Best Halal ETFs to Buy in 2026

For Muslim investors, selecting the right ETFs requires a delicate balance between financial performance and Shariah compliance. This process can be complex, as ETFs are collections of various securities, each of which needs to be evaluated for adherence to Islamic principles.

Luckily, there are ways to simplify the process. In this comprehensive guide, we’ll discuss how to identify halal ETFs, evaluate their performance, and reveal our top picks for the best halal ETFs to buy in 2026.

Table of contents

- What makes an ETF halal?

- How to evaluate ETFs

- Comparing halal ETFs at a glance

- Top 16 best halal ETFs to buy in 2026

- How to invest in halal ETFs

- Final thoughts on buying halal ETFs in 2026

What makes an ETF halal?

The process for determining whether or not an ETF is halal is similar to evaluating individual stocks. However, since ETFs are composed of multiple holdings, it’s important to consider the Shariah compliance of each underlying asset. Additionally, investors need to determine whether or not an ETF actually holds its underlying assets.

Most ETFs are directly invested in their underlying assets, which means that the ETF’s value is based on the collective value of its securities. However, 11% of the ETFs on the global market are leveraged ETFs. A leveraged ETF doesn’t directly invest in its underlying assets. Instead, leveraged ETFs rely on complex derivatives and swaps to amplify returns, often relying on debt and other interest-bearing mechanisms to achieve their leverage. Islam prohibits interest and excessive speculation, both of which are fundamental to the structure of leveraged ETFs. For these reasons, leveraged ETFs should simply be avoided.

