How to Get Started With Halal Investing: A Practical Guide

If you've been struggling to get started with halal investing, you're not alone. The stock market is riddled with companies involved in industries and practices that conflict with Muslim values. This is where Shariah-compliant stocks emerge as a practical solution.

However, mainstream investment platforms don’t prioritize Shariah compliance, leaving many investors to spend hours manually verifying each stock. This process is often confusing and time-consuming, making halal investing seem out of reach for those who don’t have the knowledge or know-how.

This guide will walk you through the essentials of halal investing—from the basics of Shariah-compliant investments to step-by-step instructions on building your own robust, halal stock portfolio.

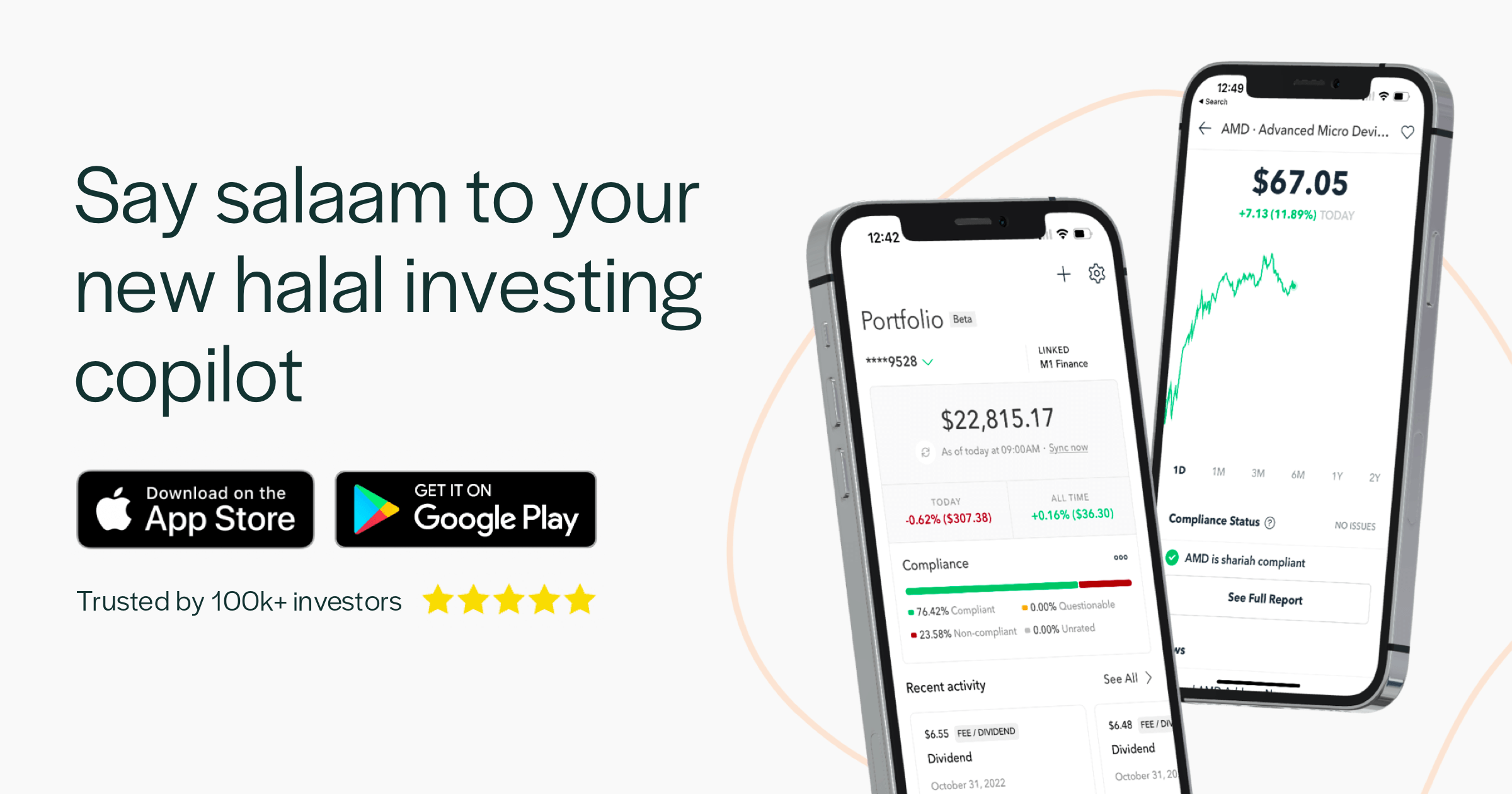

Zoya: Halal Investing App

Zoya makes halal investing easy by helping you build and monitor a shariah compliant investment portfolio with confidence and clarity.

