The Muslim Women's Guide to Investing

How often do you hear about women investing in the stock market? If you’re like most people, probably not very frequently. That’s because investing is typically seen as the domain of men, and even the words used to describe the process of investing tend to be very masculine. Words used to describe financial transactions, such as “beating the market,” “leveling the playing field,” or “building” a portfolio, are reminiscent of worlds that women did not historically have access to, such as war, and construction, or intense physical activity.

That might seem absurd at the outset but also works in the opposite direction. The way particular products are described influences how men and women interact with those products - for example, men weren’t heavy consumers of Diet Coke but resonated with Coke Zero.

But women can be great investors. Studies consistently show that women are better investors than men. When Fidelity analyzed their investors’ data, they found that women’s investments outperformed men’s by 0.4%, amounting to a difference of $267,170 over 40 years.

What makes women better investors?

We know there is a difference in investment performance between men’s and women’s portfolios but why is that the case? It’s difficult to point to one cause, however, several reasons stand out.

Better research

Before investing, women often take their time to research their investments and build out a diversified and balanced portfolio that maximizes their gains and reduces their risk. They also tend to invest for long-term growth and not short-term gains. In contrast, research shows that men tend to make more impulsive, short-term investing decisions based on hype and take less time to research their holdings.

Better money management

When women manage their money or their households’ money, they tend to put a significant portion of money into savings as security for the future. The female respondents of a 2017 Fidelity survey “saved an average of 9% of their annual paychecks,” while the male respondents saved an average of 8.6%. In 2018, when SoFi and Levo League conducted a national survey exploring millennial women’s money habits, they found that over half of the respondents had an emergency fund of 3-6 months. These findings are in direct contrast with many stereotypes about women that say they are often irresponsible, frivolous, and careless with money and need to be “reigned” in so they can stop “splurging”. The higher savings rate amongst women indicates a tendency to think long-term and prioritize stability, leading to a higher probability of sound investment decisions.

Despite being better with money, the data shows women consistently invest less. NerdWallet, a leading financial literacy site in the US, surveyed investing habits of US adults in 2021. It found that less than 50% (48%) of women in their national sample invest in the stock market, compared to 66% of men. Women of color invest even less. A recent CNBC survey found that 59% of Black women aren’t invested in anything, compared to 48% of Hispanic women, 34% of white women, and 23% of white men. In the UK, only 10% of women have a Stocks and Shares ISA (Individual Savings Account - comparable to a Roth IRA in the US, but with fewer restrictions on withdrawal), while 17% of men have opened one.

Challenges to overcome

Here are a couple of challenges that need to be overcome to increase women’s participation in the stock market.

The wage gap

Women simply have less money to invest because of the income gap. It’s been documented that women usually earn around three-fourths of what men earn throughout their careers, around $0.80 to a man’s dollar. Naturally, if women make less money, they have less money to invest monthly. Unfortunately, the wage gap compounds negatively over time and dramatically disadvantages women in how much they can invest. In the US, women have a median household income of $47,244 in retirement, whereas men have a retirement income of $57,144. The compound effect works in favor of men. While it’s true that women save more and are better investors over time, because men earn more and thus invest more, they tend to amass more significant amounts of wealth over their lifetimes than women.

Fear

The SoFi survey found that most (56%) women don’t invest due to fear. In the UK, women have cited investing as “untrustworthy,” “unwelcoming,” and “complicated,” which has caused women to think investing is scary and that it “isn’t for me.” This is something I have witnessed countless times as a financial coach. I often encourage my clients to invest but many shy away due to the fear of losing the money they worked so hard to earn. They also mention hearing crazy stories from family members about people losing thousands of dollars in portfolio value in a single day. This type of fearmongering makes them think investing isn’t for them and ultimately leads them to avoid it altogether.

Lack of knowledge and confidence

The Global Financial Literacy Excellence Center surveyed female investors in the US and found that women believe they have less knowledge about the stock market and are less confident investing. The SoFi survey found that women were more likely to indicate they didn’t know where to start even if they wanted to invest. In the UK, women mentioned feeling overwhelmed and bogged down by the investment jargon, stating that they wouldn’t invest until they felt comfortable and knowledgeable.

What’s most interesting is that this lack of confidence in investing doesn’t seem to disappear as women earn more money. Bank of America’s Private Wealth Management leg, U.S. Trust, surveyed high net-worth women across the US about their financial behavior and attitudes and found that these women tended to feel less confident than men in their ability to handle serious financial matters, including saving for retirement, despite having millions to their name.