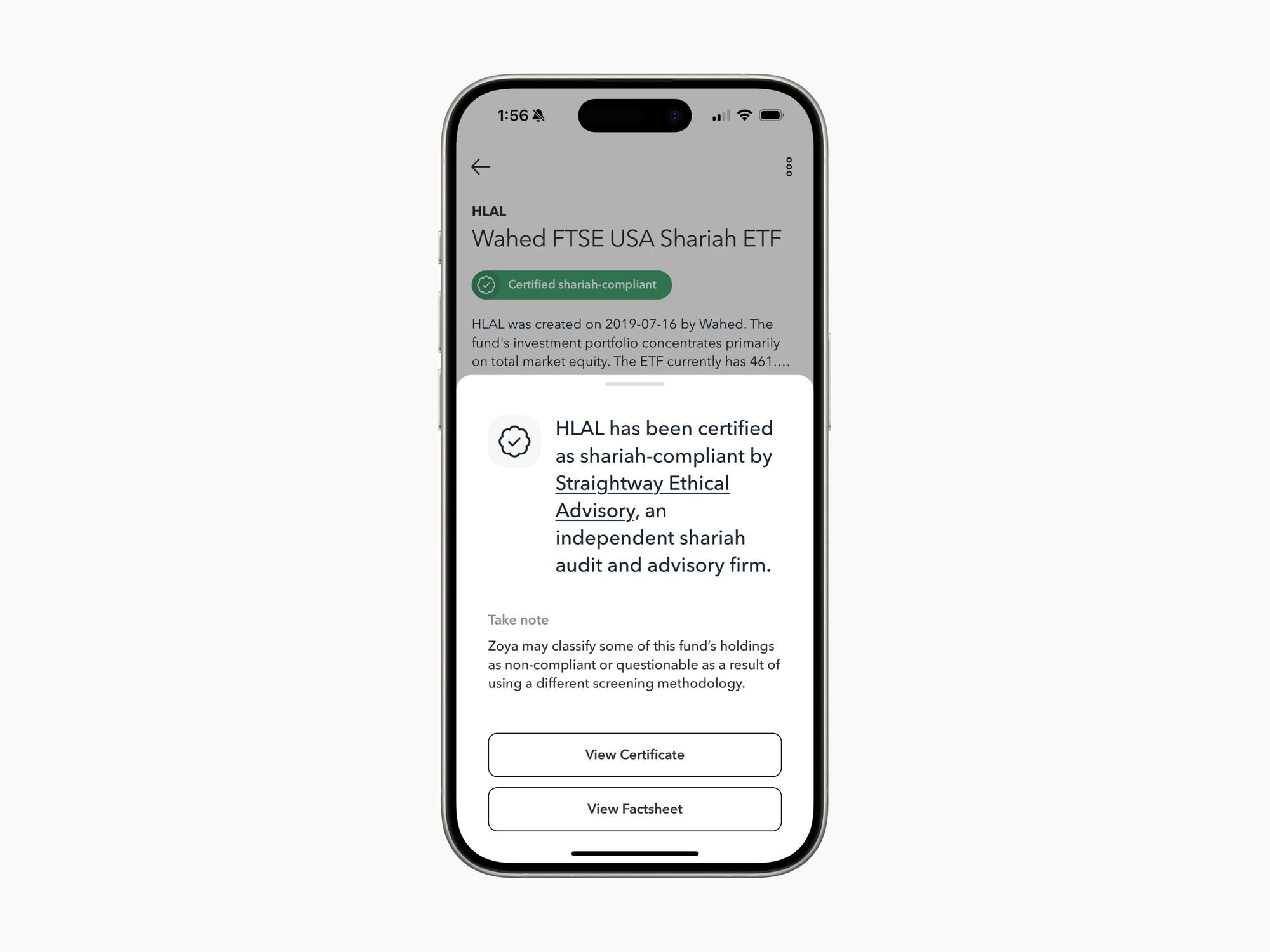

The easiest way to determine whether or not an ETF is Shariah-compliant is to check for a Shariah certificate, which can typically be found on the fund's website. A quick initial check is to look for the words "Shariah" or "Islamic" in the ETF's name. However, only a handful of ETFs have obtained such certification. Many ETFs can still be considered halal to invest in if the majority of their holdings pass Shariah compliance. You can perform a manual check by researching each underlying asset individually or by using a halal investment screening tool, like Zoya.

How to evaluate ETFs

Evaluating ETFs goes beyond just checking for Shariah compliance. While Islamic principles are crucial, understanding an ETF's structure and performance is equally important. When assessing whether an ETF is worth buying, investors should consider multiple factors, including the ETF’s underlying index, expense ratio, tracking error, trading volume, turnover rate, and assets under management (AUM).

Underlying index

The ETF's composition and strategy of the portfolio are driven by the underlying index. To get this, you'll need to look at the index methodology: how it selects and weights components, including factors like breadth, sector allocations, and rebalancing frequency. Some use market-cap weighting, while others take equal weighting or factor-based approaches.

Expense ratio

An ETF’s expense ratio represents the amount the ETF charges investors to hold shares. Efficient ETFs typically have low expense ratios and closely track their indexes. An expense ratio between 0.5% and 0.75% is considered good. ETFs with expense ratios above 1% are considered high and should be avoided.

Tracking error

Tracking error measures how closely an ETF follows its benchmark index. The lower the tracking error, the better the ETF is in replicating its index. Typically, tracking error might be influenced by management fees, trading costs, and cash drag. So, when assessing ETFs, compare their past performance against their benchmark index and check if there have been small, consistent deviations.

Trading volume

Another sign to look out for is high trading volume. ETFs with high trading volume are usually more liquid, which makes them easier to trade. A higher trading volume can also indicate a tighter bid-ask spread indicating the ETF is competitive and actively traded.

Turnover rate

The turnover rate shows how often an ETF buys and sells its holdings. High turnover can bring higher trading costs, along with the potential for tax consequences in accounts that are not tax-advantaged. Broad market index ETFs typically have lower turnover than those with a more active strategy. Think about how a high turnover would impact the fund's costs and its tax efficiency, especially if you would like to use that ETF in a taxable account.

Assets under management (AUM)

Assets under management (AUM) represent the total market value of assets under an ETF's management. As a general rule of thumb, for most ETFs, it's nice to have at least $50 million in AUM, as this level often indicates appropriate investor interest and stability. Most times, higher AUMs will lead to better liquidity and lower trading costs.

Comparing halal ETFs at a glance

The following table offers an overview of the various halal ETFs discussed in this article, allowing you to quickly compare their basic characteristics before we dive into the details.