What is halal investing, and why does it matter?

Halal investing is an ethical approach to stock selection that filters out companies involved in harmful industries like alcohol, gambling, and predatory finance. Rooted in Islamic principles, it emphasizes investing in businesses that create genuine societal value while adhering to strict financial guidelines that prohibit interest-based income and excessive debt.

Halal investing encourages a disciplined approach that prioritizes long-term, socially responsible wealth creation. This means directing capital towards industries that contribute positively to human progress.

Step-by-step guide to halal investing

Halal investing can seem complex, but by following these steps, you can build a portfolio that is both diversified and Shariah-compliant.

1. Understand Shariah compliance

Generally, a stock must meet two key criteria to be considered Shariah-compliant:

- Business activity: The company must operate in permissible sectors. This means avoiding industries like banking, alcohol, pork products, gambling, and adult entertainment.

- Financial ratios: The company should have a reasonable level of debt and interest income. While interest is impermissible, scholars recognize that it's impossible to avoid it entirely in the public markets, so they have created thresholds to determine acceptable levels. Shariah screening standards require companies to maintain debt-to-asset or debt-to-market cap ratios below a specific threshold.

2. Choose a halal investing platform

A specialized halal investment platform can make it significantly easier to find Shariah-compliant investment opportunities. Zoya, for instance, simplifies the process by screening thousands of stocks for Shariah compliance, eliminating the need for manual verification.

3. Determine your halal investment strategy

Whether you're drawn to growth stocks with high upside potential, undervalued assets, or steady, dividend-paying companies, Zoya's advanced screener lets you filter and analyze opportunities that match your strategy while maintaining Shariah compliance.

4. Choose a broker

To actually buy halal stocks, you'll need a brokerage account. When choosing a broker, look for features like the availability of Shariah-compliant stocks and ETFs, low or commission-free trading fees, and support for fractional shares to make investing more accessible. Zoya simplifies this process by integrating with several reputable brokers, allowing you to execute trades directly through the app.

5. Diversify your investments

Diversification helps you reduce risks in any investment portfolio. Instead of putting all your money into one stock, consider building a diverse portfolio that includes multiple Shariah-compliant assets across various sectors, market caps, and geographies. Zoya offers curated stock baskets that provide the diversification benefits of ETFs without the added management fees, giving you more flexibility and control.

6. Monitor and adjust

Shariah compliance isn't static—it changes as companies evolve. Regularly review your portfolio to make sure your investments remain halal. Zoya will automatically monitor your portfolio for Shariah compliance and send you timely alerts if there are any changes.

How to buy halal stocks

Getting started with halal investing through Zoya is straightforward:

- Create a free Zoya account. You can sign up for an account directly on our website or by downloading the Zoya app for iOS or Android.

- Link a brokerage account. Zoya partners with leading brokerages like Alpaca and others for a seamless way to buy and manage halal stocks.

- Research stocks. Use Zoya's powerful filters and screening tools to discover Shariah-compliant investment opportunities. If you already know what you want to invest in, just type in the name or ticker symbol in the search bar.

- Decide how much to invest. Click the buy button and input the amount you'd like to invest, either in terms of dollars or number of shares. Review the real-time stock price and estimated quantity of shares before confirming your investment.

- Manage your portfolio in one place. You can find your newly purchased stock in your Zoya portfolio alongside the rest of your holdings. Enable alerts to get notified of any changes in your portfolio's Shariah compliance.

The benefits of using Zoya for halal investing

With hundreds of thousands of Muslims using Zoya globally, it's the go-to app for easily screening, researching, and managing your portfolio in a halal way. Zoya provides you with:

- Comprehensive screening: Detailed Shariah compliance analysis on thousands of stocks, ETFs, and mutual funds.

- Portfolio tracking: Link your broker to auto-sync your holdings and monitor your portfolio.

- Diverse ways to invest: Choose from expert curated baskets of Shariah-compliant stocks or mix and match individual stocks for a portfolio that works for you.

- Instant zakat calculation: It takes just a few clicks to calculate zakat through Zoya. It's fast, accurate, and supports global stocks and currencies. You can even donate to zakat-eligible charities right through the app.

Final thoughts

Halal investing doesn’t have to be complicated. With Zoya, you have a comprehensive toolkit that simplifies everything from screening to tracking and managing a halal portfolio with confidence.

Ready to get started? Download Zoya and begin your journey toward halal investing today.