The lack of confidence may be a double-edged sword. On the one hand, it is preventing women from investing as much as they should, but on the other hand, it may be a protective factor. A famous and widely-cited UC Berkeley study found that men’s overconfidence when investing leads to risky investing behaviors, such as day trading. According to the survey), “Trading reduces men's net returns by 2.65 percentage points a year as opposed to 1.72 percentage points for women.”What’s needed, then, is to increase women’s confidence with investing just enough to encourage them to invest but still prevent them from becoming overconfident to the point that it may become detrimental.

Why women should be investing even more

Women have a plethora of reasons to be investing more than men. Here are a few.

Higher life expectancy

In general, across the world, in every continent and region, women tend to live longer than men and have a higher life expectancy. Whether the difference might be half a year, a year, or ten years, women living longer than men means they will need a more significant nest egg in retirement.

Caregiving

Women often give up years of their lives to caring for children, spouses, or parents, which impacts their careers. This is even a trend among the wealthiest women. U.S. Trust’s survey found that 37% of women claim they spend more time caregiving than their partners, and 39% of women say they’ve had to give up career advancements and higher incomes. This means that women need to be taking advantage of the periods in their lives when they are working. They should be investing aggressively if possible to make up for the difference to accumulate the higher nest egg they need in retirement. That said, the ideal scenario is that women have more supportive partners to lessen the burden of caregiving. Right now, unfortunately, the sacrifice of their financial well-being is quite significant.

Islamic inheritance rules

In Islam, in several situations, Islamic inheritance laws stipulate that a man may receive more than a woman. In these scenarios, a man gets greater shares of the inheritance when it is their responsibility to take care of the female family members and the household. Furthermore, a woman with no children is only entitled to a quarter of her late husband’s estate; if she has children, she is entitled to only an eighth. Relying on a late husband’s estate may or may not pay off depending on the deceased’s net worth, but it is certainly a gamble. Family politics may also prevent a woman from actually receiving her allotted share. As such, it is critical to not solely to rely on inheritance and instead, secure your future by investing for yourself.

3 actionable steps to help you get started with investing

Step #1: Set financial goals

One of the best ways to invest strategically is to set financial goals and work towards them. Figure out which goal you have in the short-term (1-5 years), medium-term (5-10 years), and long-term (10+ years). Do you want to go to Hajj? Buy a new car? Save for a down payment on a home? Save for your kids’ university tuition? When do you want to retire, and how much will you need?

Different goals will require different investment strategies.

For example, financial experts recommend that you don’t invest money for goals within less than two years, as you may not have enough time to absorb the “shocks” (or downs) of the stock market before you need the money. It may be best to keep that money in a savings account (interest-free, of course!).

Figuring out your goals will give you a place to start so you can (1) invest using the appropriate strategy for your goal and (2) provide you with the motivation to begin investing.

Investing without a tangible goal may be off-putting. As we noted earlier, women tend to invest strategically and for long-term growth, which allows their portfolios to perform well.

Step #2: Educate yourself on investment options

Investing is one of those things you have to learn how to do. It requires skills and knowledge, and you shouldn’t invest in things you don’t understand. This may seem overwhelming, but taking the time to learn the different investment terms and understand where you are putting your money will benefit you greatly in the long run. Once you have crossed that initial barrier and started understanding basic concepts like a stock or ETF, you will find that investing is much less complicated than it currently may seem. It will also be something you’re more inclined to do. Part of setting yourself up for success when it comes to investing is learning the difference between halal and conventional investing.

Step #3: Start building a portfolio (DIY or with a financial advisor)

Once you have your financial goals set, you’ve chosen an investment strategy, and you understand your investment options, you are then ready to invest.

For example, let’s say you decide that you have a goal of putting a down payment on a house in ten years. You theoretically need $250,000, and you decide that you’re going to use the index fund strategy. After doing your research, you decide to invest in a halal ETF (e.g., SPUS) for the next ten years until you reach your goal.

(This is a simplified example. An ideal portfolio should include more diversification).

When building your portfolio, you can either choose to DIY or receive help from a financial advisor. However, keep in mind that advisors charge fees for their services in the form of either a flat fee or a percentage of assets under management (AUM). Even if you decide to go with an advisor, it’s still important to have an understanding of investing terminology so that you don’t get taken advantage of.

Bottom line

When women are educated about investing and given the right tools and resources, they have the potential to be great investors. Unfortunately, a combination of fear, lack of confidence, and the wage gap prevent women from investing.