Note: Expense ratios and other fund details may change over time. Always verify the most current information from the fund's official website.

| Ticker | Name | Focus | Listing | Fee |

|---|---|---|---|---|

| SPUS | SP Funds S&P 500 Shariah Industry Exclusions ETF | US Large Growth | US 🇺🇸 | 0.45% |

| HLAL | Wahed FTSE USA Shariah ETF | US Large Growth | US 🇺🇸 | 0.50% |

| MNZL | Manzil Russell Halal USA Broad Market ETF | US Large/Mid Blend | US 🇺🇸 | 0.40% |

| SPSK | SP Funds Dow Jones Global Sukuk ETF | Global Bond | US 🇺🇸 | 0.55% |

| ISWD / ISDW | iShares MSCI World Islamic UCITS ETF | Global Large Blend | UK 🇬🇧 | 0.30% |

| WSHR | Wealthsimple Shariah World Equity Index ETF | Global Large Blend | CA 🇨🇦 | 0.56% |

| SPRE | SP Funds S&P Global REIT Shariah ETF | Global Real Estate | US 🇺🇸 | 0.55% |

| AMAP / AMAL | Saturna Al-Kawthar Global Focused Equity UCITS ETF | Global Large Growth | UK 🇬🇧 | 0.75% |

| SPTE | SP Funds S&P Global Technology ETF | Global Technology | US 🇺🇸 | 0.55% |

| SPWO | SP Funds S&P World ETF | Global Large Blend | US 🇺🇸 | 0.55% |

| UMMA | Wahed Dow Jones Islamic World ETF | Global Large Growth | US 🇺🇸 | 0.65% |

| ISDE | iShares MSCI Emerging Markets Islamic UCITS ETF | Emerging Large Growth | UK 🇬🇧 | 0.35% |

| ISUS / ISDU | iShares MSCI USA Islamic UCITS ETF | US Large Blend | UK 🇬🇧 | 0.30% |

| IGDA | Invesco Dow Jones Islamic Global Developed Markets UCITS ETF | Global Large Growth | UK 🇬🇧 | 0.40% |

| HIUA / HIUS | HSBC MSCI USA Islamic ESG UCITS ETF | US Large Growth | UK 🇬🇧 | 0.30% |

| HIES | HSBC MSCI Emerging Markets Islamic ESG UCITS ETF | Emerging Large Growth | UK 🇬🇧 | 0.35% |

Now, let's explore our top picks for 2026 in more detail.

Top 16 best halal ETFs to buy in 2026

The ETFs listed below are all certified Shariah-compliant. Some are available in the U.S. while others aren’t. Keep in mind that ETFs outside of your home country may not be offered by your broker. Investors should know that if they decide to purchase international ETFs, they may be subject to additional taxes and fees.

1. SP Funds S&P 500 Shariah Industry Exclusions ETF (SPUS)

Investors looking for a Shariah-compliant ETF that provides exposure to large U.S. companies might consider buying the SP Funds S&P 500 Shariah Industry Exclusions ETF (SPUS). Launched in December 2019, SPUS tracks an index composed of Shariah-compliant constituents from the S&P 500, excluding certain industries.

SPUS's portfolio is heavily weighted towards technology, with top holdings including Apple, NVIDIA, Microsoft, Amazon, and Meta as of March 2025. With an expense ratio of 0.45% and a low turnover rate of 5%, SPUS provides a cost-effective and potentially tax-efficient investment option. The fund has also received an MSCI ESG Fund Rating of AA, which may interest investors concerned with environmental, social, and governance (ESG) factors.

Keep in mind that SPUS holds significantly fewer stocks than the S&P 500 due to its exclusion of non-Shariah-compliant companies. This concentrated portfolio may lead to performance that differs noticeably from the broader index, potentially outperforming or underperforming at different times.

2. Wahed FTSE USA Shariah ETF (HLAL)

One of the best ETFs to purchase this year is Wahed FTSE USA Shariah ETF (HLAL). Launched in July 2019, HLAL tracks the FTSE Shariah USA Index, which includes large- and mid-cap US companies that are Shariah-compliant. Yasaar Limited, an international Shariah consultancy, audits the ETF for Shariah compliance four times a year, at the end of every quarter.

