How to Save and Invest Your Way to Hajj

The sacred month of Dhul Hijjah is almost upon us. It includes the ten best days of the year, the day of Arafah, and of course, Hajj. Hajj is an experience that Muslims long to perform. However, for many of us, Hajj costs are becoming more prohibitive each year.

Now more than ever, we need a clear plan to be able to save the money required to go on this life-changing experience. This article will cover how to save and invest enough money to take yourself and your loved ones to Hajj next year and beyond.

Hajj is a pillar and has many virtues

Hajj is one of the five pillars of Islam and is an obligation on Muslim adults who are physically able and have the financial means to do so.

“Pilgrimage to this House is an obligation by Allah upon whoever is able among the people.” (Quran 3:97)

“Call ˹all˺ people to the pilgrimage. They will come to you on foot and on every lean camel from every distant path, so that they may obtain the benefits ˹in store˺ for them” (Quran 22:27)

The virtues of Hajj are also detailed in the following hadith from the Prophet (peace be upon him).

“Whoever performs Hajj for the sake of Allah and does not utter any obscene speech or do any evil deed, will go back (free of sin) as his mother bore him.” (Bukhari; Muslim)

In another hadith, the Prophet (peace be upon him) said that the reward for an accepted Hajj is nothing less than Paradise. This shows the profound opportunity Hajj presents us with.

The price of Hajj keeps climbing

Research from the University of Leeds showed that the prices of Hajj packages rose around 25% between 2014 and 2018 for UK pilgrims. For Moroccans, the expected 2022 price is around 63k MAD, which is a 35% increase from the 2018 price of 46.5k MAD. The price increase is starker for Pakistani pilgrims, with a whopping 84% rise from last year's cost of 490k rupees to 900k rupees. While these are only a few examples, the trend of Hajj becoming more expensive is clear.

The Saudi government has also recently upended the Hajj application process for Muslims in Europe, America, and Australia. They have banned travel agencies and introduced a centralized online platform called Motawif. While the implementation of this new process at such short notice has been chaotic, there is hope that this centralized system could lead to lower prices in the future by removing the intermediaries and streamlining the process. Yet, the cost of Hajj is still likely to be high for the foreseeable future due to the continuing demand from Muslims and rising inflation.

While there is no compulsion to go if it's not within your means, many of us long for this experience. Moreover, as Muslims, we should be striving for Ihsan (excellence) in what we do as per the following hadith.

“Verily Allah has prescribed Ihsan (proficiency, perfection) in all things” (Muslim)

That includes striving to earn enough money to spend on important matters such as Hajj. Even if you are ultimately unsuccessful, you will be rewarded for your intention to try to perform Hajj. See the following profound hadith from the Prophet (peace be upon him).

“Verily Allah has written down the good deeds and the evil deeds, and then explained it [by saying]: “Whosoever intended to perform a good deed, but did not do it, then Allah writes it down with Himself as a complete good deed. And if he intended to perform it and then did perform it, then Allah writes it down with Himself as from ten good deeds up to seven hundred times, up to many times multiplied...” (Bukhari; Muslim)

This hadith highlights the importance of having good intentions and why you should strive your best to perform good deeds even if you aren’t assured of success. So as a first step, you should intend to try your best to be able to perform Hajj.

For the rest of this article, I will share three things you can start doing today to help turn your Hajj dreams into reality.

1. Create a savings plan

The first step is to establish a designated Hajj saving fund. Commit to putting money aside each month solely towards your Hajj fund. The reward of an accepted Hajj should be ample motivation to help you do this. You need to supplement this motivation by being disciplined and forming healthy habits.

Cut unnecessary expenditure

Start by reviewing your current expenses and identifying costs you can reasonably live without. Don’t overdo it and cut out things that will make you miserable and thus less likely to stick to your budget.

Consider cutting down on subscriptions such as streaming services or expensive gym memberships that you barely use. Eat at home more frequently and perhaps consider preparing your meals in advance. This can also help you eat healthier and avoid food waste, which often arises from impulse purchases.

