Top Halal Dividend ETFs in 2026

If you’re building a halal investment portfolio and looking for passive income, you’ve likely run into a common problem: most halal ETFs don't offer high dividend yields. This is by design. Shariah screening removes many traditional high-yield sectors that rely on interest or carry excessive debt.

Still, that doesn't mean your portfolio has to be income-dry. There are a few specialized ETFs offer regular payouts while maintaining Shariah compliance.

This guide breaks down the best high-dividend halal ETFs for 2026, covering the top sukuk, real estate, and equity options that provide more than just long-term growth.

Why is it hard to find high-dividend halal ETFs?

Shariah-compliant investing avoids companies involved in interest, excessive debt, gambling, alcohol, and other prohibited sectors. This immediately disqualifies most classic dividend-paying stocks, such as conventional banks, insurers, and many utility companies.

The remaining companies are often in growth-focused sectors like technology, which tend to reinvest profits instead of distributing them as dividends. This results in lower yields across the board for most halal equity funds.

To find reliable income, you'll need to look at asset classes that are inherently cash-generative while still meeting Islamic criteria.

The three primary sources of halal ETF income

Most investors looking for income think about dividends from stocks. But in halal investing, the most dependable income comes from different sources. Let’s break down the three categories where Shariah-compliant ETFs can provide meaningful yield.

1. Sukuk ETFs

Sukuk are often called Islamic bonds, though technically they’re structured around asset ownership and profit-sharing instead of interest. For halal investors, they offer the closest alternative to conventional fixed-income investments.

Among sukuk ETFs, one option stands out for U.S.-based investors: SP Funds Dow Jones Global Sukuk ETF (SPSK).

SPSK holds a diversified portfolio of dollar-denominated sukuk issued by sovereigns, supranationals, and high-grade corporations. It offers monthly payouts and relatively low volatility, making it an excellent choice for conservative halal income seekers.

- Ticker: SPSK

- SEC yield: ~4.3%

- Payout frequency: Monthly

- Expense ratio: 0.55%

- Availability: U.S. listed on NYSE Arca

If you're looking for stable cash flow without the price swings of equity markets, SPSK is arguably the strongest halal ETF in that category.

Another solid option is the iShares $ Sukuk UCITS ETF (SKUK), with a slightly higher trailing yield of ~5.0%. However, it's a UCITS fund domiciled in Ireland. That means many U.S. brokerages don’t support it due to local regulatory restrictions.

- Ticker: SKUK

- SEC yield: ~5.0%

- Payout frequency: Semi-annual

- Expense ratio: 0.40%

- Availability: Ideal for international investors

If you’re investing from outside the U.S., SKUK offers strong yield with broad sukuk exposure. But for American investors, SPSK is the easier choice.

2. REIT ETFs

REITs (Real Estate Investment Trusts) generate income through rental payments. In many jurisdictions, they’re required to pay out a large portion of their earnings to shareholders. That makes them attractive for yield-focused investors.

However, not all REITs are halal. Many lease to conventional banks, casinos, or alcohol companies. Fortunately, one ETF screens them out: SP Funds S&P Global REIT Sharia ETF (SPRE).

SPRE offers exposure to a global basket of Shariah-compliant REITs. It pays monthly dividends and has shown a trailing 12-month yield of over 4%. That said, the 30-day SEC yield—a more accurate measure of ongoing income—is around 2.6%.

- Ticker: SPRE

- Trailing yield: ~4.1%

- SEC yield: ~2.6%

- Payout frequency: Monthly

- Expense ratio: 0.55%

- Availability: U.S. listed on NYSE Arca

While SPRE is more volatile than sukuk ETFs, it offers a compelling mix of income and equity-like upside, especially in periods of real estate recovery or rate stability.

3. Equity ETFs

Most of Shariah-compliant equity ETFs aren’t built for income—they’re built for long-term capital appreciation. Because they screen out debt-heavy companies and focus on sectors like tech or consumer goods, the dividends they produce are generally below 2%.

That doesn’t mean you should ignore them. Equity ETFs still provide diversification and growth. But if you’re building a portfolio for halal passive income, they should play a secondary role.

If you're curious about the broader range of halal ETFs, including growth-oriented equity funds, sector-specific strategies, and international picks, check out our guide to the best halal ETFs.

Key factors to consider in a high-dividend ETF

Even if an ETF looks promising on the surface, there are a few critical details to verify before you invest. Here’s what matters most:

Understand SEC yield vs. trailing yield

The trailing 12-month yield includes special one-off payouts. It’s not a reliable measure of what you’ll earn next month or next quarter. The 30-day SEC yield is the standard for evaluating current income potential.

Check ETF accessibility

Not all ETFs are available everywhere. Many of the Shariah-compliant funds are UCITS-structured and based in Europe. If you’re a U.S.-based investor, confirm that your brokerage supports the ETF before making any plans.