As of March 2025, HLAL's portfolio consists of 211 stocks, with a notable tilt towards technology (43% of holdings), healthcare (13%), and communication services (12%). Its top holdings feature familiar names like Apple, Microsoft, Meta, Alphabet, and Tesla.

HLAL comes with an expense ratio of 0.50% and a turnover rate of 29%, suggesting a relatively stable portfolio composition.

Get a diversified, Shariah-compliant portfolio tailored to your financial goals with Wahed. Fund your account and receive up to $250 with code ZOYA.

3. Manzil Russell Halal USA Broad Market ETF (MNZL)

A notable new entrant to the U.S. halal ETF landscape is the Manzil Russell Halal USA Broad Market ETF (MNZL). Launched in November 2025 and listed on Nasdaq, MNZL offers investors broad exposure to large- and mid-cap U.S. equities through a values-aligned framework that extends beyond traditional Shariah screening. The fund tracks the Russell IdealRatings Manzil Halal USA Broad Market Custom Index, which screens the Russell 1000 Index down to roughly 450 companies, giving it meaningfully wider market coverage than many existing Shariah-compliant ETFs.

In addition to standard AAOIFI-based Shariah compliance screens, MNZL applies a secondary ethical filter based on criteria from the American Friends Service Committee (AFSC), a Quaker organization focused on peace and social justice. This additional layer excludes companies with demonstrated links to apartheid, ethnic cleansing, genocide, or other serious human rights violations.

MNZL carries an expense ratio of 0.40%, which is competitive within the North American halal ETF market given its broader scope and screening methodology. As of late 2025, the portfolio is weighted primarily toward the technology and healthcare sectors. Top holdings include Apple (15.43%), Broadcom (7.07%), Alphabet (5.66%), Tesla (4.71%), and Eli Lilly (3.06%), with other notable positions such as Johnson & Johnson, AbbVie, Oracle, AMD, and Home Depot contributing to its overall diversification.

4. SP Funds S&P Global Technology ETF (SPTE)

Investors interested in a halal ETF primarily invested in the tech industry may consider buying the SP Funds S&P Global Technology ETF (SPTE). This ETF tracks the S&P Global 1200 Shariah Information Technology Capped Index which measures the performance of Shariah-compliant, large-cap equity securities within the IT sector.

Almost all of its equities (98.91%) are invested in the tech sector. Its top holdings are: Taiwan Semiconductor Manufacturing, NVIDIA Corp., Microsoft Corporation, Apple Inc., SAP SE, Broadcom Inc., Tokyo Electron Ltd., and Shopify Inc.

5. SP Funds S&P World ETF (SPWO)

This ETF follows the S&P DM Ex-U.S. & EM 50/50 Shariah Index which measures the performance of Shariah-compliant companies in developed and emerging markets outside of the U.S. A cap is applied to ensure diversification among companies within the index.

Most of its equities belong to the tech sector (31.39%). However, this ETF also has holdings in the healthcare (19.32%), industrials (14.71%) and consumer cyclical sectors (12.43%). Its top ten holdings are: Taiwan Semiconductor Manufacturing, Novo Nordisk, Nestle SA, PDD Holdings Inc., Astrazeneca PLC, Novartis AG, Sap SE, Roche Holding AG, and Infosys Ltd.

6. Wahed Dow Jones Islamic World ETF (UMMA)

Another halal ETF to watch is the Wahed Dow Jones Islamic World ETF (UMMA). This ETF has 95 holdings in the largest Shariah-compliant companies outside of the U.S, representing 21 nations across a wide-range of established markets. The vast majority of the ETF’s portfolio is made up of stocks (99.6%). A large portion of its holdings are in the tech industry (35.6%).

The top ten holdings of Wahed Dow Jones Islamic World ETF are Taiwan Semiconductor Manufacturing Company Ltd., Novo Nordisk A/S, ASML Holding N.V., Infineon Technologies AG, Shopify Inc., Novartis AG, SAP SE, Roche Holding AG, and Nestle S.A.