You also don’t have to buy the latest and most expensive items when shopping. Consider second-hand purchases where appropriate or even reusing existing items. When giving gifts, personalized self-made gifts can often be superior to generic store-bought goods as they demonstrate an extra level of thought to the recipient.

Save in a group if you can’t save on your own

Many people struggle to hold themselves accountable when saving. A good way to mitigate this is to form a group of people that have a shared saving goal and who can hold each other accountable.

Many communities around the world have some form of community-savings scheme. In Pakistan, they have committee. In Jamaica, it is Pardna and in Egypt, it is called Gameya. These have been labeled as a Rotating Savings and Credit Association (ROSCA) in the West.

The premise is simple. Savers come together to commit to saving a fixed amount monthly. Every month, one saver is chosen to withdraw the entire amount based on either their financial need or randomly according to the rules of the ROSCA. This continues until every saver has withdrawn the entire amount.

So say you wanted to save $1,000 for your Hajj trip. You could join a ROSCA with ten people, where each person contributes $100 a month for 10 months. During each month, one saver is chosen to receive the full $1,000. After 10 months, each saver has the full $1,000.

This concept has worked for generations as the extra accountability within a group helps people be disciplined. If you are considering a savings group, make sure you either join a reputable ROSCA or save with people that you trust. There are also online ROSCA solutions for people who don’t have access to local savers. However, you want to ensure that these offerings are regulated and the fees involved are worth it.

Ultimately, if you can save alone, then that is great. If not, going for a community approach is a great way to reach your saving goals and build relationships in the process.

2. Grow your income

There are three main ways to do this:

- Work additional hours. This isn’t an ideal solution as there are only so many hours in the day. As Muslims, we strive to be balanced and so working constantly while potentially neglecting other duties (spending time with family, acts of worship, looking after yourself, etc.) is not desirable.

- Get a pay rise. With rising inflation, most employers would consider it reasonable to ask for a rise in line with inflation. Additionally, if you are advancing in terms of responsibility and your worth to the company, you could have a strong case to be compensated accordingly. You could also explore the job market and see if there are roles available that are willing to pay you more. Companies that are recruiting will usually offer you a higher salary as an incentive to join them. Just make sure the move is right for you.

- Pick up a side hustle. This could be as simple as working for Uber or as a food delivery driver for a day a week. Alternatively, you could monetize your skills by freelancing. If you don’t have a skill set that you can monetize, consider building one by doing a course or just try something new and see how you fare.

3. Invest your money

This final option could accelerate your saving if done correctly. As we discussed earlier, the price of Hajj continues to increase year over year. This means that the amount you need to save will also increase.

Moreover, the demand for Hajj is huge but the capacity is limited. In 2019, the last relatively normal Hajj before the Covid-19 pandemic, Saudi Arabia hosted around 2.5 million pilgrims. This is a small fraction of the Muslim population, highlighting the physical constraints. The demand will also likely continue to increase over time, as the Muslim population grows and as Muslims become wealthier.

Therefore, investing your money into assets that can appreciate in value could help you grow your wealth and protect your savings from inflation. It is important, however to keep in mind that investing isn’t risk-free. If you’re saving for short-to-medium term goals such as Hajj, you should consider sticking to more conservative, low-risk investment options. If you’re planning on traveling in the immediate future (say, in the next 12 months), keeping your savings in cash is better as it is notoriously difficult to predict the performance of an investment in the short term.

Conclusion

Hajj is an incredible opportunity for Muslims to cleanse themselves of sin and attain the pleasure of Allah SWT. However, it is becoming more expensive over time and thus many of us will need a plan of action to afford it.

Remember to start with the right intention. Utilizing a combination of saving, growing your income and investing your money, will set you up financially for Hajj. It is important to stick to halal income sources and investments to ensure there is barakah in your money.

Don’t fret if you are unable to do it. Just try your best and leave the rest to Allah SWT.