Through my experience as a financial coach, I have learned that many women crave stability and freedom for themselves and their families. It’s a myth that working hard and saving money in a bank account will provide financial security. In fact, that is the best way to ensure your money loses value to inflation every year. It’s through investing and working smarter, not harder, that will allow more women to reach their financial goals and build long-term wealth.

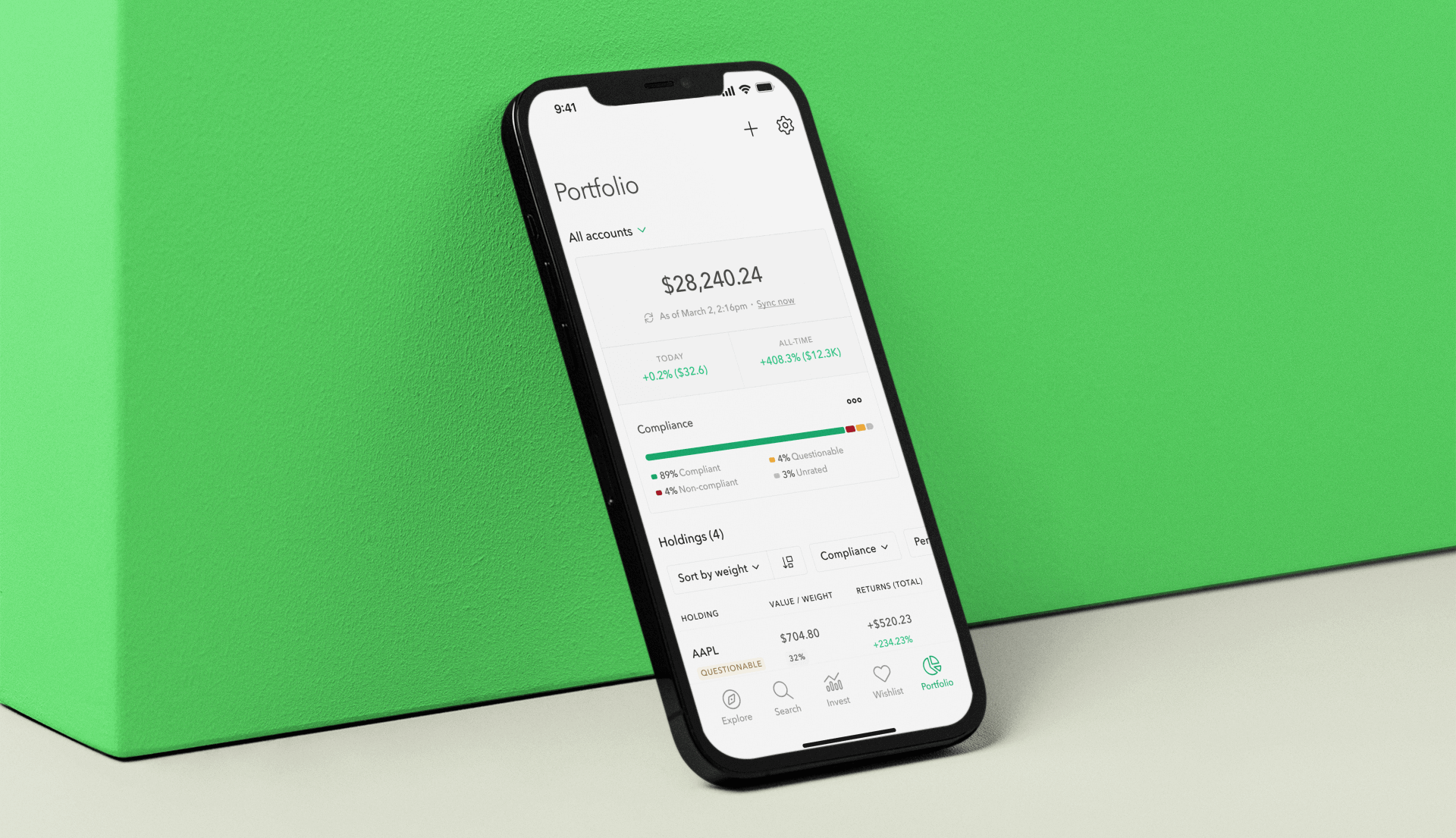

Halal Stock Screener and Portfolio Tracker

Zoya makes halal investing easy by helping you build and monitor a shariah compliant investment portfolio with confidence and clarity.