7. SP Funds S&P Global REIT Shariah ETF (SPRE)

Investors interested in real estate may consider buying the SP Funds S&P Global REIT Shariah ETF (SPRE). This ETF, launched in December 2020, tracks the S&P Global All Equity REIT Shariah Capped Index, providing exposure to Shariah-compliant REITs from both developed and emerging markets.

SPRE is unique in that it's currently the only Shariah-compliant global REIT ETF available. The fund invests exclusively in real estate companies that produce consistent rental income earnings, offering investors a way to gain exposure to the global real estate market while adhering to Islamic investment principles.

As of March 2025, SPRE's top holdings include well-known REITs such as Prologis, Equinix, Goodman Group, AvalonBay, and Equity Lifestyle Properties. The ETF is relatively concentrated, with its top 10 holdings accounting for about 75% of the fund's assets.

SPRE has an expense ratio of 0.55%, which is competitive for a specialized global REIT ETF. The fund had a trailing 12-month yield of 4.1% as of March 2025, potentially making it attractive for investors seeking income.

While SPRE offers a unique opportunity for Shariah-compliant real estate investment, as with any ETF, investors should carefully consider how it fits into their overall investment strategy.

8. SP Funds Dow Jones Global Sukuk ETF (SPSK)

As the only Sukuk ETF in the U.S., SP Funds Dow Jones Global Sukuk ETF (SPSK) is an investment worth considering for Muslim investors. Sukuk are Islamic financial certificates, similar to bonds, but structured to comply with Islamic law. Unlike conventional bonds, which are interest-bearing, sukuk grant the investor a share of an asset, along with the commensurate cash flows and risk.

SPSK invests most of its assets in the component securities that make up the Dow Jones Sukuk Total Return (ex‑Reinvestment) Index. These sukuk can be backed by various types of assets, including tangible assets like real estate or equipment, or intangible assets such as services or investment activities.

The vast majority of SPSK's holdings belong to the corporate (60.47%) and government sector (37.93%). Its top holdings include sukuk issued by entities such as KSA Sukuk Limited, SA Global Sukuk Ltd., SUCI Second Investment Co., and IsDB Trust Services No. 2 SARL. These typically represent large-scale projects or government funding initiatives that align with Islamic financial principles.

9. Wealthsimple Shariah World Equity Index ETF (WSHR)

As the first Shariah-compliant ETF in Canada, the Wealthsimple Shariah World Equity Index ETF (WSHR) is worth considering. Launched in May 2021, WSHR tracks the Dow Jones Islamic Market Developed Markets Quality and Low Volatility Index. Rating Intelligence, a Shariah screening service provider, reviews the ETF's holdings twice a year for Shariah compliance.

WSHR invests in Shariah-compliant companies across developed markets that also meet certain quality and low volatility criteria. As of July 2024, the consumer staples sector made up 16.8% of this ETF's holdings, followed by technology at 16.4% and healthcare at 13.6%.

The ETF has a management expense ratio of 0.56% and a trailing 12-month yield of 1.38% as of July 2024. Its top 10 holdings include Barry Callebaut AG, The Coca-Cola Company, Nestlé S.A., Novartis AG, Thomson Reuters Corporation, PepsiCo, Inc., Swisscom AG, Dollarama Inc., Johnson & Johnson, and Unilever PLC.

Investors should note that WSHR's portfolio construction differs from traditional market-cap weighted indexes. Instead of weighting companies based on their market size, WSHR focuses on quality and low volatility factors. This approach may lead to a portfolio that's less concentrated in the largest companies and potentially more stable during market downturns. However, it might also underperform during strong bull markets led by large growth stocks. As with any investment strategy, this approach has its trade-offs that investors should carefully consider.

10. iShares MSCI Emerging Markets Islamic UCITS ETF (ISDE)

If you’re looking for an ETF with exposure to emerging markets across the world, the iShares MSCI Developing Markets Islamic UCITS ETF (ISDE) may be a good idea. Almost half of the ETF’s holdings (41.53%) belong to the tech industry.

