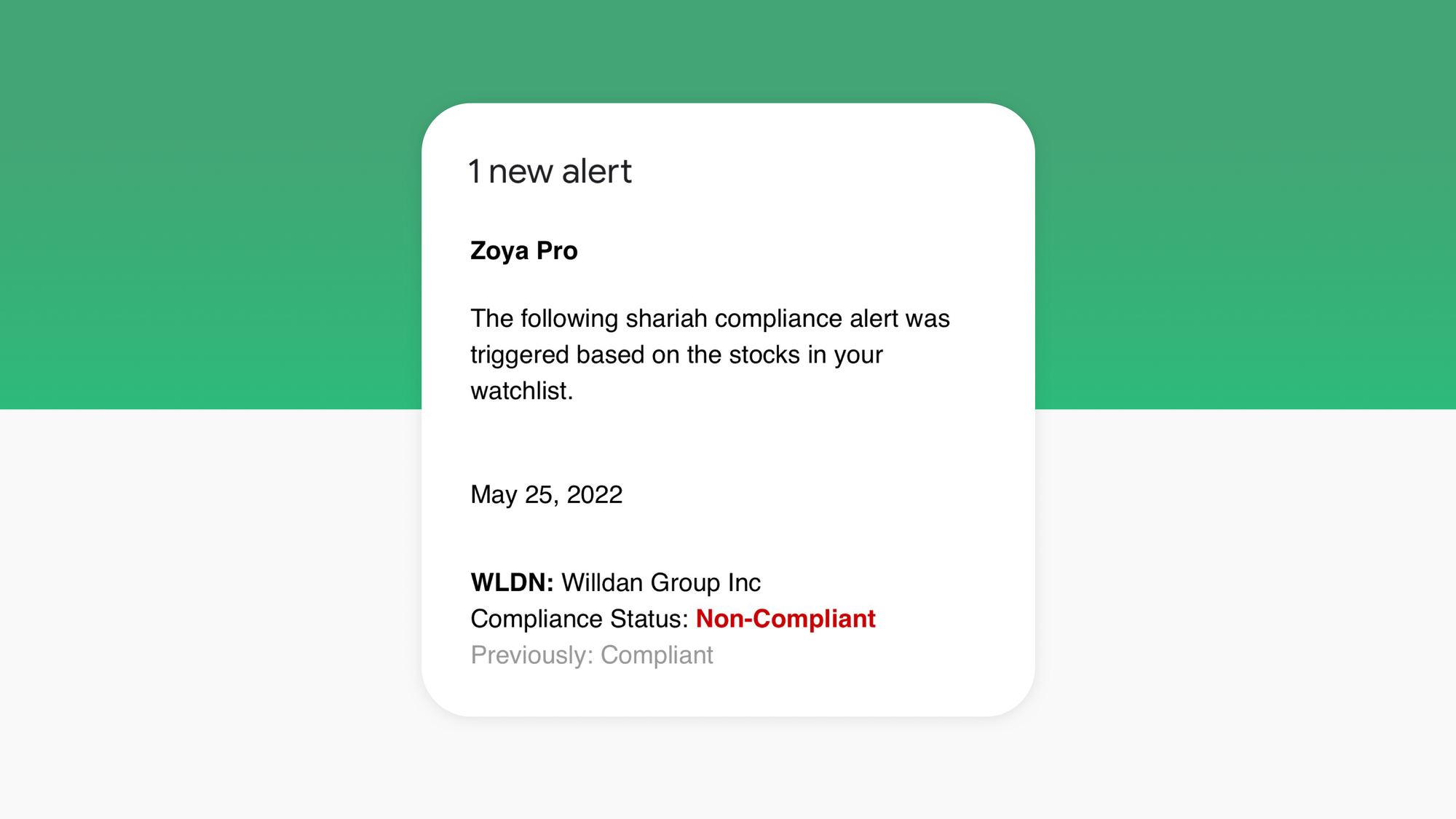

The Shariah compliance of companies has to be periodically reviewed. Companies may change their financial behavior in such a way as to make them non-compliant (i.e., ramping up the amount of interest they deal with) or by starting to engage in impermissible activities. Therefore you need to keep an eye on your fund and potentially update the holdings if the Shariah compliance changes. An easy way to do this is to use the Zoya app. You can set automatic alerts to notify you when the compliance rating of your stocks changes.

There are differing views on what you should do if one of your holdings becomes non-compliant. One view is that you sell it immediately, whereas another allows you to hold it for a grace period of 90 days (a financial quarter) to see if the situation changes. If not, you would then need to sell and purify any gains made in the interim. For more guidance, consult a trusted scholar.

Rebalancing

As part of constructing your portfolio, you will be managing the weights (% allocation) of your holdings. You can either leave them as they are or change them as you see fit. Some investors like to double down on their winners and cut their losers. Or you may need to respond to exceptional events that affect your companies. Beware of making too many changes as historically, actively managed funds have underperformed compared to passively managed funds.

The key is to establish a plan and stick to it. This will protect you from making emotional decisions in times of crisis that could hamper your investing results.

How to automate your investing

One of the main advantages of investing in index funds is being able to invest in a basket of companies at a low cost and in a time-efficient way. Therefore, to practically retain these benefits, the best solution is to adopt semi-automated solutions offered by low-cost or zero-fee brokers.

Low-cost brokers either charge zero purchase fees or a very nominal amount compared to the big traditional brokers that charge roughly $10 per transaction. Some of these low-cost brokers also have a feature that allows you to create your own “pie” of stocks, i.e., you select all the stocks you want to invest in and allocate a percentage weight to each of them. You can then deposit money into that pie, and the broker will invest that money to your desired percentage splits.

Here is a list of providers that offer such a feature:

- Trading212 (Europe)

- M1 Finance (United States)

- For Canadian investors, there isn’t a great out-of-the-box solution at the moment. However, if you have a Questrade account, you can use a tool like Passiv to replicate the same features as M1 Finance and Trading212.

Conclusion

Index funds are a powerful option for everyday investors. They offer diversification at a low cost, helping you save time and manage your risk.

There are indeed Shariah-compliant ETFs available. However, if the current options don’t suit you, you can use the advice above to start building your own halal index fund.