Don't forget purification

Even Shariah-compliant ETFs can include a small percentage of impure income, usually up to 5%. This typically comes from interest earned by companies within the fund and needs to be purified by donating a corresponding amount to charity. Most halal ETF providers publish purification ratios on their websites, often updated quarterly and reviewed by a Shariah board.

If you're managing a broader portfolio with individual stock holdings, you can use Zoya to estimate and track purification across all your assets.

Final thoughts

The reality is, there aren’t many high-dividend halal ETFs on the market, but the few that exist can offer real value if you’re strategic about how you use them.

Sukuk ETFs like SPSK may be appealing if you want to prioritize stability and consistent income. If you're comfortable with more price fluctuation, a REIT ETF such as SPRE could offer higher yield potential. Equity ETFs tend to offer lower dividends but may still play a role for those focused on long-term growth and diversification.

Be sure to review each fund’s disclosures, confirm accessibility through your brokerage, and consult the fund provider for purification guidance.

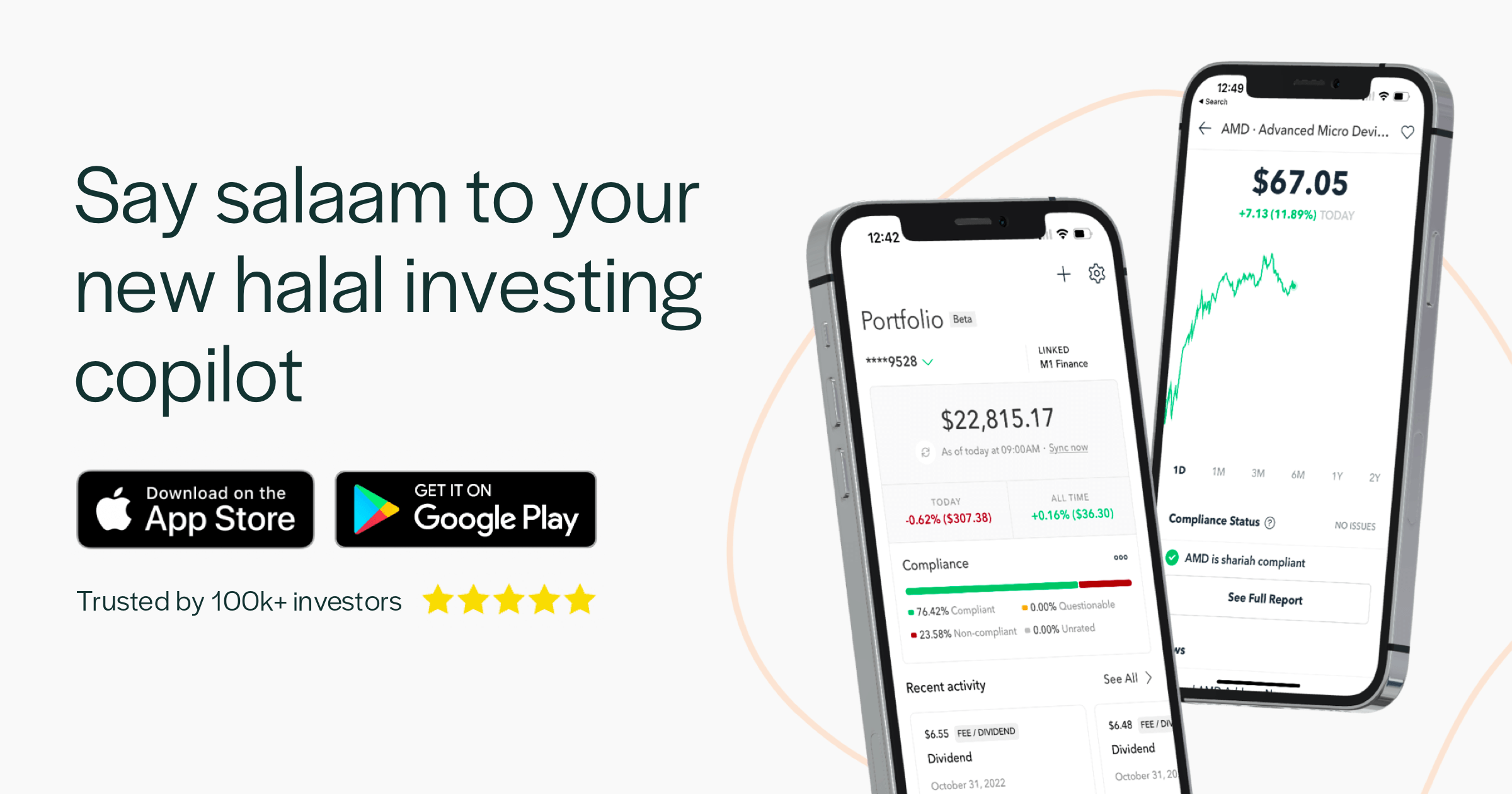

Zoya: Halal Investing App

Zoya makes halal investing easy by helping you build and monitor a shariah compliant investment portfolio with confidence and clarity.