Many of its 300+ holdings are tied to international businesses. Its top 10 holdings are Taiwan Semiconductor Manufacturing, Samsung Electronics Ltd., Reliance Industries Ltd., Vale S.A., Al Rajhi Bank, 005935, PETR4, Petróleo Brasileiro Pref SA, Hindustan Unilever Ltd., and Kia Corp.

11. iShares MSCI World Islamic UCITS ETF (ISWD/ISDW)

Another ETF with a good amount of exposure to international firms is the iShares MSCI Globe Islamic UCITS ETF. It is dual-listed on the London Stock Exchange, trading as ISWD in GBP and ISDW in USD. The ETF has an impressively low expense ratio of 0.30% and is largely invested in strong industries with 37.24% of its holdings in the tech sector.

IShares MSCI World Islamic UCITS ETF invests in variety of international businesses such as Microsoft Corp., Tesla Inc., Exxon Mobil Corp., The Procter & Gamble Company, Johnson & Johnson, Advanced Micro Devices Inc., Chevron Corp., Adobe Inc., Salesforce Inc., and Astrazeneca PLC.

12. iShares MSCI USA Islamic UCITS ETF (ISUS/ISDU)

The iShares MSCI USA Islamic UCITS ETF provides exposure to the U.S. equity market. The ETF is dual-listed on the London Stock Exchange, trading as ISUS in GBP and ISDU in USD. Launched in 2007, it tracks the MSCI USA Islamic Index and had a fund size of 176.09 million GBP as of June 2024.

This ETF has an expense ratio of 0.30%, making it a cost-effective way to invest in large-cap US stocks that pass Shariah compliance. It's top holdings include major companies like Microsoft, Tesla, Exxon Mobil, Procter & Gamble, and Johnson & Johnson, representing a diverse range of sectors with a focus on technology, energy, and healthcare.

13. Invesco Dow Jones Islamic Global Developed Markets UCITS ETF (IGDA)

The Invesco Dow Jones Islamic Global Developed Markets UCITS ETF (IGDA) provides investors with a diversified portfolio of Shariah-compliant equities in several developed markets. This ETF aims to track the performance of the Dow Jones Islamic Market Developed Markets Index.

Launched on January 7, 2022, this open-ended investment company is domiciled in Ireland and has grown to a substantial fund size of 597.97 million GBP as of June 30, 2024. The ETF has an expense ratio of 0.40%, providing a cost-effective option for investors seeking global, Shariah-compliant equity exposure.

IGDA's portfolio focuses on large-cap growth stocks across developed markets. Its top five holdings, accounting for 28.19% of the portfolio, include major tech companies such as Microsoft, Apple, NVIDIA, Amazon, and Meta Platforms. This composition reflects a strong tilt towards the technology sector, which makes up 39.22% of the fund, followed by healthcare at 15.33% and consumer cyclical at 11.17%.

Geographically, the fund is heavily weighted towards the United States (77.93%), with smaller allocations to Europe, Japan, and the United Kingdom.

14. Saturna Al-Kawthar Global Focused Equity UCITS ETF (AMAP/AMAL)

Saturna Capital, best known for its family of Shariah-compliant mutual funds in the US (the Amana Funds), offers an ETF called the Saturna Al-Kawthar Global Focused Equity UCITS ETF (AMAP/AMAL). This ETF is dual-listed on the London Stock Exchange, trading as AMAP in GBP and AMAL in USD.

AMAP/AMAL holds a curated selection of premium stocks from a wide range of global ESG companies. This Shariah-compliant ETF provides investors with exposure to high-quality global stocks that meet both Islamic investing principles and ESG criteria.

As of July 2024, the fund's holdings were primarily concentrated in the tech (38.69%) and healthcare (25.15%) sectors, suggesting a focus on growth-oriented and innovative companies. Its top 10 holdings include global leaders such as Taiwan Semiconductor Manufacturing Company Ltd., Microsoft Corp., Eli Lilly and Company, Trane Technologies PLC, Broadcom Inc., Alphabet Inc., ASML Holding NV, AstraZeneca PLC, Wolters Kluwer, and Boston Scientific Corp.