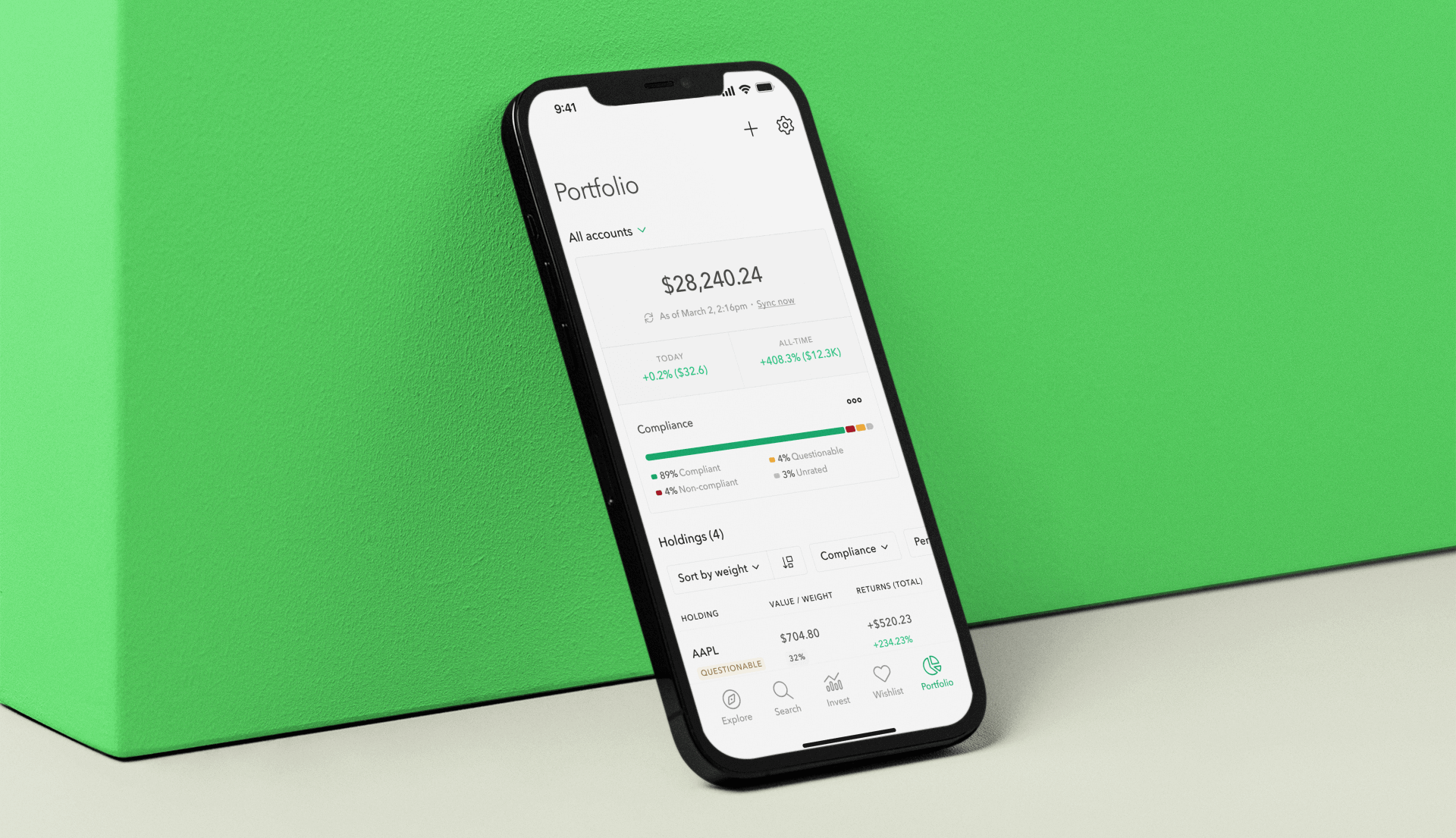

Halal Stock Screener and Portfolio Tracker

Zoya makes halal investing easy by helping you build and monitor a shariah compliant investment portfolio with confidence and clarity.