The ETF has an expense ratio of 0.75%, which is relatively competitive for an actively managed, Shariah-compliant global equity fund. Investors should note that AMAP/AMAL's active management approach and concentrated portfolio of 30-45 stocks may lead to performance that differs from broader market indices.

15. HSBC MSCI USA Islamic ESG UCITS ETF (HIUS/HIUA)

The HSBC MSCI USA Islamic ESG UCITS ETF (HIUS) is a relatively new halal ETF that launched in November 2022. This ETF aims to track the performance of the MSCI USA Custom Islamic Universal ESG Screened Index, providing exposure to large- and mid-cap U.S. companies that comply with Shariah principles while also integrating ESG factors.

HIUS has an expense ratio of 0.30%, which is competitive for a specialized ETF. The fund's assets are predominantly invested in non-UK stocks (99.88%), with a small cash position (0.12%).

The ETF has a strong focus on the technology sector, which makes up 59.43% of its holdings. Other significant sectors include healthcare (10.29%), industrials (7.64%), consumer cyclical (6.89%), and energy (6.16%). Its top holdings include well-known U.S. companies, with Microsoft Corp leading at 28.59%, followed by Tesla Inc (5.30%), Advanced Micro Devices Inc (4.17%), Adobe Inc (3.55%), and Exxon Mobil Corp (3.52%). The top 5 holdings account for 45.13% of the portfolio, indicating a relatively concentrated investment approach.

This ETF could be an attractive option for investors looking for a Shariah-compliant way to gain exposure to the U.S. stock market, particularly in the technology sector, while also considering ESG factors.

16. HSBC MSCI Emerging Markets Islamic ESG UCITS ETF (HIES)

The HSBC MSCI Emerging Markets Islamic ESG UCITS ETF (HIES) is another relatively new ETF launched on January 12, 2023, tracking the MSCI EM (Emerging Market) Islamic ESG Universal Screened Select Index. This ETF offers exposure to large- and mid-cap companies across 24 emerging market countries, adhering to Shariah principles and integrating ESG factors.

With an expense ratio of 0.35%, HIES invests primarily in non-UK stocks (99.76%). The fund has a strong technology focus, comprising 54.75% of its holdings, followed by basic materials (10.23%) and energy (8.90%). Its top holdings are dominated by Asian tech companies, with Taiwan Semiconductor Manufacturing Co Ltd (29.83%) and Samsung Electronics Co Ltd (16.57%) leading the portfolio. The top 5 holdings account for 55.08% of the fund, indicating a concentrated investment approach.

This ETF presents an opportunity for investors seeking Shariah-compliant exposure to emerging markets with an emphasis on technology and ESG considerations.

How to invest in halal ETFs

Buying halal ETFs is a straightforward process that doesn't differ significantly from buying any other ETF. You can typically find them through most major brokerage platforms like Fidelity, Interactive Brokers, or Robinhood. The process is as simple as opening a brokerage account (if you don't already have one), funding it, and then placing an order for your chosen halal ETF using its ticker symbol.

While your broker handles the actual buying and selling, using a specialized halal investing app like Zoya can help you make more informed decisions about which halal ETFs align best with your values. Zoya provides valuable insights that brokers typically don't offer, such as detailed Shariah compliance information and even the full list of the ETF's underlying holdings.

Final thoughts on buying halal ETFs in 2026

The halal ETF landscape in 2026 offers a diverse range of options to build Shariah-compliant portfolios. From broad market funds to specialized offerings in various sectors and regions, you can find a halal ETF to suit almost any investment strategy.

When selecting halal ETFs, consider not only Shariah compliance but also factors like expense ratios, tracking error, and underlying holdings. A specialized tool like Zoya can provide valuable insights into an ETF's compliance and composition, helping you make informed decisions.

As with any investment, halal investing requires you to carefully consider the impact of your decisions on your finances. Be sure to conduct your own research and consult with qualified professionals to ensure alignment with your values and financial goals.

Zoya: Halal Investing App

Zoya makes halal investing easy by helping you build and monitor a shariah compliant investment portfolio with confidence and clarity.